Million-dollar dumps abound in Auckland. Sometimes it’s not worth doing them up because the value of the land so far outstrips the “improvements”, which largely means the home.

These almost derelict properties can sell for as much $2 million because of the value of the land beneath them. Sometimes buyers view the property as just a development site.

Auckland Council’s new CVs that were due out this month have been delayed until March 2022 thanks to “inconsistent” price estimates. That’s left many homeowners wondering what their new rating valuation will be. For some it’s there only gauge of what their home is worth.

Tom Rawson, branch manager of Ray White Manukau, says that the land is the most valuable part of probably 98% of houses in Auckland. Sometimes the house that sits on the land is in fact a hindrance to many property sales.

Start your property search

“We're selling stuff where people don't go and see the property because the improvements are of no value to the buyer. They're just purely using the unitary plan to intensify the land.”

The dream house for land bankers and developers is a 90sqm ex state house on a quarter acre section that can be developed into multiple homes under the Auckland Unitary Plan. “The developers are scrapping over [them],” says Rawson. “Anything over 600sqm is a development site because they can build multiple dwellings on that. This has really pumped up the second-hand market.”

Those new homes on erstwhile single-family sections have become highly desirable. “You get a new build, you get to claim your interest back [if you’re an investor],” he says. “You’ve got a Master Builder guarantee and you’ve got warranties on all your appliances.”

Ray White Manukau branch manager Tom Rawson: “We're selling stuff where people don't go and see the property.” Photo / Fiona Goodall

Rawson says a typical example where the land value eclipses improvements would be a 700sqm Manurewa property where the CV is $600,000, of which $500,000 is the land. A developer might pay $1.2m at auction, and bowl the house.

Owners do need to think twice about adding a new kitchen or bathroom or other “improvement” such a s a swimming pool, says Rawson. These make the homes less desirable to developer type buyers. “If you've really pimped out your big quarter acre section with swimming pools and waterfalls and all that stuff, to scrape it back to usable land can be extra cost.”

Many owners love to imagine a young family moving in and enjoying the new kitchen and bathroom and big back garden, but the drive to intensification means that’s unlikely to happen.

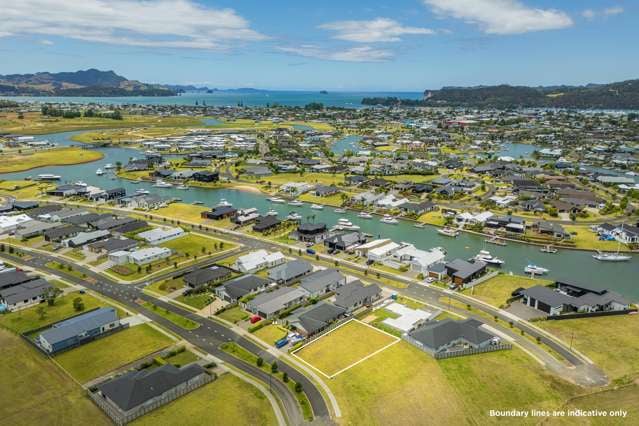

Rawson says the areas where improvements are closer in value to the land are new suburbs such as Hobsonville where there are good modern homes on smaller sections.

It’s more black and white to compare land and improvement values in Wellington, thanks to brand new RVs from the Wellington City Council, issued at the start of December.

When OneRoof and Valocity analysed the Wellington data it transpired that there wasn’t a single suburb in the city and surrounds where the improvements were worth more than the land value, although in Broadmeadows and Makara the land value as a proportion of capital value were both 50%.

Land values in Oriental Bay in Wellington have soared. Photo / Getty Images

The suburbs where the land value most outstripped the improvements were Moa Point, 88% in 2021, Karaka Bays, 83%, Seatoun, 82%, and Breaker Bay, 81%.

The highest absolute land values are in Seatoun, $1.670m, followed by Oriental Bay, $1.6m, and the Karaka Bays $1,560m.

Another interesting output of the Wellington CV data is the suburbs with the greatest CV percentage growth since 2018 were Horokiwi, 97% growth, followed by Grenada North, 78%, Strathmore Park, 76% and Johnsonville, 73%.

The lowest growth in CVs over the three years from 2018 were Pipitea, 32%, Oriental Bay, 33% and Te Aro, 37%.