Amid all the uncertainty caused by the spread of the coronavirus, some Kiwis are in the middle of making one of the biggest decisions of their lives: buying a property or selling a property. OneRoof asked Bindi Norwell, the chief executive of the Real Estate Institute of New Zealand, for her perspective on the property market:

Will house prices crash as a result of the coronavirus?

That’s the million-dollar question at the moment.

It’s a very different scenario to the 2008 recession but we did look at some data. Prices went 6 per cent down within a year of the recession but then bounced back within a year.

Start your property search

It’s a very different scenario now because its lockdown and once lockdown has gone people can get back on with business. So it might recover pretty quickly, but it will depend on factors such as unemployment and how long this lockdown goes for.

The market was in a very buoyant stage prior to coronavirus and the activity and the confidence around purchasing houses was very high. I do feel that eventually it will bounce back.

Will we see an increase in forced sales like we did during the GFC?

We may, but there’s some support around the mortgage holidays. The Government is really putting a lot of focus on this, so I guess they don’t want to see a lot of people lose their homes and have mortgagee sales and forced sales. There’s a lot of emphasis on this and hopefully this buys people some time.

I think the Government is trying hard. If this were to happen a lot across the country, I think they would take it realty seriously and do what they can to give support.

House prices after the GFC rose quite quickly and in Auckland there was a boom. Is this a likely scenario once the virus is under control?

It will probably bounce back pretty quickly once people can buy and sell. Auckland is the largest city, there’s quite a lot of demand, it seems to have a lot of the activity around housing.

I still believe it will depend on that level of unemployment and how long it takes for people to get confidence back, but I do expect it to bounce back pretty quickly.

Bindi Norwell, chief executive of the Real Estate Institute of New Zealand. Photo / Supplied

How long that will take is such an unknown and it’s probably a little bit early to tell. But I don’t think people’s love of property and getting on with their life and everyday decisions around property will change. It will bounce back.

In the US, they are talking about U shaped (slow) and V shaped (quick) recoveries for the property market. What do you foresee for New Zealand?

It’s probably too early to tell but I think it will probably be V-shaped. I do feel it will bounce back. But as I said, it depends on those other factors of how long it is.

If we think about the confidence in the market prior to coronavirus, there was a lot of interest, a lot of activity, a lot of infrastructure development. When that kicks off again I think there will be a lot of the Government really trying to invest in this country to get things moving again.

People will start getting jobs, people will start wanting to move to different areas, so it will come back. I expect it to recover. I mean, even with the GFC it still bounced back within a year.

I’m not saying it’s going to do that but it did bounce back pretty quickly and it superseded where it was. It bounced back even further. If I had to put money on it, I’d probably say a V shape.

What advice to you have for those who want to withdraw their listing?

I think people need to speak to a lawyer because if they do pull out of their listing agreement they may still be liable for the marketing costs the company or the agent has already outlaid on that.

I think what’s even more important to think about is if they do pull out of an exclusive listing and then they sell it within a 90-day period they may be still liable to pay that commission to the agent, and if they change to a different agent they may still be liable if it’s in that 90 day period so it’s extremely important to look at the listing agreement in very fine detail and seek legal advice before you pull out of anything.

A refund for marketing costs if the property was withdrawn would come down to the individual agreement with the agent and what they’ve spent on the marketing campaign. If it’s just a day or two they may say that’s fine. If they’ve spent a lot of money, time and energy on it the vendor may be liable. It really will depend on the agent.

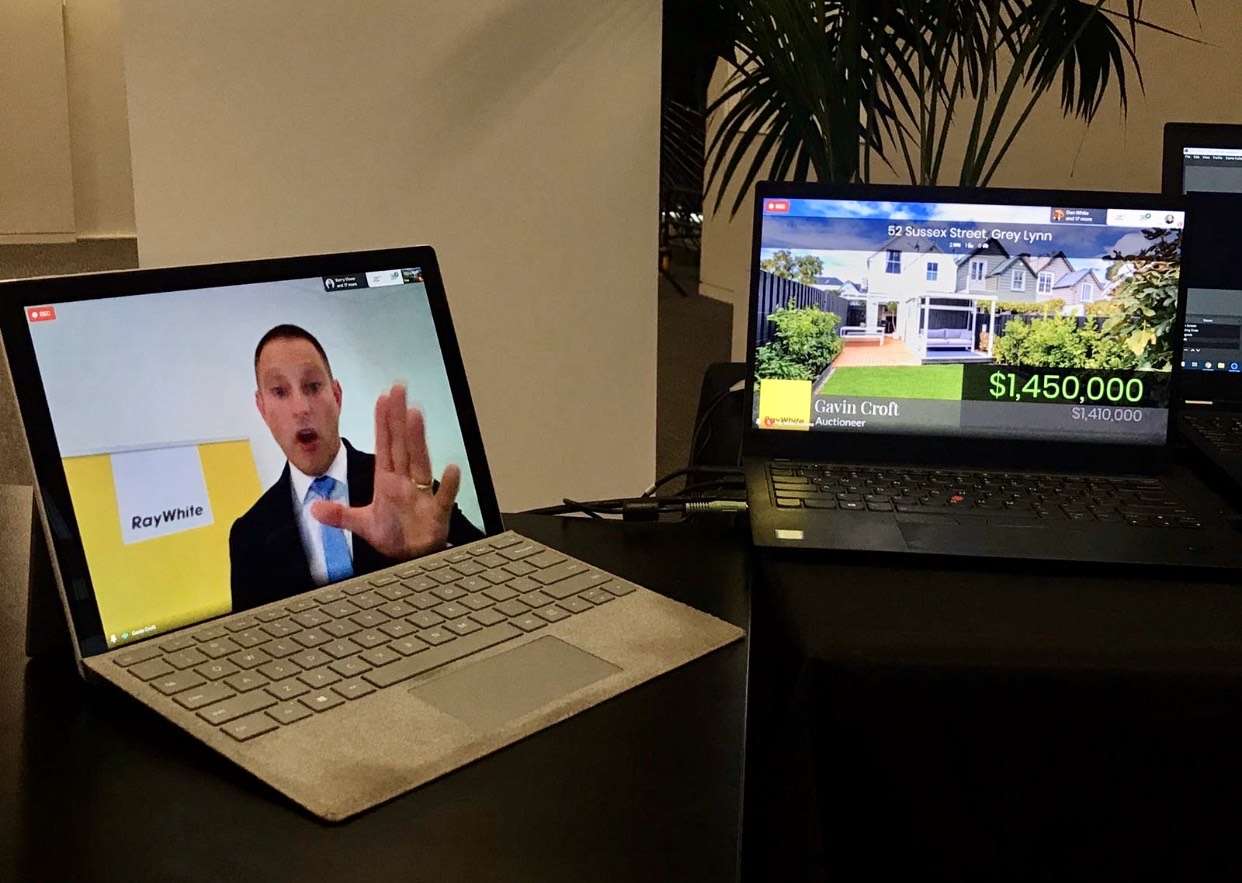

Real estate agencies, such as Ray White, are finding new ways to keep the market going by conducting auctions online. Photo / Supplied

For those who had just started looking before the lockdown came into effect, what should they be doing now?

I’d say this is giving people a bit more time to thoroughly research so continue with it, because it will pick up again. Once lockdown is over we can actually start making decisions so get ready so you’re quite prepared.

There might not be as much choice in terms of listings and houses to have a look at online but it’s still a great time to do research, understand different areas, what kind of house or property you’re interested in. I think it’s a really good time for people to check in and do additional due diligence and research and understand the property market at the moment.

Research has gone up at this time, I believe. Anecdotally I hear searching on websites and property websites I hear has gone up. People have a bit more time to have a look at things. People’s love of property hasn’t gone away.

What sort of research should they be doing?

Number one, if you haven’t done it already, is around the area you’d like to live in, the agents that can support you in the area and what is planned for that area in terms of infrastructure. Are there new transport links coming? What are the developments in the area?

I’d say be looking really closely at the economic factors around the country and really understand what is going on in terms of the economic activity.

And really research finance: be speaking to financial advisers, be speaking to lawyers and to people about your own position.

Agents are working at the moment, they’re very happy to help in any way. Some properties are still listing and they’ll know what’s going on in the area in terms of other people that may not have listed. Things can happen behind the scenes and I think agents are in the perfect place to be able to help that. You can see everything on maps and think ‘I like that house’ so contact an agent to find out a little bit more about it. I think a lot can be done.

How can people inspect a house without being there physically?

I’ve been astounded by some of the virtual reality. There’s been a lot of virtual reality tools around, or virtual look-through software, that agents have already implemented. You could do it through those virtual walk-throughs.

Some agents are working out ways to get photography done with the vendor so they can help with that process. Vendors can take the photos and the agent can support them through that. But also some vendors may be open to showing someone around using video technology as well, do a bit of a walk-through themselves and answer any questions. It’s just making sure we think outside the box, and some agents are really up to speed in terms of the other tools we can use.

Can Kiwis still buy or sell homes during the lockdown?

Yes, they can, they just can’t move in. What we’ve been advising, which is really advice from ADLS and the New Zealand Law Society, is around trying to delay settlement until after the lockdown. You know, you’re not in the midst of it now so you can actually delay it. Even though we don’t know when we’ll come out, there are clauses available to say 10 days or so after lockdown ends.

All the negotiation can happen still. It’s interesting, we’ve got FlexiSign, which is an online negotiation and digital signing platform. We’ve had that for a while but we’ve provided it for free now for all of our members because it’s a really good platform to be able to do it all online. We’ve been saying to the industry please just use it for free and let’s keep things moving if you want to.

What about getting a building inspection?

It’s hard with that. You can’t do building inspections at the moment. There is a certain degree you could probably do virtually by looking at it. But I guess you could put in “subject to” clauses if you do come up with a negotiated offer - “subject to building inspection when we come out of lockdown”. I think there are ways around it. And people absolutely need to get legal and financial advice through this process, it’s never been more important.

What advice do you have for first home buyers who may be worried about their deposit and their ability to use KiwiSaver?

It’s tough because KiwiSaver really has been significantly impacted at the moment. I would recommend seek financial advice. It really depends on people’s individual circumstances and investing in some good financial advice is paramount at the moment and they would know to say ‘actually, it may pay off to hold tight for a time’ or ‘actually, you’ll be fine because you’ve got enough equity or whatever’ so it really does depend, but not to give up, it will bounce back eventually.

Uncertainty over settlements is a concern for those in the middle of a transaction right now. What is the latest guidance?

This has been one of the biggest issues we’ve been dealing with.

We’ve estimated there are 5800 settlements over this lockdown period; that’s about $3.7b worth of sales so it’s not small. The advice from ADLS and the New Zealand Law Society is to try to delay the settlement if you can.

Now, there are situations where people can’t do that genuinely and it’s really trying to be kind, to come to some sort of negotiation around the settlement.

Some people can’t because they will be financially penalised for it. An example was that someone didn’t want to settle because they would be moving in or settling on a vacant property and they were really worried that it was unsecure and not protected. It would be their house, but they can’t go and put any security around it. They negotiated with the other party to pay for some extra security and then they settled.

So I think it’s really just trying to find solutions across the parties but it’s not always easy.

Some buyers will have been caught out by the lockdown and face the prospect of having to pull out of their deal due to finance issues. What options do they have available to them?

If they do have to pull out of the deal it really does depend on their particular contract as to what they can and can’t do. They may be able to negotiate something as well or with their bank. I think the main thing is that hopefully people are trying to do the best thing, and banks and lawyers are trying to do the best thing as well to try to work out solutions. Get as much advice as possible.

Can they be held to a purchase if their circumstances have changed? If not, where would that leave vendors?

A contract is a contract. That’s why it’s so important that any time you get into a contract you seek legal advice, because you never know what’s going to happen. It’s making sure you understand the terms and conditions.

You could be held to it if that’s what the contract states. You may risk losing the deposit, you may risk losing something as part of that contract. Seek legal advice. If someone has purchased a property or they’ve said they’re going to buy it and it’s unconditional but then they can’t get the finance or they’ve decided they’re going to change their mind because of Covid-19, that will depend on their particular contract and whether the vendor will agree to it.

The vendor might say "actually, I’m pulling out too, we’ve come to a conclusion together" or "no way, you can’t pull out of that contract". It can get quite intricate.

What's the best method of sale while restrictions are in place?

It really depends. They’re all still going on. In terms of auctions, you’ve got virtual auctions or online auctions. People can phone in, as well. There are lots of platforms for that at the moment.

The other thing is price by negotiation. That can all happen by phone or online with emailing.

I think tenders can still happen if they do it online by emailing in a secure way. There’s a process around that.

These all can still happen, it just depends on the type of property and the level of interest, so the agent will be able to recommend what is best. Some people are putting a price on property at the moment so it’s all very clear, but that’s still a negotiation at the end of the day.

It will just depend on who you’re marketing the property to and what the agent advises as to what the best methodology is.

Are landlords eligible for mortgage relief?

It may depend on the particular bank but we understand that residential landlords can get mortgage relief.

People need to really understand that if you have that mortgage relief - a mortgage holiday - it doesn’t mean it disappears. It gets added on to your mortgage term so it might be a longer period to pay off your mortgage. I don’t think people really understand that enough - you still have to pay it back.

What advice do you have for commercial property buyers, sellers and tenants?

There’s a lot of questions around commercial property at the moment around leases and people not wanting to pay rent.

I think it is very important people understand their obligations as a commercial property owner, what they need to do in these circumstances. Some contract clauses provide that certain things need to happen. Following the Christchurch earthquake there were certain clauses put in so I think people really need to understand their own particular contracts, including the no access clauses.

I would talk to landlords and try to negotiate a compromise. People don’t want to lose tenants or sales. It’s about how we work through this, and it’s the same thing as residential - virtual tours, settlement deferments. Everything can still keep proceeding, it’s just that it’s virtual.

Any last advice?

I just think it’s extremely important we get through this together. I think post-making sure we’re all clear on what we can and can’t do we try to be as kind as possible throughout this process because I know it’s a lot of anxiety and stress, particularly for people settling. It’s so important we try and work through things together.