OneRoof's latest house price figures reflect growing uncertainty in the property market, especially in areas where weakness was evident before Covid-19 struck.

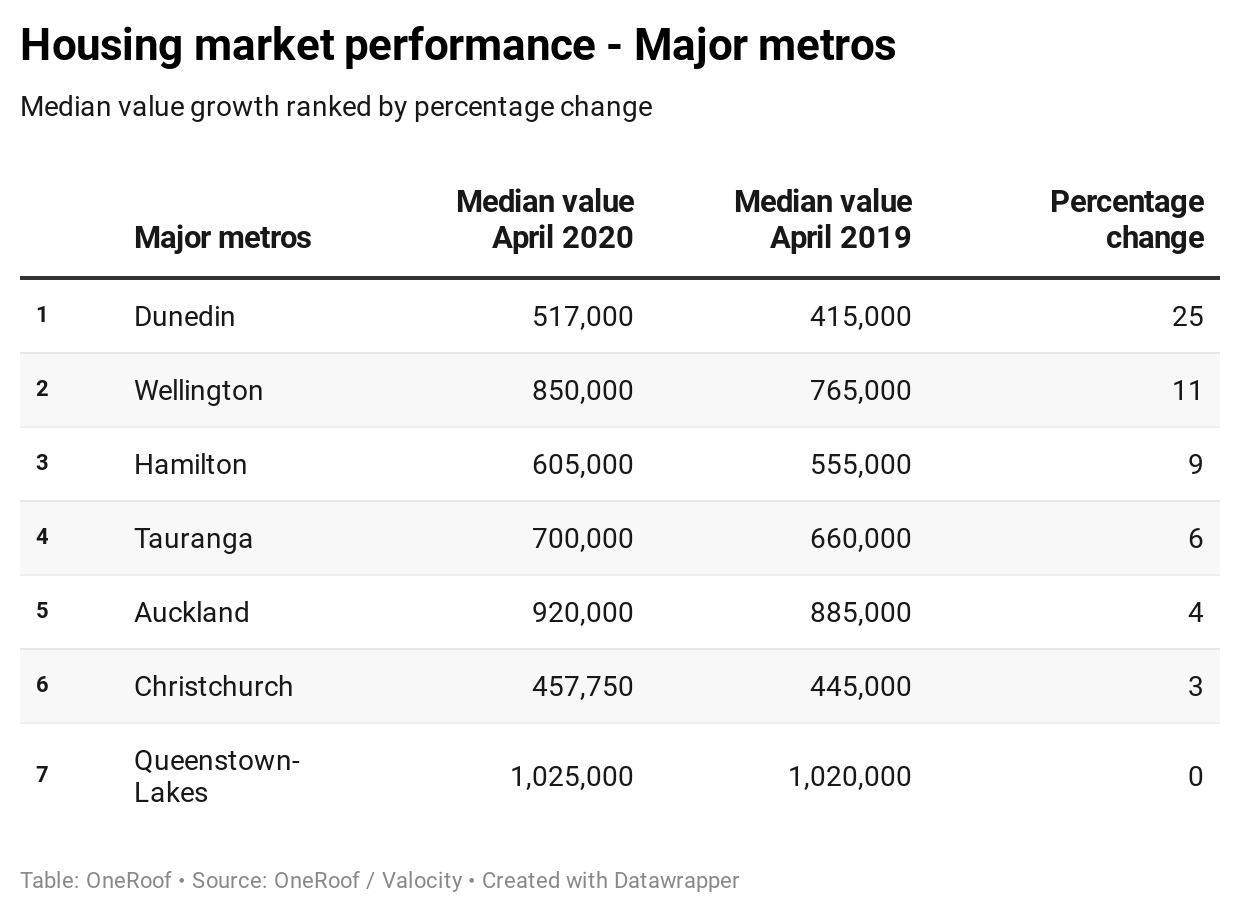

Of the major metros, Dunedin and Wellington saw the biggest value growth in the 12 months to April 2020, while Christchurch and Queenstown house prices barely grew at all.

Dunedin's median value was up 24.58 percent year on year to $517,000, a sign that the city's housing market will be immune to the negative effects of Covid-19 as long as listings remain in short supply and houses there are still seen as affordable compared to the rest of the country.

Start your property search

Wellington's median value grew 11.11 percent year on year to $850,000, and although the capital cannot claim affordability as a driving factor in its price growth, it does have the country's most stable job market and a dearth of new listings to support its market in the months ahead.

Showing steady growth despite a month-long pause on the property market were Hamilton (up nine percent year on year to $605,000) and Tauranga (up six percent to $700,000).

Auckland's housing market had reached almost red-hot levels in the months leading up to Covid-19's arrival. The lockdown put the brakes on the market somewhat, although record sales are still being achieved, with one Remuera home selling for $8 million under the hammer last week. Year on year growth for April was 3.95 percent, with property values for the city as a whole hitting $920,000.

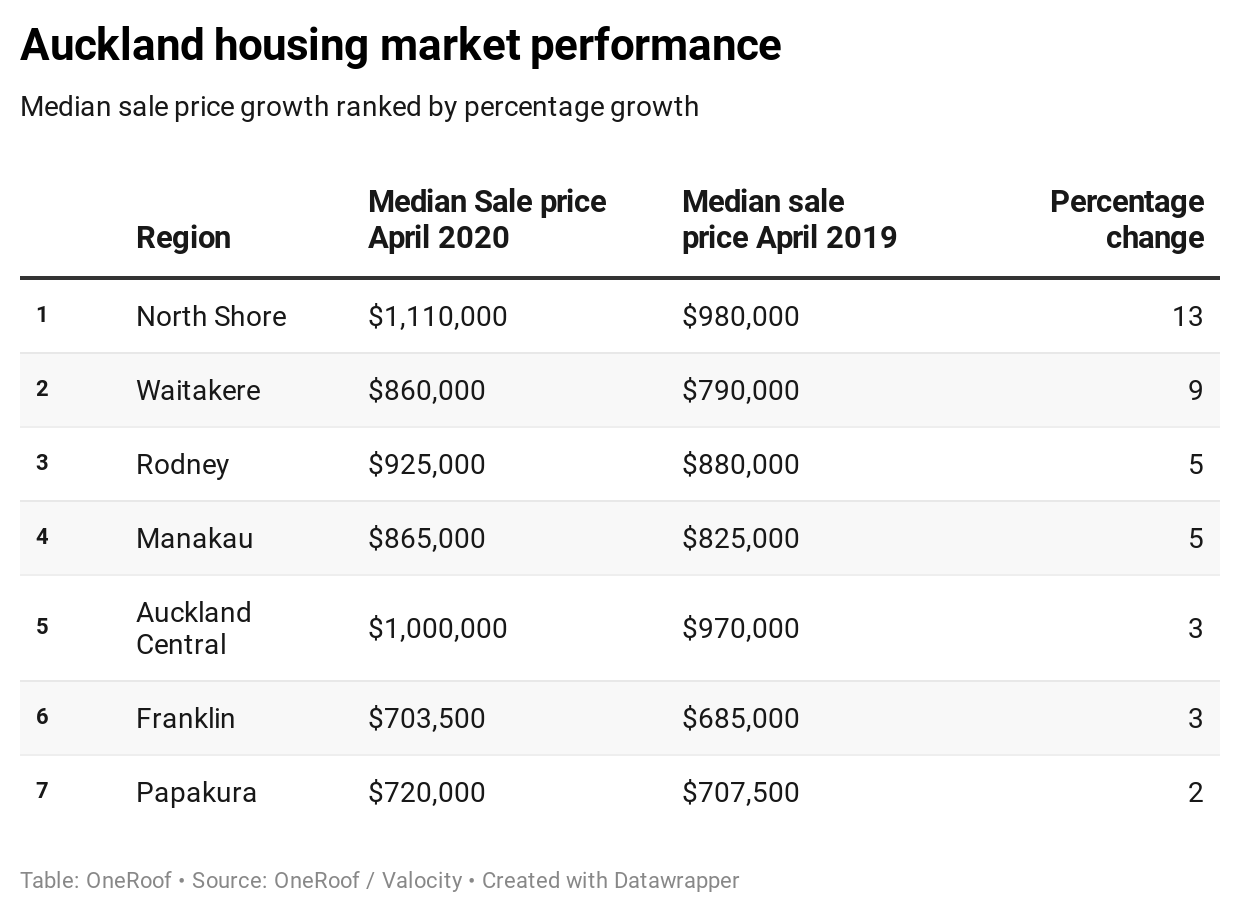

Figures tracking the median sale price - which reflect the prices buyers are paying for houses that are on the market - show growth in all regions of the city, with North Shore and Waitakare recording the biggest leaps year on year (13 percent and 9 percent respectively).

As encouraging as those figures are, they should be viewed in context, with big changes in median sale price the likely result of several big sales that may not be reflective of the wider market. However, they do show that some buyers, even post lockdown, are willing to pay big money to secure the home of their dreams.

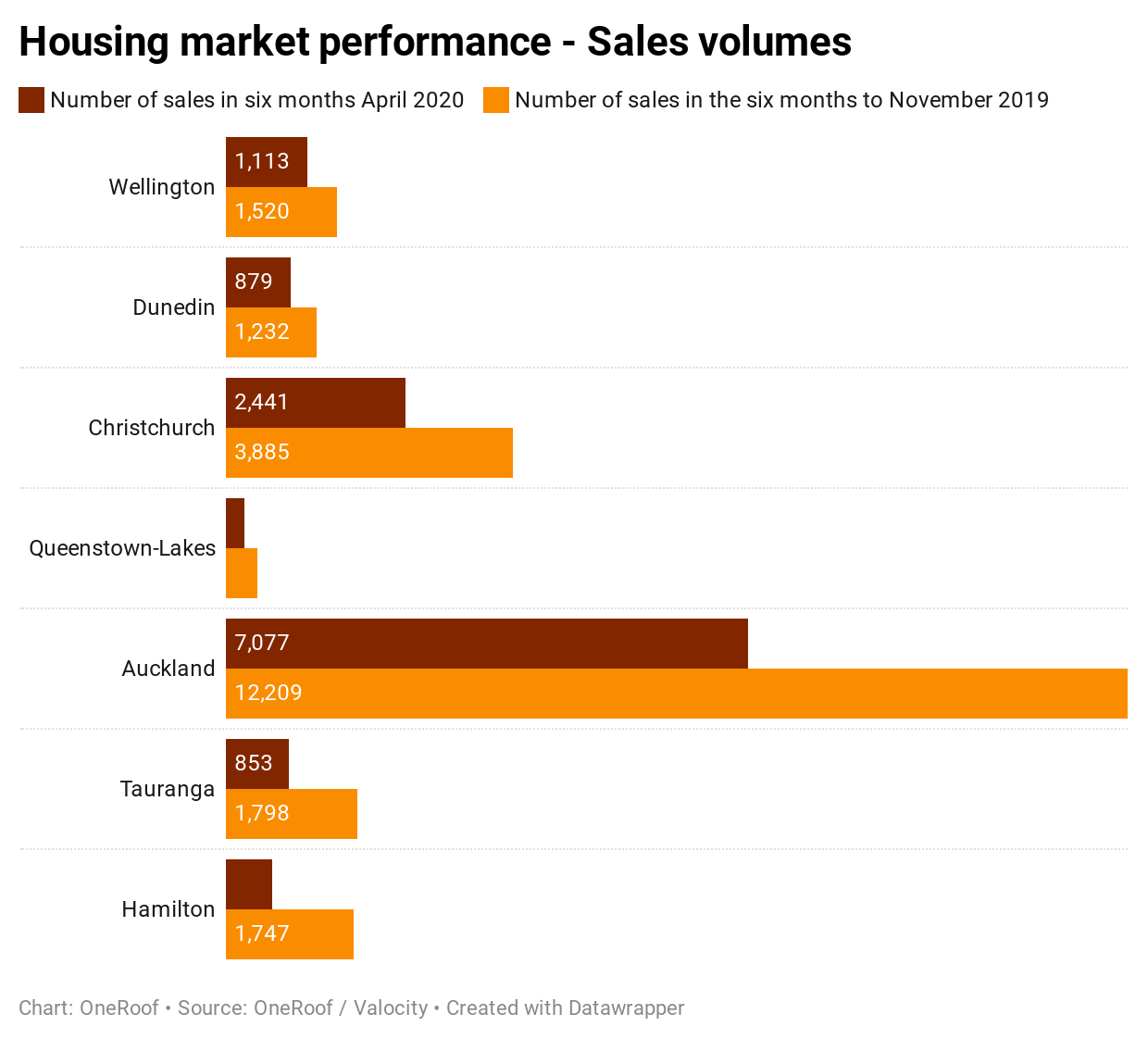

Shortage of stock and buyer demand is likely to support Auckland house prices over the next quarter, although the continued slide in sales volumes is a worrying sign for the market: total sales in the six months to April 2020 was just 7077, compared to 12,209 in the six months before that.

The downward trend in Auckland sales volumes is no different to that seen in the other major metros but Auckland accounts for the bulk of New Zealand sales and figures have dropped 36 percent between 2015 and 2019.

House values in Christchurch saw little growth over the last 12 months, with the city's median value up just 2.8 percent to $457,750. That's not cause for alarm, though, as Christchurch values have been flat for several years now, mostly due to the particular dynamics of the city's housing market. In its favour in the months ahead, though, is the fact it is a strong employment centre and has a good stock of quality new builds at affordable prices. Kiwis seeking value for money would do to turn their attention to properties there.

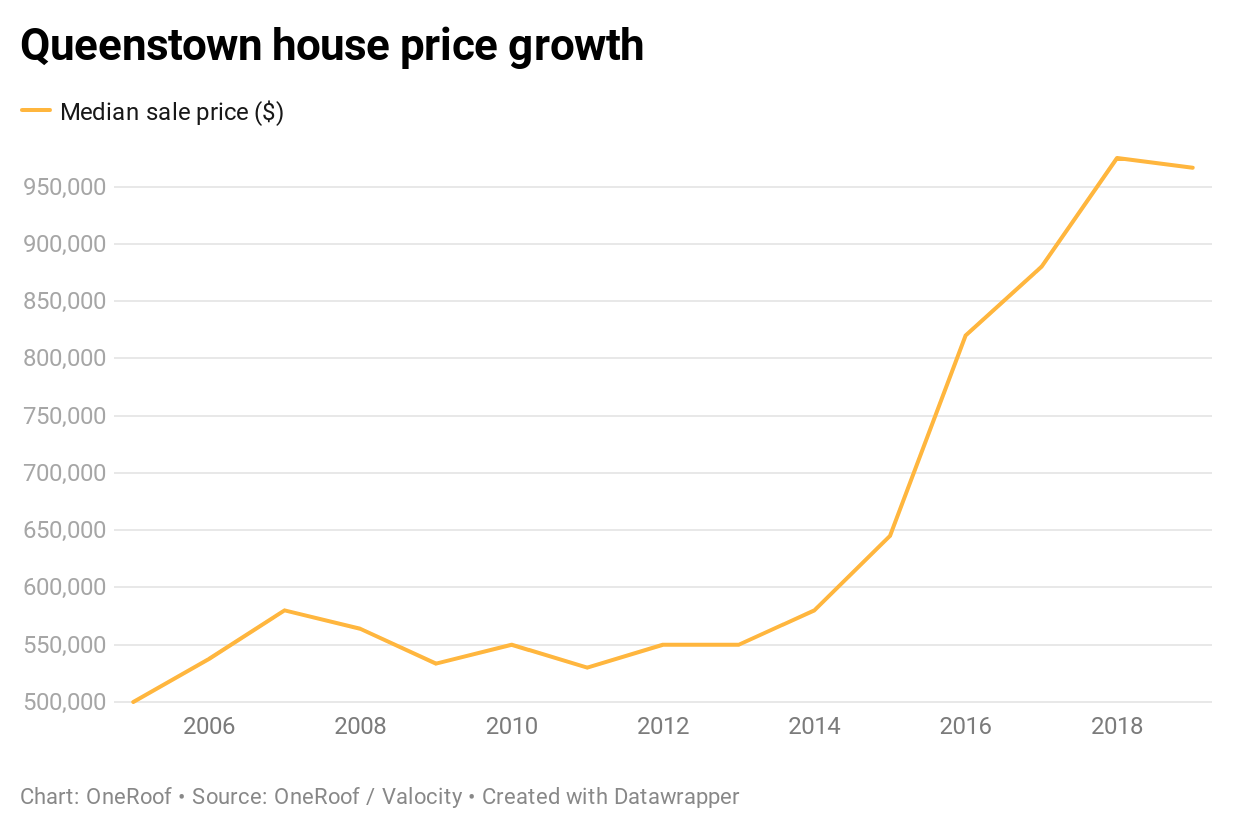

The standout statistic is the one measuring year-on-year growth in Queenstown. House values in the city were up just 0.49 percent on April last year to $1.025 million - a challenge for a city whose tourism-dependent economy has been torn apart by Covid-19.

House price growth in what is still New Zealand's most expensive property market was already slowing before the lockdown hit and borders were closed, and that weakness is likely to become more apparent in the months ahead as the economic downturn puts pressure on investors and second-home owners, especially those who bought at market peak.

Recent sales show that the market may be in for a wild ride. A four-bedroom house with a separate two-bedroom unit sold under the hammer last week for $1.422 million after intense bidding. The sale of 28 Myles Way, in Lower Shotover, was brought forward after a pre-auction offer of $1.3 million was made.

However, several days later, at a big auction event, 17 Queenstown properties passed in. Of the 21 properties on the list, just four sold, mostly for prices around their 2017 rating valuation.

Many of the homes brought to auction on Friday were in Lower Shotover and relatively new. The suburb, which is about 8.7km outside Queenstown, started life in 2012 when the first of around 900 residential subdivisions were released to the market and OneRoof figures for April show the median value there has grown five percent year on year to $1.06 million and 51.4 percent since April 2015.

It's that last figure that should give Queenstown's market hope. The majority of homeowners and investors in the city will have seen huge capital growth.

And the slowdown in the market may represent the best opportunity for buyers to enter the market. The last time Queenstown prices took a hit was during the global financial crisis. Then the median sale price dropped from a market high of $580,000 in 2007 to $533,500 in 2009 before climbing again. Those who bought at the bottom of the market will have seen house prices shoot up 81 percent over the following 10 years.

Feedback from Queenstown agents shows that some Kiwis are already making that calculation. Agents have told OneRoof that cashed-up buyers from Dunedin and expats looking to return home are eyeing up Queenstown's market.

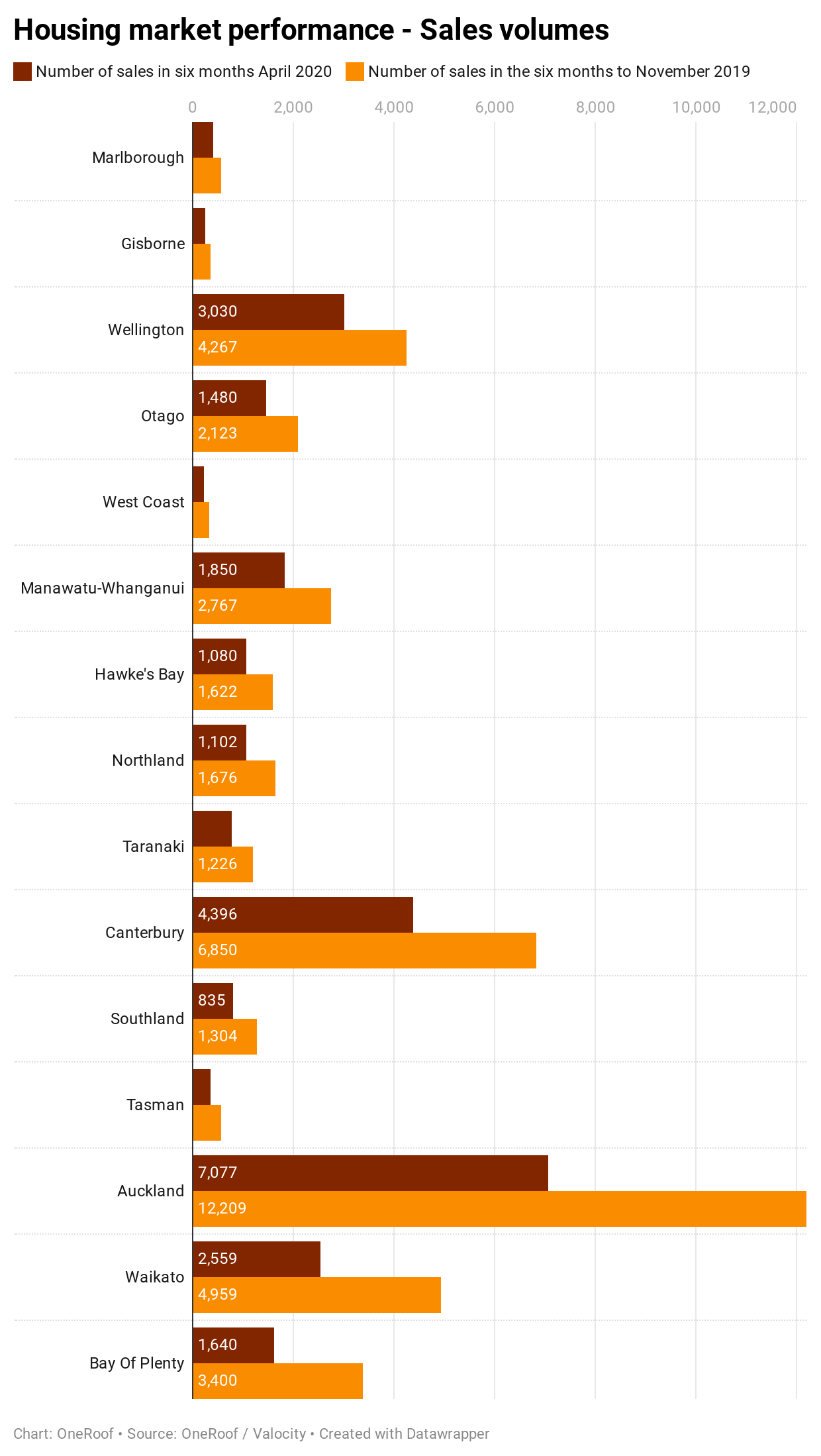

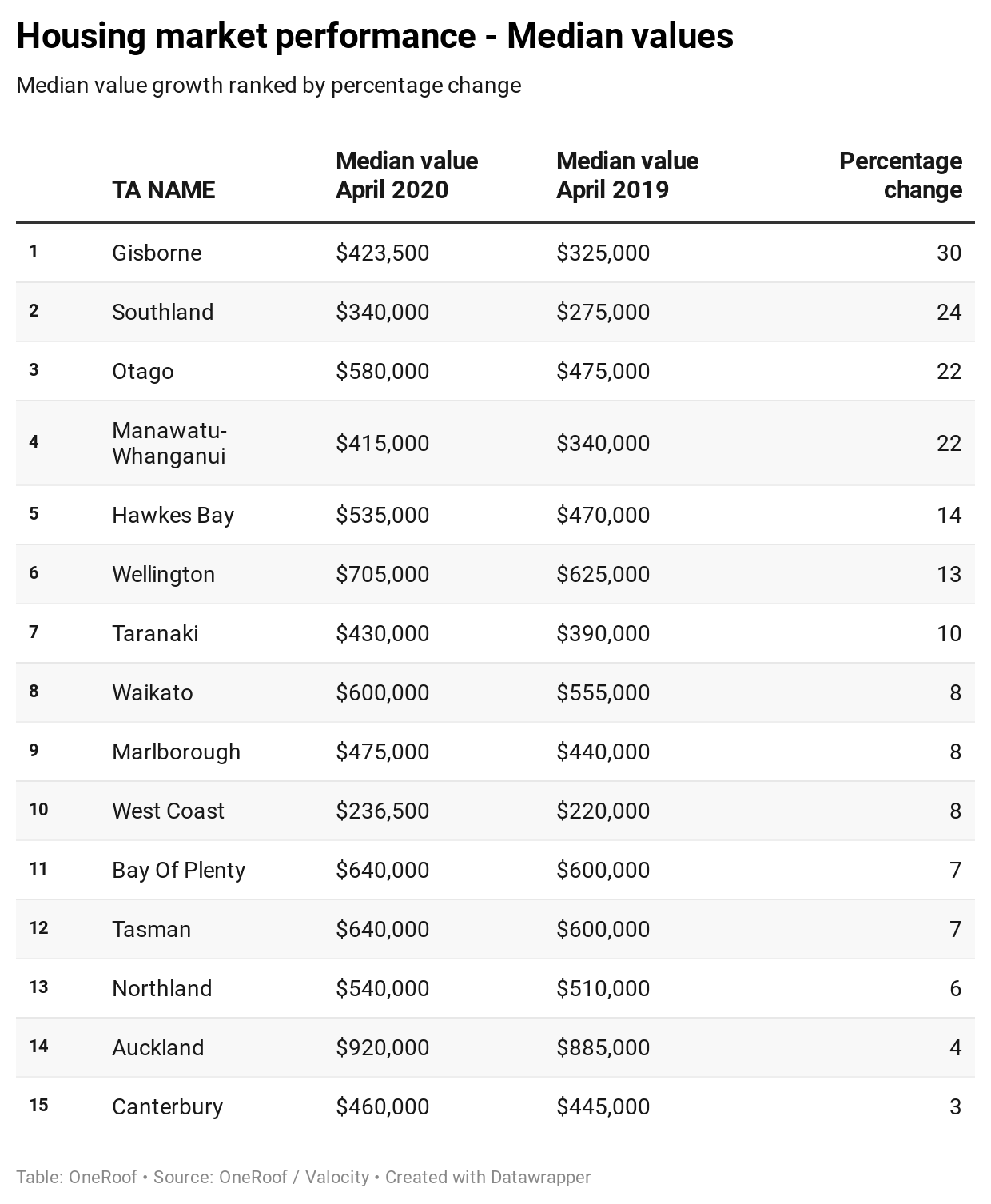

Of the major regions, Gisborne saw the most growth year on year, with the median value of all properties there rising 30 percent to $423,500. Affordability is the main driving factor in the region's housing market. The same can be said for growth in Southland (up 24 percent to $340,000), Otago (up 22 percent to $580,000) and Manawatu-Whanganui (up 22 percent to $415,000).

This is not to say that these regions are red-hot right now, although 24 Gisborne properties did sell under the hammer at special auction just over a week ago. The figures more likely reflect the huge price growth enjoyed in the months before Covid-19 struck, as first home buyers and investors sought out affordable locations in which to purchase.

The next three months will show if there is continued appetite in these regions.

- Owen Vaughan is editor of OneRoof.