Click here to download this report >

The house price gains of 2021 are in danger of being wiped out, with the latest figures from the OneRoof-Valocity House Value Index pointing to the steady erosion of property values across much of the country.

The nationwide average property value fell 2.9% in the last three months to $1.064 million - $21,000 below where it was at the start of the year.

Start your property search

The average property value in 12 of the country's 16 regions dropped in the last three months - compared to just one region registering a decline in the first three months of the year.

Hardest hit by the market slowdown, and in danger of dropping out of the $1m club, was Greater Wellington.

The region's average property value tumbled 8.3% ($95,000) in the last three months to $1.046m, but worryingly for those who bought at market peak in the region, the tally is just 1.8% ahead of where it was a year ago, illustrating the extent of the region's decline after the sharp rise of 2021.

Dragging down the region were steep value declines in Lower and Upper Hutt - down 9.1% and 11.2% respectively over the quarter, and more worryingly, down 2.3% and 2.6% year on year. The capital's housing market has also taken a hit. Its average property value fell 10.1% ($136,000) over the quarter to $1.206m, with its best performing suburb still registering negative growth.

No other region's house prices suffered as brutal a change as Greater Wellington's, but feeling the squeeze over the quarter were property values in Hawke's Bay, down 5% to $888,000, and Auckland, down 4.3% to $1.485m. Declines in another eight regions were between 0.1% and 2.9%.

The country's best-performing region was Canterbury, with quarterly growth of 2.1% slightly up from the 1.9% it recorded in the three months to the end of May. The region's average property value of $792,000, buoyed by strong sales activity in Christchurch, is now $138,000 ahead of where it was in June 2021.

Christchurch was the only major metro to record value growth over the quarter (+2.2% to $795,000). Queenstown-Lakes' average property value slid 0.6% to $1.874m while Tauranga's fell 2.7% to $1.213m. Dunedin's average property value took a 3.6% hit, taking it back to $724,000, and Hamilton's dropped 4.4% to $888,000.

The new figures found that a total of just over $124 billion was lost from the value of New Zealand properties in the last six months.

Thirty-eight of the country's 72 territorial local authorities suffered value declines over the quarter, with the biggest drops outside of Greater Wellington in Auckland’s North Shore (down 6% to $1.608m) and Hastings (down 5.5% to $958,000)

Of the 966 suburbs that had 20 or more settled sales in the 12 months, 615 (63%) suffered value declines over the quarter, up from 488 in the three months to the end of May. The biggest drop was in Brown Owl, in Upper Hutt. The suburb's average property value fell 13.6% ($140,000) to $886,000 over the quarter and dropped 6.6% over the last 12 months.

Of concern for new homeowners is the fact that the average property value in 454 suburbs with 20 or more settled sales in the last 12 months is lower now than what it was six months ago. And of those, 68 are in a worse position now than they were 12 months ago.

James Wilson, head of valuations at Valocity, OneRoof’s data partner, said: “The latest set of figures show the impact of inflation, rising interest rates and the CCCFA. Buyers have taken a step back and are certainly not acting with the urgency seen last year. That's certainly true in Upper and Lower Hutt - two housing market that were powered by first home buyers in 2021."

Wilson said that with the market continuing to experience low sales volumes, weekly and monthly housing market metrics were becoming increasingly volatile, "with each month appearing to reveal a new change in conditions".

“However, the housing market isn't the share market, and for the majority of homeowners negative equity won't be an issue. Many areas and property types have experienced significant value growth over 2020 and 2021, providing owners with a relatively large cushion. If you don’t need to sell and have purchased a property for long-term use, then value drops over the short-term shouldn’t worry you too much,” he said.

James Wilson, head of valuations at Valocity: "Buyers have taken a step back." Photo / Fiona Goodall

Owen Vaughan, editor of OneRoof, said the figures pointed to bumpy winter and spring. "House prices in five regions - Greater Wellington, Auckland, Hawke's Bay, Nelson and Manawatu-Whanganui - are below levels recorded six months ago, while the value slide in Greater Wellington will soon wipe out the house price gains made in the latter half of 2021.

"While recent employment data points to stability in the jobs market, the spectre of a recession looms large. Many of those who bought at peak will be in the unfortunate position of owning an asset that is, on paper, declining in value."

Mortgage registration volumes continue to their journey downwards, as rising rates scare off potential buyers. Wayne Shum, head of research at Valocity, said first-home buyers’ share of the market had fallen from 39% in the three months to the end of May to 37% in the three months to the end of June. Investors' share of the market rose from 23% to 26% in the last quarter, but the number of registrations remained consistent, at around 5000. "Further rate rises are certain this year, which will likely blunt any increased appetite as a result of this month's changes to the CCCFA," Shum said.

He added: "Many homeowners who took advantage of the record low mortgage rates in 2020 and early 2021 are now due to have their borrowing rates refixed at a much higher rate, which will also take a toll on the market."

-------------

THE KEY POINTS: Biggest winners, biggest losers

New Zealand's average property value grew 9.6% ($93,000) in the last 12 months to $1.064 million, but in the three months to the end of June it dropped 2.9% ($32,000). Any gains made at the start of the year have been wiped out, with the current average property value 1.94% ($21,000) below where it was in January. Canterbury was the hottest region over the quarter, with growth of 2.1% ($16,000) leaving its average property value just $8000 shy of $800,000. Hauraki, in Waikato, was the country's best-performing territorial local authority over the quarter, with its average property value up 8.2% to $899,000.

As seen in June’s figures, low sales volumes are contributing to the value slide. In the 12 months to the end of June, the number of settled sales totalled 103,597, down from 108,238 in the 12 months to the end May and 109,238 in the 12 months to the end of April. Just 966 suburbs recorded 20 or more sales in the last 12 months, down from 984 in the 12 months to the end of May and 990 in the 12 months to the end of April. (The figures cited below only cover suburbs with 20-plus settled sales in the last 12 months.)

NZ's most expensive: With an average property value of $4.272m, Herne Bay, in Auckland, is home to New Zealand's most expensive real estate. Value growth in the exclusive waterfront enclave was 12.7% over the year and 1.5% over the quarter. Strong activity in Coatesville, in Auckland's Rodney district, is providing Herne Bay some competition, with the lifestyle suburb's average property value up 4% ($146,000) over the quarter to $3.807m. The most expensive suburb outside of Auckland is Queenstown-Lakes' Kelvin Heights (up 2.9% over the quarter to $2.667m).

Fifty-seven suburbs with 20 or more settled sales in the last 12 months have an average property value of $2m-plus, and of those, just 27 saw value growth over the quarter, with 29 in a worse position now than they were six months ago. Whitford, on Auckland's south eastern fringes, is the only suburb in the $2m-plus club where house prices are lower now than they were 12 months ago, with its average property value dropping 2.1% ($73,000) over the year to $3.373m. Among the suburbs falling out of the $2m club over the quarter were Farm Cove, in Auckland's Manukau (down 7.8% over the quarter to $1.908m); Murrays Bay, in Auckland's North Shore (down 3.3% to $1.964m), and Roseneath, in Wellington (down 8.5% to $1.833m).

NZ's cheapest: Runanga, in Grey, is the town with New Zealand's lowest average property value, at $237,000 (an amount that still wouldn't cover the typical deposit required for a house in Auckland). House price growth over the quarter was a subdued 0.4% ($1000) and over the last 12 months 17.3% ($35,000). Neighbouring Cobden and Blaketown, and Ross, in Westland, and Mataura, in Gore, are the only other suburbs / small towns to have an average property value of less than $300,000. Of the 68 suburbs with an average property value of less than $500,000, 40 experienced value declines over the quarter.

In demand: Ten suburbs or small towns in Waikato recorded double-digit growth over the three months to the end of June. Leading the surge were Waerenga, 30km north of Huntly, and Raglan, on the west coast, 40km west of Hamilton, both of which enjoyed an 11.6% lift in their average property value. While membership of the double-digit growth club for the three months to the end of June is double the number for the three months to the end of May, the overall number of suburbs recording value growth over the quarter was 330, down from 484 in the three months to the end of May.

On the slide: Oriental Bay, in Wellington. Photo / Getty Images

Kingston, in Queenstown-Lakes, was the hottest major metro suburb over the quarter, recording a 7% lift in its average property value to $838,000. Nine other suburbs in the TA enjoyed growth over the quarter, and in Christchurch, the average property value rose in 46 out of the 73 suburbs with 20 or more settled sales in the last 12 months. Growth figures for the other major metros were grim, reflecting the downturn in the market: just five in Dunedin, eight in Hamilton, two in Tauranga, and none in Wellington. In Auckland, growth was recorded in 53 out of 217 suburbs over the quarter - just 24%.

Biggest winners: Mangatawhiri, on the Auckland-Waikato border, gained the most, dollar-wise, in the last three months. Its average property value jumped $151,000 (11.5%) to $1.465m. Fourteen of the 16 suburbs that saw lifts of $100,000 or more over the quarter were in Waikato, with three in Queenstown-Lakes and one in Auckland.

Biggest losers: The suburb that has recorded the biggest value decline in the three months to the end of June is Brown Owl, in Upper Hutt. Its average property value fell 13.6% ($140,000) over the quarter to $866,000. Another 18 suburbs, all in Greater Wellington, saw double-digit declines over the quarter. The suburb that lost the most, in dollar terms, over the quarter is Waiheke Island, which saw its average property value drop $295,000 (7.7%) to $3.554m. Losses of $100,000-plus were recorded in another 62 suburbs over the quarter, with the overall number of declining suburbs hitting 615, up from 488 in the three months to the end of May.

For buyers who bought during market peak, the figures are even more worrying - if they are in an unfortunate position of needing to sell right now. The average property value in 454 suburbs is lower now than what it was six months ago. And 68 suburbs are in a worse position now than they were 12 months ago. The worst affected by the slump are: Kenepuru, in Porirua, down 7.7% over the last 12 months; Alicetown, in Lower Hutt, down 7.2%; and Avondale, down 6.9%. The slump has also eroded the somewhat small gains that Auckland Central, Newmarket and Manukau enjoyed during the post-Covid boom, with the average property value in three apartment-heavy Auckland suburbs up between 5% and 12% over the last 24 months. Expect the market correction to claim more post-Covid gains in the months to come.

-------------

Northland's average property value fell 1.2% to $908,000 in the last three months. That's still $144,000 up on a year ago (and $287,000 above the June 2020's figure), but while Northland's slide into negative growth has only become apparent in the last quarter, the trend line for house prices in the region is downwards. What's notable in the figures is the sudden change in Northland's fortunes. In the three months to the end of March, the region recorded growth of 7.4%, on the back of an incredibly hot summer.

Dragging the region into slump territory is Whangarei, where the average property value dropped 2.8% ($28,000) over the quarter to $955,000. Of the 28 suburbs in the TA that had 20 or more settled sales over the past 12 months, just four registered growth over the quarter, although that growth was marginal: Kensington (+0.8%); Ruakaka (+0.7%); Langs Beach (+0.2%); and Parahaki (+0.1%). Six suburbs suffered falls of more than 9% over the quarter, with the slump wiping more than $120,000 off the value of properties in Whangarei Heads and Kauri.

Kaipara's overall average property value didn't budge over the last three months, with strong house price growth in Mangawhai (+5.1%) and Kaiwaka (+5%) offsetting falls in Mangawhai Heads (-0.8%) and Dargaville (-2.9%).

Northland's star performer over the quarter was the Far North, with the TA's average property value up 1.4% to $806,000 on the back of growth in Russell (+3.5%), Kaitaia (+3.4%) and Karikari Peninsula (+3.1%).

-------------

Greater Auckland's average property value fell 4.3% ($67,000) to $1.485 million in the last three months. House values in the city are 1.55% below where they were at the start of the year and only 7.8% above where they were in June 2021. The continued slide in house prices in the city will likely eat into much of the value gains made in the latter half of 2021.

All seven of the region's former local government areas recorded negative growth over the quarter, with the North Shore again taking the biggest hit; its average property value fell 6% ($103,000) over the quarter to $1.608m. The rate of decline in Auckland City and Manukau was 4.7% and 4.8% over the same period, while the value falls in the four remaining areas was between 1.4% and 2.9%.

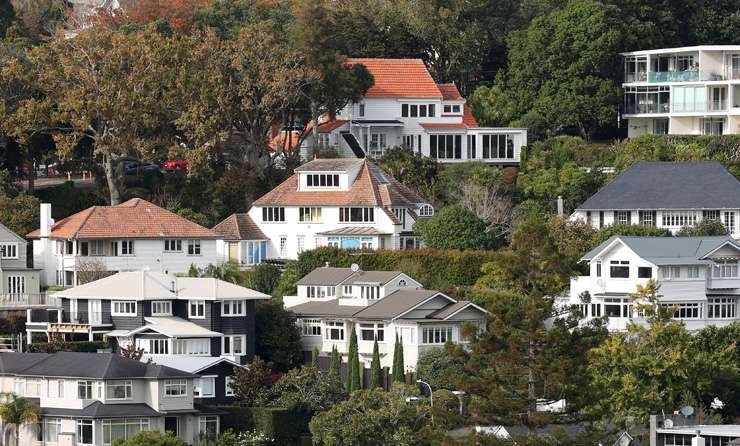

Houses in Remuera, Auckland. Photo / Fiona Goodall

The percentage of Auckland suburbs that dropped in value rose from 20% in the first three months of the year to 72% in the three months to the end of June. House values in 18 Auckland suburbs are down year on year, up from just two last month. Of the suburbs that recorded 20 or more sales in the last 12 months, Belmont suffered the biggest quarterly decline. The posh North Shore suburb's average property value fell 9% ($165,000) to $1.67m. Two lifestyle suburbs on the city's northern fringes, Matakana and Riverhead, recorded the strongest quarterly growth, with Matakana's average property value up 4.5% to $2.256m and Riverhead's up 4.7% to $2.158m.

-------------

Waikato's average property value dropped 0.1% to $986,000 in the last three months, with strong value growth in the TAs of Hauraki (up 8.2% to $899,000) and Waikato (up 4.4% to $1.149m) offsetting falls in Hamilton (down 4.4% to $888,000) and Otorohanga (down 5.5% to $718,000). House values in the region are still $122,000 ahead of where they were in June 2021 and $307,000 ahead of June 2020 levels. The slow rate of decline means the overall value gains of the last two years are safe for now, but weaknesses exist in the region's diverse housing market.

Hamilton's average property value is $30,000 below where it was at the start of the year, and only $60,000 ahead of June 2021's number. The trend line suggests property values in the city will come under further pressure. Just eight Hamilton suburbs registered value growth over the last three months - quite a turnaround from the first quarter of the year when every suburb recorded growth. Sales volumes are also shrinking, from 3866 in the 12 months to the end of March to 3641 in the 12 months to the end of June.

The slump has hit Chedworth, in the city's eastern fringe, the hardest, with the suburb's average property value down 8.1% ($83,000) over the quarter to $947,000, but Waikato's biggest faller overall in the last three months is Karapiro, in Waipa. The village's average property value tumbled 10.7% ($178,000) to $1.489m. Waikato's best performing suburb or town over the quarter was surfing hot-spot Raglan. Its average property value was up 11.6% ($142,000) to $1.365m.

-------------

Bay of Plenty entered negative growth territory in the second quarter of the year, as its average property value slid 0.7% to $1.071m. The market slowdown in the Bay of Plenty hasn't been as severe as experienced in other regions, with house prices still 2.72% above where they were at the start of the year and 14.3% above June 2021 levels, which suggests homeowners will be able to hold onto value gains for longer.

The change in market conditions has started to drag some of the region's strongest performers. Rotorua's late autumn surge is tapering off, with the 5.6% growth recorded in the three months to the end of May easing to 2.5% growth in the three months to the end of June. Whakatane was the only other TA to register growth over the quarter, with its average property value up 2.2% to $819,000.

Tauranga's average property value took the biggest hit over the quarter, dropping 2.7% ($34,000) to $1.213m. Just three suburbs in the city, Papamoa, Maungatapu and Poike, registered value growth, with Bellevue recording the biggest drop - it was down 6.6% to $864,000. House prices in more than half the city's suburbs are lower now than what they were in January.

-------------

Hawke's Bay, Manawatu-Whanganui and Gisborne all suffered drops in their average property value over the quarter, with Hawke's Bay suffering the steepest decline. Its average property value fell 5% ($47,000) to $888,000 on the back of weak market conditions in the region's two biggest centres, Napier and Hastings. Sales volumes are down and listings are up in both TAs, putting downwards pressure on prices. House values in more than three quarters of Napier's suburbs are in worse position now than they were six months ago, while house values in almost half of Hastings' suburbs are similarly prone.

The 3.9% fall in Wairoa's average property value over the quarter is a brutal turnaround for the TA, which had enjoyed a 5.3% value surge in the three months to the end of May, further evidence of instability in low sales markets.

Napier's hillside suburbs. Photo / Getty Images

Value drops of more than 3% in Horowhenua, Palmerston North and Whanganui pushed Manawatu-Whanganui's overall average property value down 1.5% over the quarter to $680,000. Only Ruapehu and Tararua saw growth, with Manawatu's average property value unchanged and Rangitikei's sliding 1.4%.

Value growth in Taranaki was a positive 1.4% over the quarter, but the brakes are well and truly on the region's housing market - in the first three months of the year value growth was 6%. Keeping Taranaki afloat was an exceptional 4.1% lift in Stratford's average property value, although South Taranaki, another affordable market, is under pressure, with its average property value down 2.8%.

-------------

Greater Wellington's rate of decline accelerated in the three months to the end of June, with the region's average property value dropping 8.3% ($95,000) over the quarter to $1.046m. In the three months to the end of May that rate of decline was just 2.9%, so signalling volatility in the housing market and perhaps more bruising months ahead for homeowners in the region. This is further reinforced by fact that the region's average property value is 6.36% below January's figure, and only 1.8% ahead of where it was in June 2021 (although values in 27% of the region's suburbs are down year on year).

The region's overall performance has been dragged down by steep value declines over the quarter in Upper Hutt (-11.2%), Wellington (-10.1%), Lower Hutt (-9.1%) and Porirua (-7%). South Wairarapa, Carterton and Masterton are now in negative growth territory, with their rate of decline over the quarter around 2%. The downwards momentum will likely pull the region's overall average property value below the $1m mark before long.

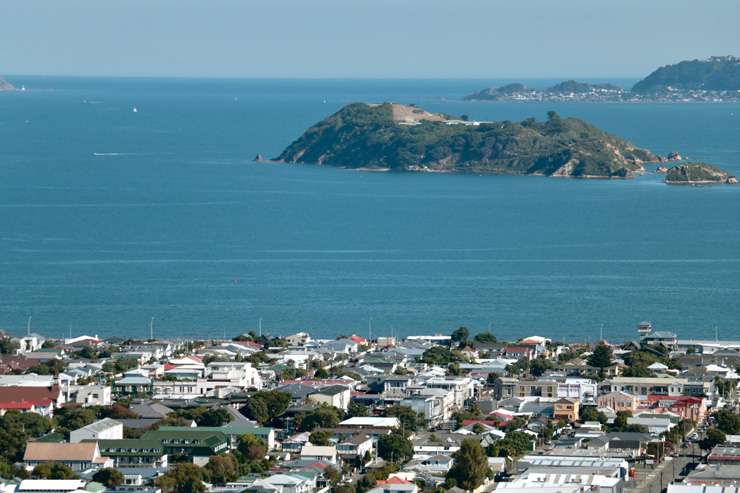

Petone in Greater Wellington. Photo / Getty Images

Shrinking sales volumes are also a cause for concern, with the number of settled sales in the region falling from 9083 in the 12 months to the end of March to 8554 in the 12 months to the end of June. The turnaround in the capital's housing market fortunes has been severe. In the three months to March, just three suburbs recorded declines in their average property value: Pipitea (-9.9%), Thorndon (-0.8%), and Karori (-0.3%). The city's overall average property value was up 4.9% over the period. Within the space of one quarter, the capital's average property value has fallen $136,000, and every suburb has recorded negative growth over the quarter, with the rate of decline ranging from -0.5% in Mornington to -12.4% in Karaka Bays. The average property value in 12 of the capital's suburbs is down year on year. Pipitea, in the central city, is particularly vulnerable, with its average property value just 2.5% ahead of where it was in June 2020, meaning the downturn has all but wiped out the value gains made during the post-Covid boom.

-------------

Tasman and West Coast kept their heads above water this quarter, with the former’s average property value up 1.4% and the latter's up 2%. West Coast's strong showing, taking it across the $400,000 mark for the first time, was driven by a late autumn surge in Westland. Its average property value was up 3.7% over the quarter, exceptional given the fact that the TA recorded a 0.23% value in the first three months of the year, but the volatility in the market can be partly explained by the fact that it's a TA with relatively few sales.

Tasman is likely to soon drop into negative growth territory, with value declines in some of its biggest housing markets over the quarter (Richmond was down 0.1%, Appleby was down 3%) pointing to bumpy months ahead.

Marlborough's average property value slid 0.1% over the last three months while Nelson's dropped 3.9%. It was also down 1.24% on average property value at the start of the year.

House prices in all four regions are up year on year, but the gains made in the latter half of 2021 are eroding, with house values in seven suburbs - most of which are in Marlborough - now below June 2021 levels.

-------------

Canterbury's average property value grew 2.1% ($16,000) over the quarter to $792,000. That's down on 3.2% growth rate recorded in the first three months of year, and the 9.3% surge Canterbury enjoyed in the last three months of 2021. But while the region's housing market is unlikely to see the super-charged growth rates of 2021 again, it's equally unlikely to experience the steep declines seen in other parts of the country, with the region's main centres still seen as affordable and desirable by buyers right now.

At a TA level, quarterly growth was strongest in Waimate (up 6.2%) and Hurunui (up 3.7%). Christchurch is still humming, with its average property value up 2.2% ($17,000) to $795,000 and it's likely it will be crossing the $800,000 mark before winter's close. That's quite a turnaround for a market that was flat for much of the last decade, with the city's average property value rising just 3% between June 2017 and June 2020.

However, there are weaknesses in the region. Selwyn, Canterbury's most expensive TA, recorded minimal growth over the quarter, with its average property value up just 0.3%, a come-down from the 12% growth it enjoyed in the last three months of 2021. Kaikoura, which has its own unique problems, was down 0.3% over the quarter, and Mackenzie, while up 1.3% over the same period, is only 7.3% ahead of where it was a year ago. Both markets are experiencing a fair amount of volatility, driven by low sales.

-------------

Otago's average property value dropped 1.5% ($15,000) to $955,000 over the last three months, while Southland's slid 0.6% ($3000) to $528,000 over the same period. House prices in both regions are up more than 30% on where they were just after the first Covid lockdown lifted, but the gains made in the latter half of last year are slowly being eaten away by the slump.

The view over Clyde, in Otago. Photo / Getty Images

Southland's overall growth rate for the quarter was pulled down by house price falls in the region's biggest housing market, Invercargill, with the city's average property value dropping 2.3% ($12,000) to $517,000. Southland and Gore both enjoyed growth, but both TAs are low-sales environments.

The slowdown has put the brakes on the summer boom in Queenstown-Lakes, with the TA's average property dropping 0.6% in value to $1.874m over the quarter. The decline in Dunedin's housing market accelerated, with its average property value dropping 3.6% over the quarter to $724,000. House prices in 19 Dunedin suburbs are lower now than they were a year ago, some by as much as $30,000.