The housing market shrugged off the return of community transmissions in New Zealand last month, with new house price figures showing positive growth in all but two regions since the start of the pandemic.

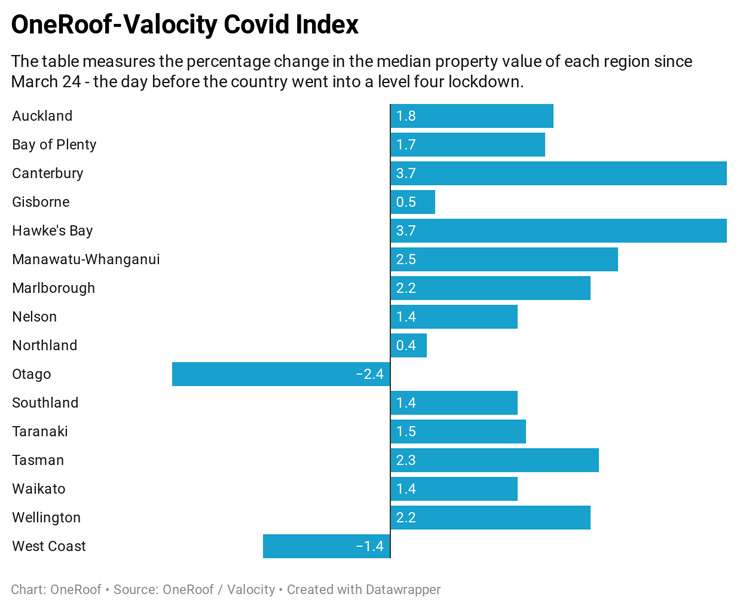

The OneRoof-Vaolcity Covid Index, which has tracked change in the housing market since March 24, the day before the country went into an alert level four lockdown, found that property values nationwide were up 1.9 percent in the five months to the end of August.

Start your property search

Only two regions, Otago and West Coast, were still in negative growth territory, down from four regions the month before.

Greater Auckland was up 1.8 percent on the index, despite the city’s return an alert level three lockdown for 20 days last month that put opens homes and in-person auctions on hold.

The best-performing regions on the index were Hawke's Bay and Canterbury - both up 3.7 percent - followed by Manawatu-Whanganui (+2.5 percent) and Wellington (+2.2 percent).

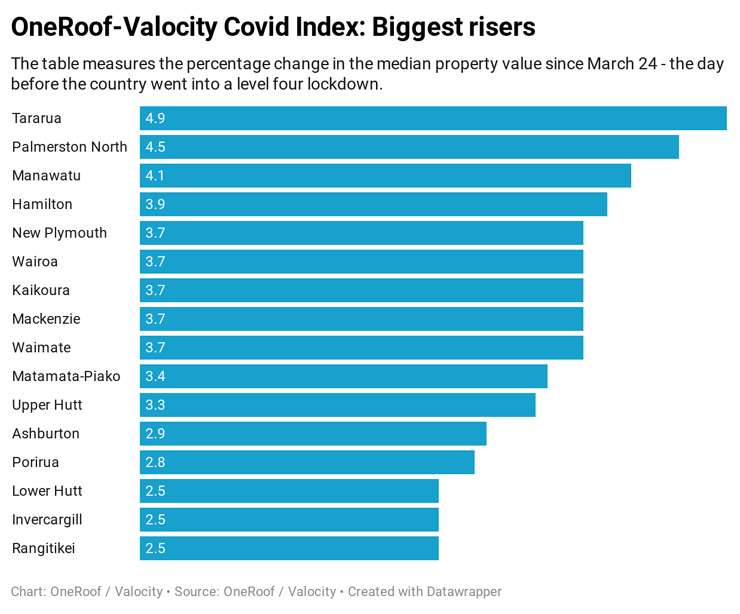

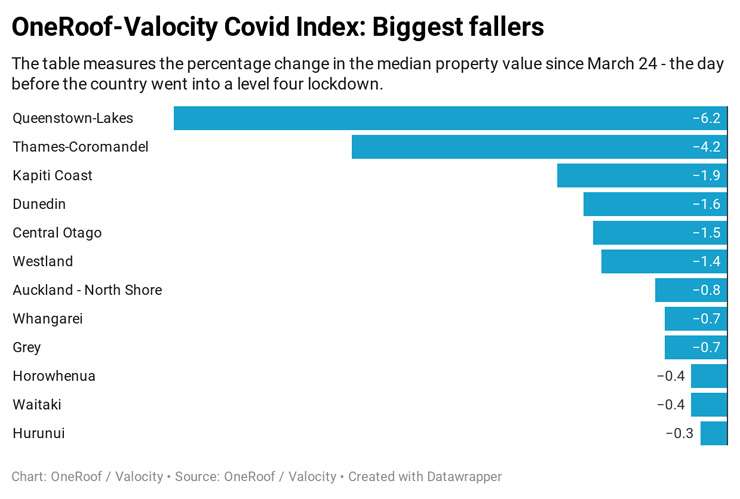

The index also marked change at a territorial authority level. Fifty-four of the country's 72 TAs registered positive value growth since March 24, up from 48 the month before.

The three biggest risers on the index, Tararua, Palmerston North and Manawatu, are all in the affordable Manawatu-Whanganui region, and saw growth of between 4.1 percent and 4.9 percent. Hamilton, up 3.9 percent, was the only major metro to feature in the top ten.

With a drop of 6.2 percent, Queenstown-Lakes is the country's weakest housing market, although it has slightly improved on its position at the end of July when it was down 7.7 percent. Of the major metros, Dunedin (-1.6 percent) and Auckland's North Shore (-0.8 percent) are still exhibiting softness.

At a suburb level, growth was highest in areas that had median values of between $500,000 and $1.2 million – a price bracket which is currently dominated by first home buyers.

James Wilson, director of valuation at OneRoof's data partner Valocity, says: “Whilst still early days, it appears that the 'pent-up demand' effect is here for the longer term, especially in Auckland.

“Confidence in the housing market, especially among first home buyers and investors, remains strong, supported by low interest rates and talk of further cuts in the official cash rate.

“Property searches on listing sites is up, and anecdotal evidence of increased buyer enquiry and competitive bidding at auctions, especially in Auckland, shows the return to higher alert levels have not dented the market. Listing shortages are particularly evident in Auckland, creating strong demand conditions.

“However, it is important to note that sales volumes are still significantly down on previous years.”