The housing market’s two biggest stars right now aren’t Auckland or Wellington. Even though real estate has been shifting in huge volumes in the last six months, they’ve been overtaken by Palmerston North and New Plymouth.

Palmerston North’s median property value has grown almost eight percent since lockdown ended to $520,000, while New Plymouth has seen its median value shoot up 6.7 percent to $505,000.

READ MORE: Find out if your suburb is rising or falling

Only Gisborne and Hastings have seen more growth on the OneRoof-Valocity house price index.

Start your property search

By comparison, Auckland’s two highest growth regions, Manukau and Rodney, grew only 6 per cent and 5.2 per cent, while Wellington’s Lower and Upper Hutt picked up 6.4 and 6.3 per cent and Christchurch grew 6.6 percent.

In the last five years homeowners in Palmerston North will have pocketed an extra $255,000, on the back of increased interest in the uni town, while homeowners in New Plymouth’s have gained $160,000 over the same period.

Bayleys Manawatu, Rangitikei and Horowhenua owner and managing director Rod Grieve, said Palmerston North had been a top performer for some time, “but Covid has been kind to the provinces”.

“Demand is outstripping supply and we’ve now got record low listings,” he said, pointing to the fact the town had only 165 properties for sale now, down from 200 last week.

Lack of stock was also driving up prices. “We’re at the lowest days to sell in the country - 23 days. Stock is highly liquid, it will turn over in weeks, where we’d like to have a three-month pipeline of activity.”

Grieve said that while most real estate agencies in the city sell by offers, he was in favour of auction campaigns.

“We want to give a property more oxygen, with a three-week campaign. It gives more time and an auction is more transparent that offers. An early offer bargain offer is like trying to steal [a property]. It takes courage for an agency to stay the course.”

Huge infrastructure spend in the city for the gorge development, Kapiti express, the KiwiRail distribution hub and growth of the Ohakea defence force site mean jobs and growth are plentiful, while a core of some 38 per cent of the workforce in government-aligned work means the town is “insulated from the high highs, and low lows”.

“We have a strong core, it’s not flimsy. It's one of the best-kept secrets in New Zealand,” he said.

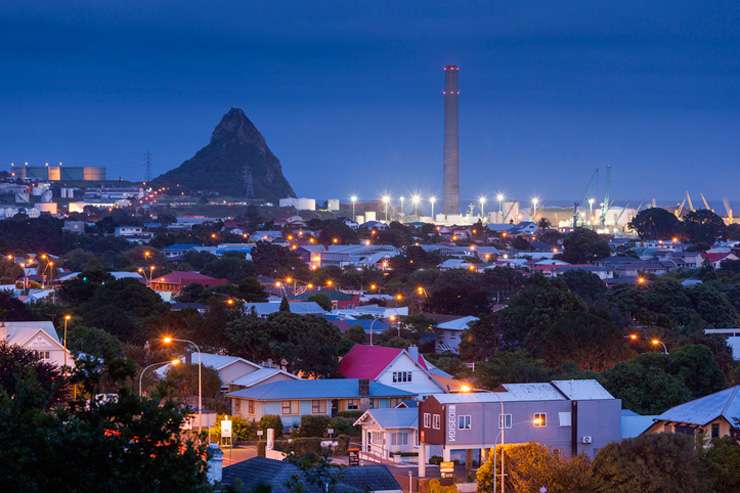

New Plymouth property values have risen more than six percent in the last six months. Photo / Getty Images

Property Brokers New Zealand managing director Guy Mordaunt, who has just opened a branch in New Plymouth, said both towns were thriving.

“There’s a complete mis-match of buyers versus stock available. We had 29 offers on one house in Palmerston North, from both investors and first home buyers because it’s affordable. It went for $570,000, that same place would have gone for $470,000 a year ago.

“It’s hard to buy under $400,000 and every single property has a competing offer,” he said.

Mordaunt said the listings shortage was particularly acute in affordable homes, with new builds more likely to be in the $700,000 range.

He sees the price rises driven in part by buyers in their 40s coming back to the city because they want to give their kids the opportunity to grow up in a smaller town like they did.

“They come out of Auckland and go ‘how cheap is this?’ and what they’ll spend is not based on value,” he said, adding some homes are getting 20 or more offers, from both investors and first home buyers trying to get their foot on the ladder.

Both New Plymouth and Palmerston North had benefited from the huge growth in commodity prices as demand for food rocketed.

“It’s awesome. Farmers are good buggers again. We need to eat and that’s made farmers feel good.”

Century 21’s Tim Kearins said that Palmerston North was “simply playing catch-up to the rest of the country”.

He said that every ten years the housing market enjoys a huge spike in activity. The last spike was in 2006 to 2008, but Kearins said “this market feels stronger”.

He said demand was highest for properties in the $400,000 to $500,000 range. “It’s just about affordability.”

Across in New Plymouth, Harcourts general manager Graham Richards said that much of the enquiry in the last six months had come from outside the region.

“Forty percent of people looking for property here are from Auckland, another 20 per cent from outside Taranaki, and that’s across all price ranges.

“You won’t get into the market now for under $400,000 – a year ago that figure was $300,000,” he said, adding that properties in the $800,000 to $1.2 million segment were also doing well.

“It’s not unusual to get anything from eight to 16 offers in a three-week period, and traffic through open homes is up 200 to 300 percent. We’ve had 100 people and six offers the last few weeks on a property.”

Richards echoes agents around the country saying that the FOMO (fear of missing out) factor is driving the market, as first home buyers do the math and figure that owning is now cheaper than renting. Stock in the city is between 150 and 200 properties, compared to eight years ago when 500 was the norm.

“It's really sad to see, we’re seeing the same people at different properties, and the same names on multi-offers. People give it their best shot but the market is moving so fast,” he said.

Richards predicts that, even with the lost momentum in March to May, sales figure for the year will be back to what they were last year.

He said people coming back to the city after a decade away had really noticed the attractions of the place.

“It’s a great place to live, off the beaten track and we’re ‘mountain to sea’. The availability of property has steadily declined but saleability is on the increase.”