The latest house market figures showed 2020 was shaping up to be one of the best for the property market, with a summer-long run of lifts in all 16 regions of the country.

That growth came to a halt as coronavirus cases in New Zealand started to rise and the Government introduced a series of measures that led to a nationwide lockdown.

The market has been on pause since March 26, with the Government's restrictions putting a stop physical open homes, private inspections and auctions, although tech solutions have allowed a degree of buying and selling to take place in a digital space.

As the country prepares for life post-lockdown, OneRoof canvased opinion from real estate experts from around the country to find out what sort of market Kiwis can expect. Much of the conversation around the housing market during lockdown has tended to focus on Auckland, and while the city is the country's biggest real estate market, it's not its only one. In our series Outside the Auckland Bubble, OneRoof has already profiled the smaller regional towns and cities as well as Queenstown. Today we look at the market in the country's major metros - Wellington, Tauranga, Christchurch, Hamilton and Dunedin - and find out where the areas of concern are and highlight where the opportunities will lie for buyers and sellers in the weeks and months ahead.

Start your property search

Tauranga - Ready for action post-lockdown

In the Bay of Plenty region, REINZ median sales prices were up nearly 14 per cent to $665,000 in March, a record for the region. Auctions were strong in the area, with 19 per cent of homes selling under the hammer last month, up from 12 percent last year.

Heath Young, chief operating officer for Eves and Bayleys in the region, says the market may be on pause but agents and vendors are preparing for a return to activity once the lockdown ends.

The company completed some notable deals during lockdown, including one in Papamoa that was sold sight unseen and another where the final viewing/walkthrough was completed in a three-way Zoom call with the vendor, purchaser and agent.

“We are seeing plenty of activity building for the eventual lifting of alert level 4, with conditional contracts subject to final viewing quite common,” he says.

Jason Eves, of boutique agency Oliver Road, says that a last-minute push to get homes photographed and paperwork prepped in before the lockdown measures came into force has kept buyer interest levels in their listings high.

“It’s like the Christmas holidays, because people have more time to look,” he says, adding that buyers are holding out to do in-person viewings. Most in-demand are properties in desirable higher value areas, where houses don’t come onto the market very often – one property had seven enquiries in its first week of listing, including viewers from Australia, UK, USA and Asia," he says.

Tauranga agents say buyers and sellers are poised for action once the lockdown is lifted. Photo / Getty Images

“Top-end [vendors] are not getting distressed - they do not have to sell. [The lockdown] is an event with a definite end point, so they’ve not hit pause. There are still buyers in the market, so people are not worried about their property looking stale - it’s pretty obvious why it has stuck around."

Eves expects that the post-lockdown surge might include some highly-leveraged investors who need to quit the market, particularly as they’ll now be competing with a glut of former Airbnb properties now returning to the market as long-term rentals.

There's movement in the city too, with Tauranga City Council issuing resource consents for a $40 million tertiary student accommodation block near the city's Waikato University campus. A $130 million development on the former Farmers site in the CBD that includes 97 high-end apartments and 23 luxury townhouses, as well as retail and car parks, is still on track for completion by 2021.

Hamilton – 'Prices are rising and there’s not enough property'

Jeremy O’Rourke, of Hamilton’s Lodge Real Estate, says his vendors have been pitched a few sight unseen offers during lockdown but these have been too low to be taken seriously, were often loaded with too many conditions and were from people “taking advantage of vendor fear”.

Thankfully, most of his vendors are keen to keep their listings on the market, with only a couple pausing their campaigns. He says buyer interest has climbed during lockdown, adding that mortgage brokers are still fielding new loan applications, albeit with more cautious applicants.

Most auction campaigns were switched to price by negotiation to keep the listings active, and O’Rourke is expecting big things post-lockdown. “It’s a booming market here, even to Cambridge, Te Awamutu and Morrinsville. Prices are rising and there’s not enough property," he says.

Hamilton agents say the fundamentals of the city housing market are still strong. Photo / Getty Images

“We went into it with a housing crisis, and we’ll come out of it with the same housing crisis. We’ll need more property. Our rental bookings had only 1 percent vacancy, and the foreign students hadn’t even arrived yet.

“The world still needs to eat, so that [farming] is the backbone of our economy, I can’t see that fundamentally changing. Returning Kiwis might kick off a boom again, like they did post 2002 and 2008, we will feel a lot safer.”

O’Rourke says that Hamilton Council’s urban regeneration policy will kick off more building, supporting the growing developer confidence in building more density. “Last week a developer in Frankton sold five out of 22 apartments. Investors still have confidence,” he says.

Wellington - Keeping steady, as always

The capital city’s property market has traditionally not had the same extreme highs – or lows – as Auckland’s or Christchurch’s.

Helped by a stable workforce (43 percent of the nation’s public service are based in the city), the city only recently saw demand outstrip supply, driving up house prices. But the lockdown has put everything on the backburner, agents say.

“Nothing’s happening,” says David Platt, managing director of Tommy’s Real Estate. Agents in the company concluded a few property sales that were underway before lockdown, but there are no new listings now.

“We’ve just told the owners to put listings on the back burner,” he says. “There are not many looking online and we’re not selling sight unseen.”

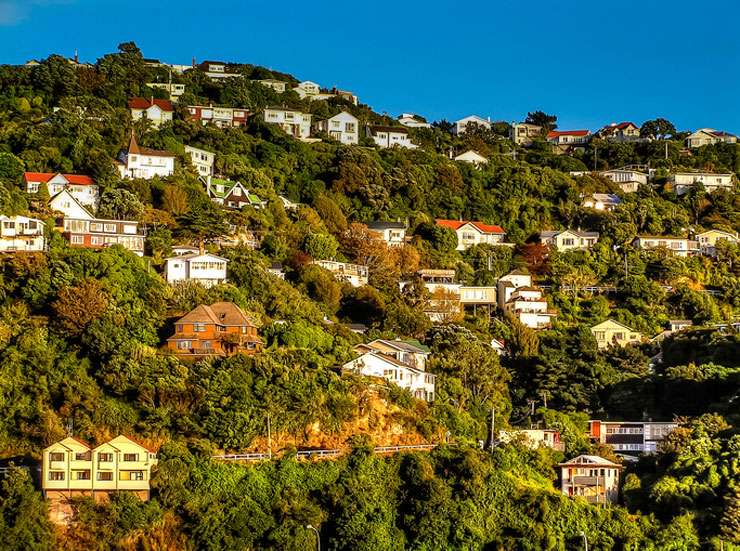

Many Wellington vendors have hit pause in their selling campaigns. Photo / Getty Images

Platt is hesitant to make predictions on what might happen post-lockdown, but believes Wellington’s market may be a bit more “insulated” from downturns in business activity or employment than other parts of the country.

Tall Poppy Real Estate chairman Michael Seymour says that his agents have managed to execute new ways of working during the lockdown. With vendors unable to move out of properties to provide vacant possession, agents moved swiftly to put rental agreements in place with the new owners, so that they could stay put.

“We’ve used goodwill between agents and vendors. In one case, the tenants were taking as good photos as they can to get the house on the market for listing – it was better than not going on the market, and we’ve still got cases where it needs to be on the market.”

He said that with some parties not prepared to change settlement times, there have been higher than normal number of offers falling over. REINZ figures showed sales volume in the Wellington region down 13 percent, with 749 properties selling.

And while Seymour says the company is at the forefront of virtual and video walkthroughs “none of the tech can replace physically seeing the aspects of the house, nothing replaces in-person”.

Christchurch - Market still ticking along

Ray White’s South Island regional manager, Jane Meyer, says that while “a smattering” of sales were finished once lockdown began, the only activity now is around the “as is, where is” market, which deals in post-earthquake properties.

“But these are buyers who are technically well-versed in reading and understanding the documentation. They have a portfolio and they’ve been doing it for the past eight years since the earthquake,” she explains, adding that many of these deals go through ordinarily without buyers seeing the property, so nothing has changed post-lockdown.

She says agents are well-prepared for no-contact viewing of listings, encouraging as many vendors as they could to invest in virtual walk-throughs of their properties so that buyers could use their time to browse – saying the company’s agents raced to get photographers and videographers through properties from Monday right through to the Wednesday before lockdown.

Now, she says, the focus is on caring for vendors and prepping for the "green light" to do business again.

Mike Pero, head of Mike Pero Real Estate, says that while a handful of settlements already in the pipeline concluded post lockdown, he thinks most people are still a long way from dealing entirely virtually.

The Christchurch earthquake prepped the housing market for disruptions. Photo / Getty Images

“With no open homes, people are not signing away $500,000 or $1 million. There’s heightened activity, but too many factors for people to make decisions.”

That said, Pero said only a tiny percentage of vendors had cancelled their listings. He thinks most buyers figure “the house will still be there” post lockdown.

Across at Mike Pero Mortgages, chief executive Mark Collins says that it’s easier to sort out the money side of things on-line, especially with banks that are keen to keep customers. “Those with money will get to spend up when we get everyone back into employment,” he says. “Banks are not taking any new business, just coping with demand for existing hardship requests, but they will be very picky [when they do].”

“It’s the same everywhere, house prices will be challenged at the end of this so most banks will review applications, will look harder at transactions and will do re-valuations – not just desk valuations, especially for deposits less than 20 percent.”

Dunedin - Red-hot market will return post-lockdown

Dunedin’s market pickup came later than much of the country, but by summer there was talk of listings shortage and record median price rises.

OneRoof Valocity data for February showed 15 percent increase on March 2019, and a whopping 45 percent increase over three years, the highest of the six main metro centres. But by March, sales volumes dropped 17 per cent, with the wider Otago region clocking 342 sales.

Dunedin vendors are holding firm on selling prices, say agents. Photo / Getty Images

Richard Stringer, Harcourts Dunedin branch manager, says that vendors were not budging on price in the lead up to lockdown. “There were cash buyers anticipating a dropping market, making low offers, but they were not successful. Vendors are still confident that after this the market will rebound. The expats will come back, they’ll increase demand,” he says.

The agency converted auction sales to tender or deadline sales, and was still receiving offers from committed buyers two weeks into lockdown. New listings have still gone up and Stringer says that there were very few deals falling over. “Only if the bank changed [approval] criteria. Others are conditional sales depending on building reports, and LIMs and so on. Online listings are still getting hits,” he says.

In Dunedin, there will still be “plenty” of properties sold after lockdown. “The fundamentals are still that we don’t have enough houses and money got cheaper.”

Outside the Auckland bubble: Read more in this series:

- Outside the Auckland bubble: Strange upside to crisis in NZ's regional towns

- Why Queenstown's housing market has experts worried

- Covid-19: What the real estate chiefs think it will do to house prices