Holidaymakers aren’t the only people itching for New Zealand’s borders to reopen. Overseas commercial property investors are keen to visit New Zealand in person and put their money where our offices, hotels and industrial sites are.

Both Brent McGregor, CBRE New Zealand executive chairman, and Todd Lauchlan, JLL’s New Zealand managing director, say New Zealand is an attractive option for investors because of historically high yields.

Sales statistics show investor commitment held up despite the difficulties of doing business during the past year, and the country’s high-profile pandemic response has bolstered its reputation as a stable, transparent place to do business.

McGregor says the second half of 2020 saw the continuation of a strong investment market, “although there was still a cautious but optimistic air to most campaigns”.

Start your property search

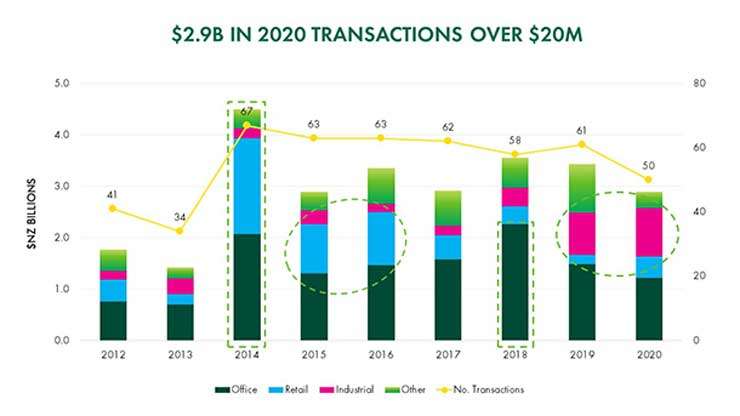

He saw continued asset price growth across the main markets, with $2.9 billion of transactions in the $20 million-plus space for the year, consistent with the past six years.

The market was largely influenced by border closures but particular categories of offshore investors remained active and interested.

Of the deals CBRE transacted in 2020, 36 per cent of bids were from offshore buyers but they concluded only 25 per cent of completed deals, “mostly due to an inability to demonstrate acquisition conviction from afar combined with travel restrictions”.

McGregor says his firm experienced consistent transaction volumes, even with 6-8 weeks of strict lockdown: “2020 was a depth test for the local market and we quickly proved that we have more than enough appetite locally to sustain historic volumes and even firm prices at the same time.”

New Zealand-based private investors and local listed property entities stepped into transaction bidding in a big way. Office and retail took a back seat to the industrial and logistics sector, which remains flavour of the month, McGregor says.

“An interesting observation is the extent to which the various buyer groups are missing deals. As in a normal year, a large number of the private buyers remain bargain hunters and on average those private bidders who missed deals undershot the purchase price by 20 per cent, closely followed by iwi groups missing by 18 per cent. Local listed groups stepped up in 2020 and were the most active and competitive investor group in the $20 million-plus space.”

JLL’s Lauchlan says New Zealand’s transparent property market continues to be a great attraction for offshore investors, some of whom have effectively been operating property-owning businesses in this country for more than three decades.

“Historically we’ve had a lot of investment from Southeast Asia and Australia – typically you might have an Australian head office for a European or US pension fund or investment vehicle. From SE Asia you’ve got a mix of sovereign wealth funds and large family conglomerates or offices that have invested in New Zealand for years.

“They’ve expanded their footprint over time and continue to invest, develop and hold property here. They’ve invested in new developments and created a lot of new assets as well as investing in the assets they’ve already got.

“New Zealand’s been an attractive location for other Commonwealth countries as well – the pension funds out of Canada and the UK have always been investors here.

“They’re familiar with the legal system, the structure and the transparent property market and feel comfortable with the rule of law and that sort of thing. We run a Global Transparency Index which lists New Zealand as one of the most transparent property markets in the world so they see it as a good place to invest.”

Lauchlan notes that New Zealand has always offered a higher yield than some more mature Asian markets and that remains the case. “Singapore, Hong Kong, Japan – particularly Tokyo – our returns are typically better than theirs. You’d normally expect to get a slightly better return in New Zealand than in Australia as well.”

Auckland remains the first port of call. “Inevitably, because the market’s bigger in Auckland, there’s a bigger proportion of foreign investment here. If you’re coming into the market for the first time, and there have been a number of new entrants in the recent past, they typically come into the biggest market first.

“A number of those players do deals in Auckland and then look at Wellington. My gut feeling would that north of 50 per cent of foreign investment in commercial real estate coming into the country would be in Auckland.”

Lauchlan also sees a change in priorities. “Office and hotel have historically been the two biggest avenues for foreign investment, particularly from SE Asia. A lot of our Malaysian, Singaporean, Indonesian clients have bought and held and developed hotels for this market, and the more institutional investors such as the sovereign wealth funds have bought into offices or retail malls.

“More recently a number of foreign investors have invested in warehousing. The industrial market has been strong, and that’s predominantly existing properties with long leases.”

Previously, that was the domain of local private institutions - players like Goodman (although Australia-based, effectively an Australasian group), BFI and other listed property companies.

“But last year JP Morgan, as investment partners with Stride, became quite active in the market and are investing in a number of assets.”

Both executives exude optimism for the rest of 2021. In McGregor’s words: “New Zealand overwhelmingly is viewed as an outperformer in the current environment, so there is an expectation that our country will outperform in the global competition for capital.”