COMMENT: KiwiSaver is now a vital nest egg for millions of New Zealanders. As we age, buy our first home or protect against hardship, we are turning to our KiwiSaver funds for support.

More than $62 billion is now under management, and many Kiwis are sitting on savings of over $20,000. And now, as the volatility of 2020 fades, is a good time to run a financial ruler over your KiwiSaver.

READ MORE: Find out if your suburb is rising or falling

Firstly, looking at performance. It’s an obvious attraction for any fund, but it also needs to be considered in context. And past performance is not a predictor of future performance.

Start your property search

But the onset of COVID-19 and resulting market uncertainty has delivered extremes of investment performance.

KiwiSaver newcomer Juno smashed it out of the park, with more than 30% returns on its growth fund over the last year and over 20% on its balanced fund, after fees. This compares to other providers whose returns languished in the single digits. For a typical KiwiSaver fund, that’s a difference of several thousand dollars in just one year.

Juno’s remarkable annual performance was rightly applauded, but it is worth considering longer-term performances of KiwiSaver funds when making decisions around providers.

Consistency of performance makes a huge difference for investments like KiwiSaver, given the number of years they can be locked away. At Canstar, we assess the performance of KiwiSaver providers every year and we have seen a handful of funds repeatedly outperform.

Over the last five years Milford, Aon, Booster and Fisher funds have ruled the roost, with 5-year average returns of nearly 10% in their balanced funds. Booster, Fisher and Milford also joined Juno as top performers last year, with returns of over 10% across balanced funds and edging higher in their growth funds.

As such, when Kiwis are choosing where to put their cash, it’s worth taking long-term performances into account, along with the impact of fees. And beyond the pure financials, individual concerns such as life stage and attitude to risk should also be primary concerns.

Alongside these bigger questions, it’s worth looking at other ways of boosting your nest egg, for example with small, regular savings.

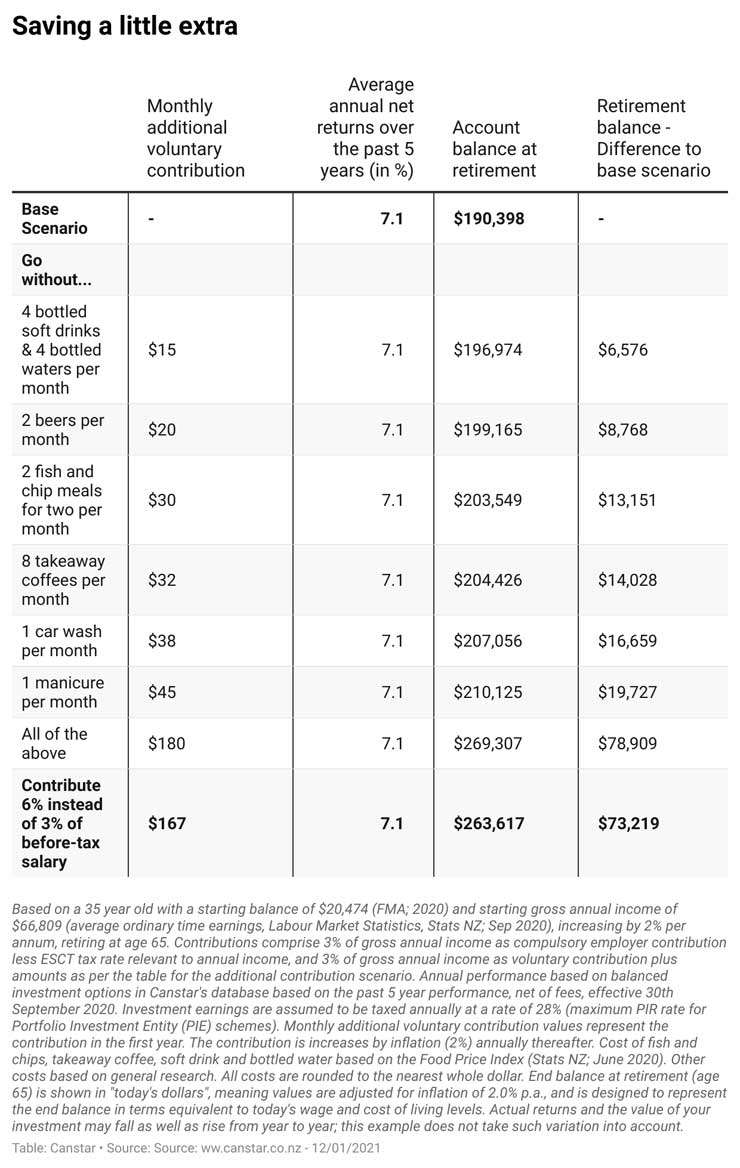

Canstar ran the numbers on some easy wins, such as skipping coffee twice a week and putting the funds into KiwiSaver instead.

We tested this idea against a base scenario, being a 35-year-old on an average income of $66,000, with a typical $20,000 saved in a balanced KiwiSaver fund, and making contributions of 3%. We based the scenario’s returns on the previous five years’ of performance in balanced funds, across the market.

So if you lose a couple of coffees a week, what do you gain? Extra funds of more than $14,000 by 65. We also considered what might happen if you skip, for example, a monthly manicure costing about $45. End result? Up to $20,000 extra.

Or, if you really want to hit the savings accelerator, doubling the salary contribution to 6% delivers $73,000 more by 65.

The type of fund being invested in also makes a significant difference. From July this year, the ‘default’ fund profile will switch from conservative to balanced. Those who join KiwiSaver, without making an active choice on their fund, will be automatically assigned to balanced funds rather than conservative.

This is a welcome move from the government. We ran some quick numbers on what impact this could have for a 35-year-old, with savings of $20,000, on an average income, invested in a conservative fund. If, in this scenario, those funds and ongoing contributions were invested in a balanced fund, it could deliver nearly $60,000 by 65. By way of further comparison, we considered the impact if the investment had been put into a growth fund. The result? Perhaps $122,000 more at 65. All scenarios have assumed average returns based on the past five years’ performance.

So, all these decisions - whether big or small - matter. It’s worth taking a minute to ensure your KiwiSaver provider and fund is the very best fit for you, and your life.

- Jose George is general manager of Canstar New Zealand