Covid-19’s body blow to global tourism has weakened the economic outlook for many towns and cities across New Zealand. Queenstown’s dependence on international visitors has raised concerns about the future of the housing market there, with many experts predicting prices will come under pressure.

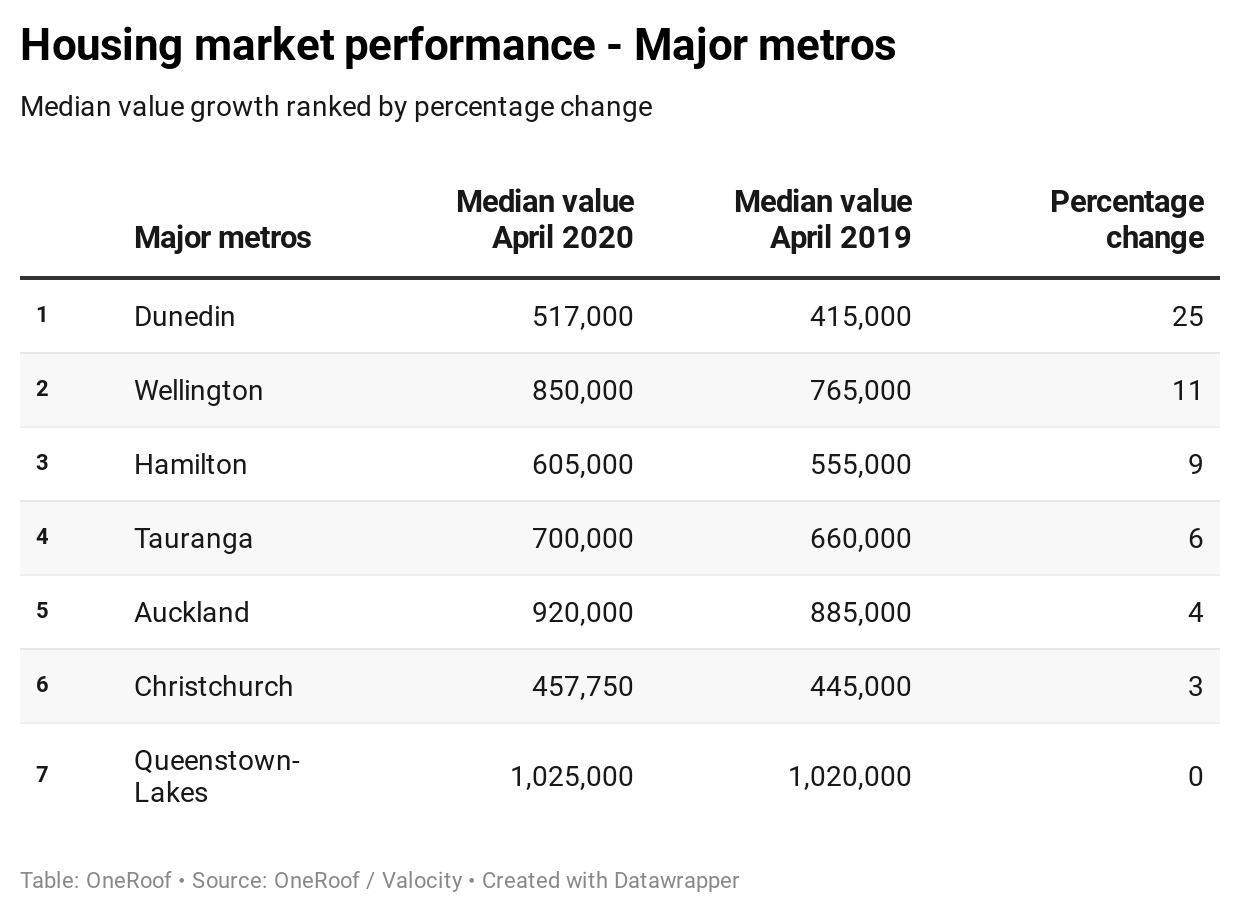

The latest OneRoof-Valocity figures show house values in the city were up just 0.49 percent on April last year to $1.025 million, but unlike other markets stopped in their tracks by Covid-19, Queenstown values were already beginning to soften in the latter half of 2019.

Queenstown’s median property value had dipped 0.3 percent in the three months to December 2019 and hadn’t changed in the three months to March 2020.

OneRoof editor Owen Vaughan says part of this was due to unique pressures in the Queenstown market – a lack of affordable properties for first home buyers, high rents and top end market that was dealing with the after effects of the foreign buyer ban.

Start your property search

- Click here to see the latest Queenstown homes for sale

“House price growth in what is still New Zealand's most expensive property market was already slowing before the lockdown hit and borders were closed, and that weakness is likely to become more apparent in the months ahead as the economic downturn puts pressure on investors and second-home owners, especially those who bought at market peak," Vaughan says.

Capital growth

“Recent sales show that the market may be in for a wild ride. A four-bedroom house with a separate two-bedroom unit sold under the hammer last week for $1.422 million after intense bidding. The sale of 28 Myles Way, in Lower Shotover, was brought forward after a pre-auction offer of $1.3 million was made.

“However, several days later, at a big auction event, 17 Queenstown properties passed in. Of the 21 properties on the list, just four sold, mostly for prices around their 2017 rating valuation.

28 Myles Way, in Lower Shotover, was bought by an out-of-town buyer for $1.422 million. Photo / Supplied

“Many of the homes brought to auction were in Lower Shotover and relatively new. The suburb, which is about 8.7km outside Queenstown, started life in 2012 when the first of around 900 residential subdivisions were released to the market and OneRoof figures for April show the median value there has grown five percent year on year to $1.06 million and 51.4 percent since April 2015.

“It's that last figure that should give Queenstown's market hope. The majority of homeowners and investors in the city will have seen huge capital growth.”

James Wilson, director of valuation at OneRoof’s data partner Valocity, says Queenstown house prices are unlikely to drop right away and when they do, it will unlikely affect those who purchased for long-term gain.

“If you’re looking for a property to raise your family in, then it doesn’t matter what’s happening to values right now. The days of buyers being able to make short-term capital gain – i.e. flip properties for huge profits - are gone, not just in Queenstown but throughout the country,” he says.

Wilson says treating Queenstown’s housing market as a single entity can lead erroneous conclusions about what’s going on there. “Queenstown has lots different submarkets, such as new-build family homes, investment properties, holiday homes and $4m-plus luxury-style lodges. Price movement in one of these submarkets doesn’t necessarily mean price movement in the others. For example, one of the biggest residential real estate sales last year was for a four-bed 450sqm home at 516 Ladies Mile, in Lake Hayes. It was bought by Queenstown Council for $15.5 million, but the sale didn’t lead to more sales at the top end of the market. The property was bought for development purposes.”

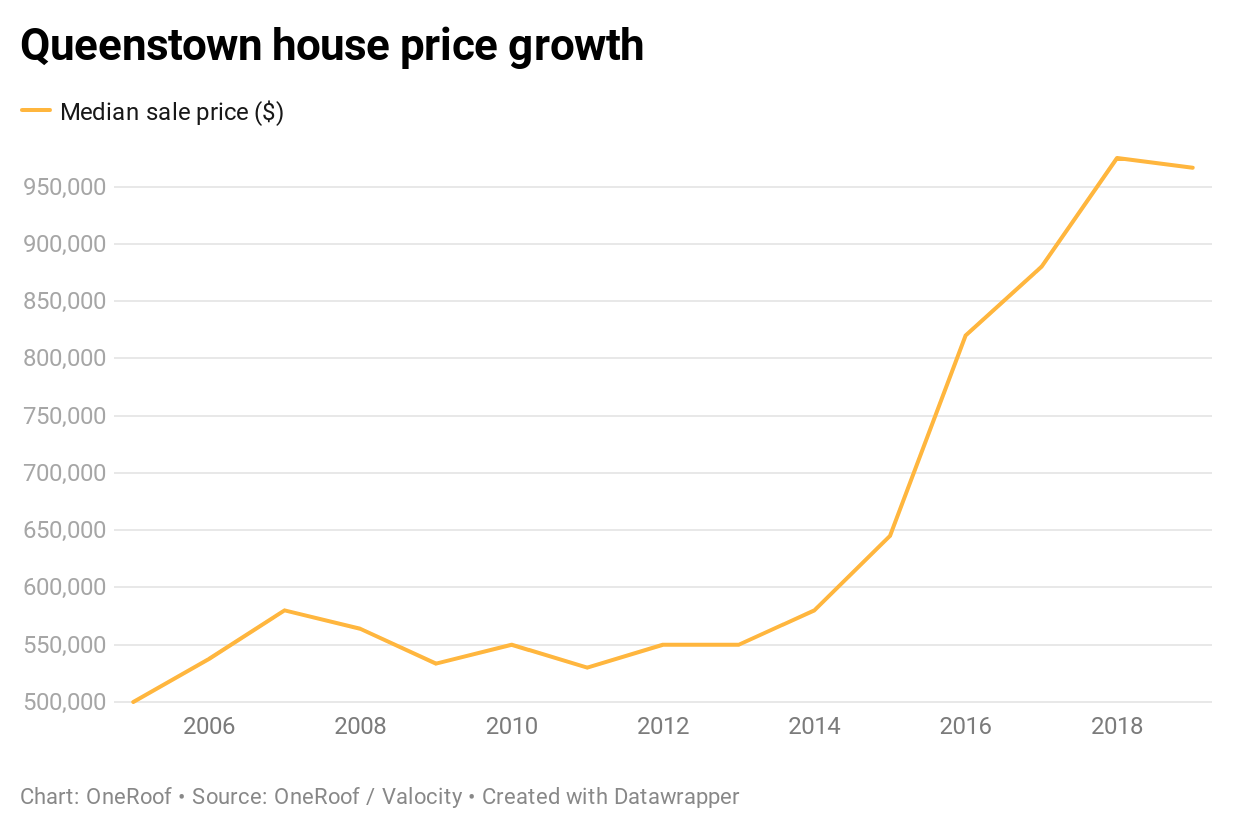

Wilson notes that slowdown in some of the submarkets may represent the best opportunity for buyers to purchase property in Queenstown. "The last time Queenstown house prices were under pressure was during the GFC. The median sale price dropped from a market high of $580,000 in 2007 to $533,500 in 2009 before climbing again. Those who bought at the bottom of the market will have seen house prices increase 81 percent over the following 10 years."

Expats and buyers from Dunedin

Feedback from Queenstown agents shows that some Kiwis are already making that calculation. Agents have told OneRoof that cashed-up buyers from Dunedin and expats looking to return home are eyeing up Queenstown's market.

Bayleys Queenstown managing director David Gubb told OneRoof about a quarter of his buyers were from Auckland, with another 50 percent coming from Central Otago.

However, he had noticed a recent surge in interest from buyers from Dunedin, which he put down to rapid house price growth there.

Gubb said: "They now have a lot more money to spend because of growth there in the past two to three years."

OneRoof figures for April show Dunedin eclipsing the other major metros when it comes to value growth, with the city's median up 24.58 percent year on year. Auckland's growth by comparison was 3.95 percent.

Gubb also noted a lift in buyer enquiry from expats but not the kind who come back home to raise their young children.

They were mostly young professionals aged between 25 and 35 doing their OE, who wanted to come back to New Zealand for lifestyle reasons, Gubb said.

"They are not super wealthy, but people who are looking for affordable homes. They have had a chance to reflect on where they want to live and Queenstown is quite a desirable place so they are coming through."

Window of opportunity

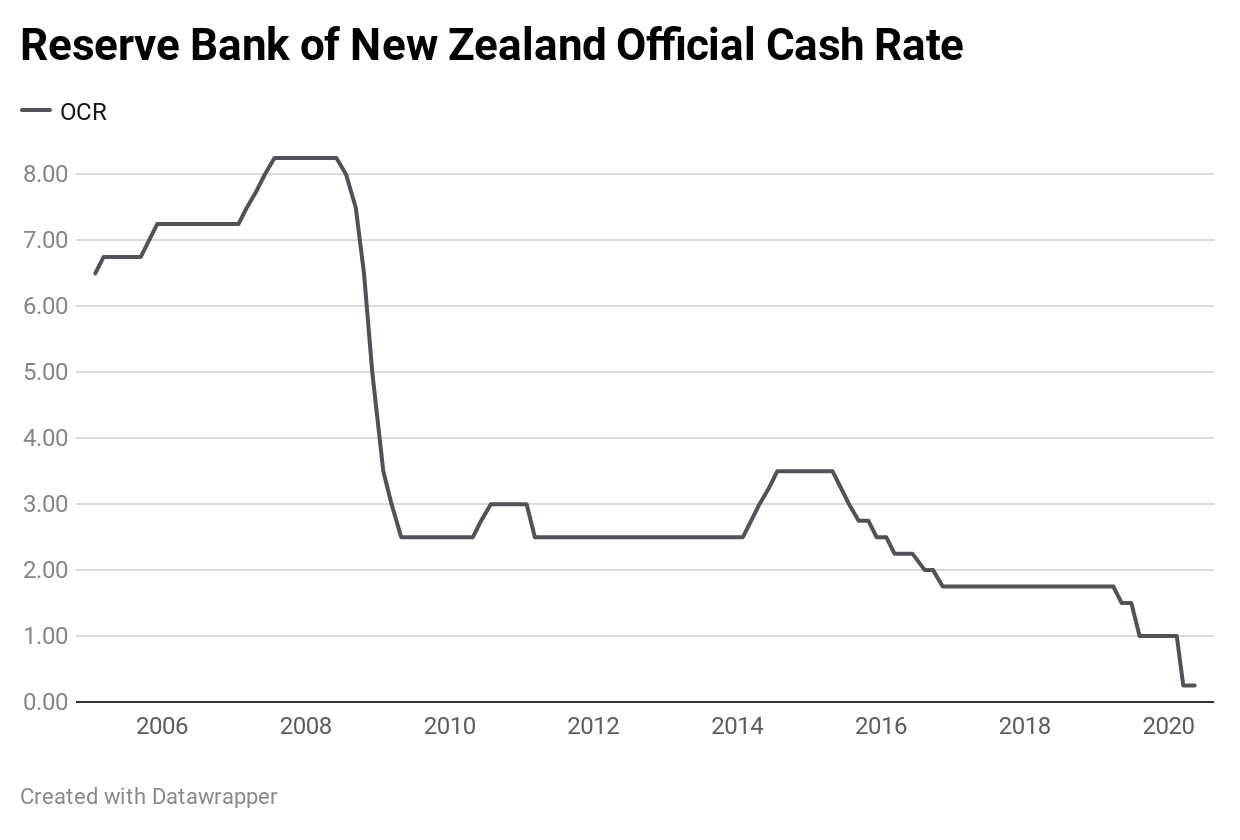

Colliers International agent Richie Heap says changes in Queenstown’s economic fortunes may make the market more accessible to first home buyers. Low interest rates, less competition from investors and strains in the rental market, as short-term holiday lets are converted to long-term rentals and international workers exit, could mean more opportunities for those who had previously written off the city as too expensive.

“Instead of paying $850 a week in rent for a standard four-bedroom house, buyers could buy a home of their own with weekly mortgage repayments of $700. The numbers add up for them to act now,” he says.

When international visitors return, rental prices and house prices will increase, Heap says. “Buyers who are active now know that. We’ve always had cycles in Queenstown and the signs we’ve seen in the last two weeks have been quite encouraging.”

Economist Tony Alexander says the attitudes displayed during the GFC are different to ones apparent now. This time Kiwis have a “glass half-full” approach.

He also says the window for making bargain purchases will be a lot shorter than people think.

“Asset price weakness is likely to be substantially less than many might be thinking, and opportunities for low-priced purchases will be short-lived,” Alexander says.

Queenstown Harcourts agent Kirsty Sinclair says buyers should take advantage of the shifts in the market. “At the moment, if the prices have adjusted, it’s a good time to good buy, especially if you are committed to being in the market long term,” she says.

“Because of how small our market is it’s always going to be desirable and at some stage it’s going to recover,” she says.

Hold on

Economist Ed McKnight says the number of potential buyers in Queenstown has decreased; those who lost jobs will be moving to bigger cities for work and those who are uncertain about their income will be taking a wait and see approach, hoping for prices to fall even further.

“Queenstown Lakes is the most expensive district in the country and even if we saw a 20 per cent decrease in house prices, it would still be one of the most expensive regions in the country and those who are looking for bargains have other areas they’d rather invest in,” he says.

McKnight says those with investment properties in the city will be looking to hold on, with many offering substantial rental discounts to lock in tenants and secure some sort of income.

“The investor who still has an 80 per cent mortgage on their property is not going to sell it for 60 per cent of its value...and it’s going to come down to what sellers and owners are willing to accept,” he says.