The latest OneRoof-Valocity house price figures point to a slowdown in the New Zealand housing market.

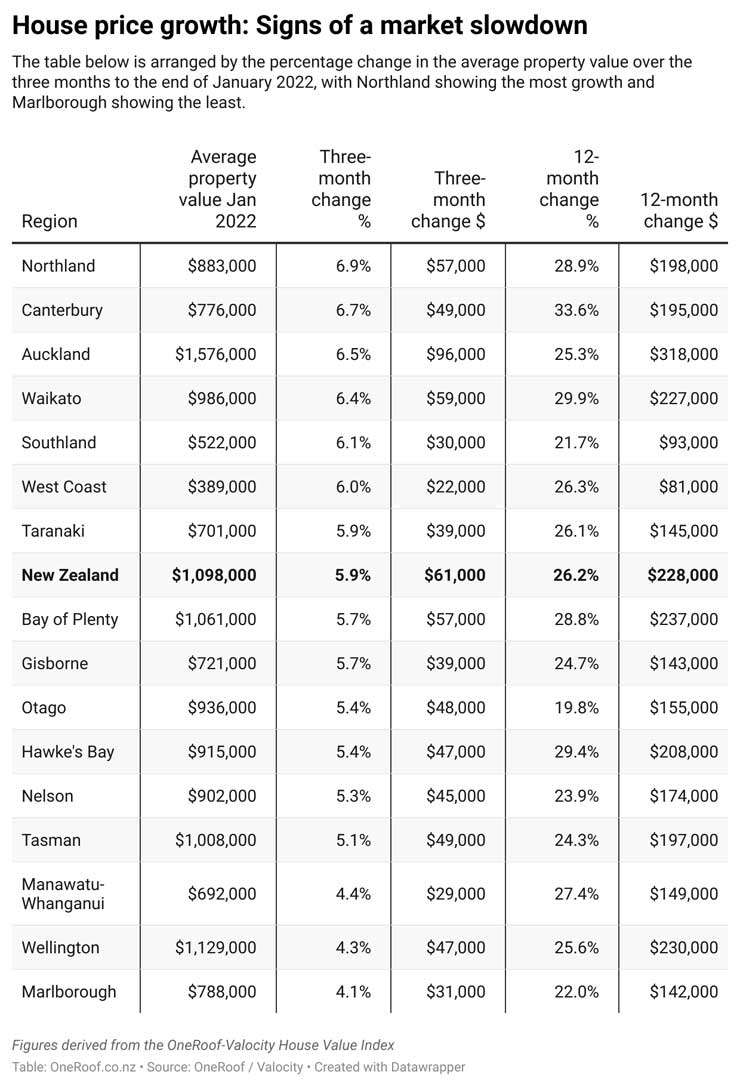

The nationwide average property value was up 5.9% ($61,000) in the three months to the end of January to $1.098m.

Start your property search

While still strong, the pace of growth is starting to ease across all regions, in a sign that the new lending rules and uptick in listings may be starting to have an impact.

A return to seasonal normality - December and January are traditionally quieter months - is also evident.

Quarterly growth was strongest in Northland (+6.9% to $883,000); Canterbury (+6.7% to $776,000); and Auckland (+6.5% to $1.576m).

Growth of 5.1% pushed Tasman into the $1m club. Waikato (up 6.4% to $986,000) is not far behind.

With an average property value of $389,000, West Coast remains New Zealand's cheapest region for real estate, while Marlborough was the country's slowest market, registering quarterly value growth of just 4.1% to $788,000.

Of the major metros, Auckland performed best over the quarter, with much of the energy coming from the city's Franklin and Rodney districts, where the average property value was up 9% and 7.9% respectively.

The summer shutdown seems to have put the brakes on Christchurch's hot run, with quarterly growth in city falling from a high of 10% to "only" 6.2%.

Queenstown's average property value grew 6.1% to $1.764m over the same period, while Tauranga was up 5.7% to $1.23m and Hamilton was up 5.4% to $931,000.

Lagging behind was Wellington (up 4.6% to $1.303m) and Dunedin (up 4.1% to $756,000).

Of the major regional centres, Rotorua appears to be in the most trouble, registering quarterly growth of just 0.1%.