As expected, the Reserve Bank of New Zealand kept the official cash rate (OCR) on hold at 5.5% – but the RBNZ's accompanying Monetary Policy Statement, delivered today, doesn't rule out a future rate hike.

The language in the MPS won’t be especially comforting to homeowners, with the RBNZ signalling the possibility of another hike in the cash rate in November, the New Zealand Herald reported.

While a cloud of uncertainty still hangs over the future of mortgage rates, the country’s economists seem to be more confident about the direction of house prices, with the major banks all revising their growth predictions for 2024.

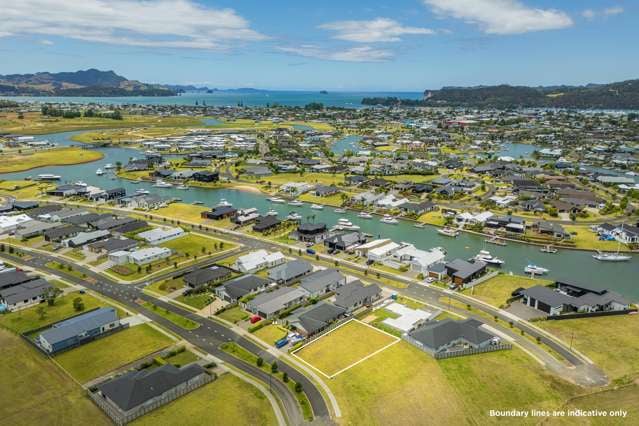

Start your property search

Currently, the forecasts for 2024 range from 2.3% price growth to 8%, which are a far cry from the start of the year when the forecasts ranged from a drop of 2.6% to growth of 3.3%.

Housing market forecasts are notoriously complex, affected by economic conditions, interest rates, government policies and unforeseen events. Before today's cash rate decision, OneRoof asked the economists at the major banks – ANZ, ASB, BNZ, Kiwibank and Westpac – why they seemed more upbeat about the market and what factors had led to their revised forecasts on house prices and interest rates.

ANZ

At the start of the year, ANZ’s economists were predicting a 1.3% fall in house prices over 2024, but this was upgraded to a 2.3% rise.

Senior economist Miles Workman told OneRoof: “It’s always important to note that economists aren’t the best at getting forecasts of the house price cycle, perfectly accurate.”

“One of the biggest surprises that we've seen over the past year, is just the sheer strength of the net migration figures, ultimately boosting demand for housing. [That] appears to be affecting prices.”

Post-Covid policy changes, both domestic and overseas, have also had an impact on New Zealand’s housing market.

The Reserve Bank of New Zealand governor Adrian Orr earlier this year. The RBNZ has kept the official cash rate on hold at 5.5%. Photo / Getty Images

“We’ve seen the Reserve Bank recently loosen LVR restrictions,” Workman said.

“The message from the coalface when we talk to people who are working in the market, is they’ve seen a small increase in demand for mortgages, particularly among first-home buyers.

“And then we had the CCCFA [Credit Contracts and Consumer Finance Act], which contributed to the downswing in the housing cycle [from December 2021], but then the government reversed some of those changes, which in a relative sense, was another loosening and financial conditions.

“Then there has been a higher degree of robustness [than expected] across the household sector. When you look at the household balance sheet data, there is some clear evidence there that household incomes are still rising quite strongly. Households have built up a very strong savings buffer through the pandemic era.”

ANZ has also substantially revised its forecasts for the OCR. This time last year, the bank was picking that the cash rate would top out at 4%; now it’s thinking there will be one more hike before the end of the year, taking the cash rate to a peak of 5.75%. Workman said the main reason for the new forecast was inflation, which the bank believes needs more belt-tightening to bring it under control.

ASB

ASB economists base their forecasts on the QV House Price Index, which can differ from the REINZ index used by other banks, although over time the two should move roughly in the same direction, ASB chief economist Nick Tuffley told OneRoof.

ASB has revised its 2024 house price forecast from a drop of 2.6% to a rise of 7%. The big change between the two forecasts was the surprise lift in net migration figures.

“We have changed our house price forecasts a couple of times [this year], and particularly a few months ago on the strength of net migration. It was February and March this year when we had the massive months, but you still have a quite clear trend of 5000 to 7000 net per month,” Tuffley said.

ASB chief economist Nick Tuffley says the bank has changed its house price forecast a couple of times this year. Photo / Supplied

Year-on-year to October this year the net migration figure is predicted to be 92,000 people. That feeds through into the housing market.

The Reserve Bank's strong signals in May and July that the cash rate had peaked also had an influence on market sentiment, Tuffley said.

Last August, ASB, like others, expected the cash rate to peak at 4%. Despite new forecasts of a peak of 5.75% from others, ASB is sticking with its revised prediction of the cash rate holding at 5.5% before falling in the second half of next year. “Back then, there wasn't the full appreciation that inflation pressures would be as persistent as they have been.” It wasn’t until the September 2022 quarter figures came out in December of last year that it became apparent how hot inflation was running.

“Suddenly we got this picture of the economy growing at a much, much faster pace, which people weren’t aware of. Also, [there were] signs that non-tradable inflation was going to remain high, and the labour market [remain] tight.”

BNZ

BNZ, which also uses QV data, is picking house price growth of 7% in 2024, four percentage points more than what it had forecast eight months ago.

It’s always tricky to make predictions that far out, BNZ senior economist Craig Ebert told OneRoof.

Like the other economists interviewed by OneRoof, Ebert cites the strong rise in net migration numbers as the reason for its revised forecast.

The bank’s forecast for house price growth would have been higher, solely based on the strength of migration, but rising mortgage rates, a slowdown in the economy and an easing of the labour market have reined its expectations. “This is a constantly evolving environment,” he said.

Kiwibank

Kiwibank chief economist Jarrod Kerr told OneRoof that rapidly rising mortgage rates had hit home.

In January this year Kiwibank was predicting a 4% rise in house price over 2024, but has since revised that upwards to 5%, although it cites the interest rate environment as a key reason for its expectations of modest price growth. “The heavy-handed approach from the RBNZ is dominating the outlook. The rate rises that took hold late last year have hit households hard,” Kerr said.

Kiwibank chief economist Jarrod Kerr: "We just keep hiking rates." Photo / Fiona Goodall

Household spending patterns had changed, with Kiwis spending more money on essentials, which had become more expensive as a result of inflation, at the same time as reducing spending on big ticket items.

“[It] is showing up in government revenues, or lack thereof. GST receipts have softened, in a clear sign of softening economic activity. And the corporate tax take has come in well below Treasury forecasts. Corporates are generating less revenue, in another clear sign of an economic slowdown.”

The much higher OCR than was expected a year ago was a global story, said Kerr. “Inflation around the world surprised us all on the upside. We’ve spent the last three decades with inflation falling, and surprising on the low side.

“The demographic influence was powerful. Slowing population growth and ageing populations contributed to a global savings glut. The rise of China, and the amazing advancement in technology also contributed. The weak inflation experienced since the GFC in 2008, had us all expecting inflation to remain low. But, the colossal spending from governments, and the experimental use of new monetary policy tools [such as money printing], stimulated demand in a way we haven’t seen in decades.

“Broken supply chains during Covid, and the war in Ukraine, restricted supply of commodities and goods, at a time when demand was being stimulated with the strongest of monetary steroids.

“Central banks have an asymmetric response function. They are much more willing to stimulate, because we don’t want to face deflation. And we know how to contain inflation. We just keep hiking rates.

“So here we are. We’re in a tough situation, with persistent inflation. It’s a situation the RBNZ would much rather face, rather than really weak activity and low inflation or even deflation.”

Westpac

Westpac’s house price forecast for 2024 in January was 1% growth but this has been revised to growth of 7.7%.

Senior economist Satish Ranchhod said there were three main reasons for the change in outlook:

- The housing market has bottomed out much sooner than the bank’s economists had anticipated. “We had expected prices to continue to ease down a bit,” Ranchhod said.

- Interest rates may have peaked. “The fact that that peak is coming into sight is giving some buyers a bit more confidence.”

- Population growth is stronger than anybody expected and boosting the housing market. “Historically we have seen that in periods when migration is quite strong, the housing market does also pick up.”

A year ago Westpac, like other banks, was picking a cash rate peak of 4%, but now, like ANZ, it’s picking that cash rate will be lifted in November to 5.75%. “The big thing that happened over that period, leading to revised predictions, was inflation,” Ranchhod said. “We thought that inflation was going to peak around 6 to 6.5%. In fact, it rose to well over 7%. The Reserve Bank had to take the official cash rate higher. That flowed through to where we are today.”

Use the search field to find out the best mortgage deals available today.