New Zealanders last year saw historically low interest rates, a dramatic price recovery in Auckland after fears of a crash and Dunedin continued its hot streak as the country's best performing real estate market.

Now eyes are on where the real estate hotspots will emerge in 2020.

The strongest contenders for residential growth are ones that are seeing increased development, boast strong transport links and are at an affordable price point.

And if buyers get in now, they could see the value of their purchases increase considerably over the next decade.

Start your property search

According to real estate expert Pete Evans, there are ten locations that have the most potential - nine are in Auckland, and one in the Bay of Plenty.

Colliers head of residential projects Pete Evans has as his hot picks Auckland suburbs Northcote, New Lynn, Glen Innes, Wynyard Quarter, Manukau, Onehunga, Albany, Mt Roskill and Waterview, and Tauranga Central in Tauranga.

First home buyers are the reason why these suburbs and not others are likely to see big capital growth, Evans says, with many of the new developments there catering to their needs – as well as their budgets.

He says buyers in the $500,000 to $650,000 price bracket are looking for well-located apartments and terrace homes, rather than new homes at least 25km from the city with their long (and expensive) travel time and costs.

“The focus in 2020 will remain on the supply of affordable homes and regeneration of traditionally less expensive suburbs. We believe the tide is turning from strong growth in the regions to the start of the growth phase of a new cycle in Auckland.”

He adds that return of investors to the Auckland market also “will provide sales momentum”.

OneRoof research shows huge price growth the suburbs identified by Evans over the last five years – between 30 and 50 percent - and a significant amount of “affordable” housing stock in the sub-$1 million price bracket.

OneRoof editor Owen Vaughan says new developments will help raise the profile of the suburbs and boost property values for existing homes.

“Growth will benefit existing homeowners as well as those who buy into the suburbs.”

Manukau, which had the biggest percentage of apartments and units of the ten suburbs, and concurrently the most affordable, was one of the few Auckland suburbs to see growth last year, with its median property value rising 1 percent year on year to $495,000.

Of the 10 suburbs named, only Albany and Northcote had median property values of more than $1 million.

James Wilson, from OneRoof data partner Valocity, says: “The next few years may introduce changing demand drivers, as the market reacts to new and proposed areas of development.

“Much like within other international cities, we are beginning to see growing importance placed on proximity to public transport."

“Affordability is now all about buying new in an area that’s changing, as modest older-style houses coming down and new houses come in,” Evans says.

“It’s a transformation of housing form for residents downsizing or making lifestyle changes, second homes, investors and the rental market.”

Evans says that last year developers focused primarily on meeting first home buyers’ needs, spotting that after the slow-down in the Auckland market post the 2016 peak, recovery would come at that affordable end of the market.

“Others picked up on KiwBuild that gave them almost guaranteed underwriting and infrastructure spending that [brings] a lot of changes in the suburbs, those affordable areas not far out where the amenities improved.”

The exception to the affordability is Wynyard Quarter, which Evans expects will have a fresh burst of activity ahead of the 2021 America’s Cup. Last year saw the first residents move into the over 170 upscale apartments in Halsey and Madden St, while the new $300 million five-star Park Hyatt is due to open early this year.

Manukau and Albany

Evans says Manukau will be a fantastic place to live in the coming years.

It has been prioritised as a city hub by Auckland Council under the Panuku-led Transform Manukau which Evans says will “unlock a sleeping giant” in central Manukau and Wiri.

The new integrated rail and bus station, an upgraded main street, Manukau Institute of Technology’s new trade learning centre, revamped parks and pedestrian- and cycle-friendly connections to downtown Manukau will be in place as the first residential neighbourhood of some 400 architecturally-designed new homes, selling for less than $600,000, come to market.

Ray White’s Tom Rawson, who has offices from Manukau south, says that already developers are meeting the demand for good new town houses instead of a poorly built, uninsulated 90 sq m houses on huge sections.

Right now they’re replacing like with like – three bedrooms for $650,000 to $700,000– but are now responding to market demand for four bedrooms. The first of the high rise blocks is almost complete is sold out.

“Developers have got enough confidence to do that, they saw four years ago how popular it was, it set the benchmark.

“Mum and dad developers are doing four to ten houses, and everything is selling,” he says. “People realise their 800 sq m needs to be built on, and that apartments are the fix.”

Another sleeping giant picked by Colliers is Albany, which was the last of the 1990s un-master-planned car-based suburbs. It has been tapped by Auckland Council as one of the city’s big growth nodes for employment, commercial activity and amenity.

Evans says investment in public transport, the Park’n’Ride and busway, is essential as driving to the city gets increasingly difficult, picking walkability to the bus will be the future key.

Westfield has plans for a $500million redevelopment with shopping, offices and apartments in Albany. Photo / Scentre Group

After their new Newmarket development, Westfield plans a similar scale of improvements at Albany: $500m to add nearly four hectares of retail, a dining precinct and possibly two 15-level office towers.

Evans says that overseas land owners in the suburb, mainly from China, have sat on greenfields plots. They understood the connection between higher density and transport, so may now be ready to match the retail development with residential towers, perhaps up to eight storeys or high rise up to 20.

Barfoot & Thompson agent Andy Riley, who’s been in the area 25 years sure hopes that includes meeting the market demand. He’s disappointed that, so far, developers have focused on only price.

“Oteha valley is filled with fast food and land that was mixed use retail is now just cheap builds to cover their rates,” he says.

Riley says there is demand for smaller houses with some space for outdoor recreation, but says land prices are driving the big houses with no yard trend. He’s seen local parks like Rose Gardens and Kell Park no longer big enough to serve the residents in nearby apartments, and pressure on street parking spaces.

He hopes the earlier lack of a master plan will be replaced by an Albany that’s more “thought through”.

Ben Macky of Wallace and Stratton concurs that the types of homes in the area needs to appeal to a wider demographic for families drawn to the amenities of restaurants, transport, Massey University and the stadium.

“It’s definitely a suburb for the future.”

Northcote and Glen Innes

Evans’ picks of Northcote and Glen Innes are already well underway in their transformations by Panuku and new housing organisation Kainga Ora.

Northcote will get 1500 new homes, upgraded greenway and parks and a revamped town centre, helped, Evans adds, by proximity to the city, Takapuna and Smales Farm.

Regeneration of former state housing around Fraser Ave in Northcote is kicking off development of the town centre, with greenways and improved amenities. Photo / supplied

Glen Innes’ Tāmaki Regeneration Company (with Kainga Ora) is adding 7,500 new homes to the wider area over the next 15 years and a revitalised town connected to the train station.

“As the town centre continues to improve, new dwellings close to village amenity will attract young professionals and families, as well as investors.

“Glen Innes remains one of the last places for affordability in the Eastern Bays, and 2020 will see opportunities that first home buyers and astute investors won’t want to miss.”

Mount Roskill and New Lynn

Mount Roskill, another established suburb with amenities and transport connectivity is next off the block, with a Government-led project bringing 10,000 new homes over the next 10 to 15 years, including state housing and market and affordability caps.

Stage one, replacing over 250 state houses with 900 new homes will be ready at the end of this year.

Evans predicts this will attract further investment from the private sector.

“Development could be not too dissimilar to Hobsonville Point, but in a much closer location and an already established area.”

The transport hub for west Auckland, New Lynn, already has a good mix of retail, commercial and residential that grew up around the new sation opened in 2010 and is about to get another boost. The council expects it to be home to 20,000 residents and 14,000 workers by 2030.

New Lynn is picked as one of the country's top ten suburbs, with well-designed density developing around the train station.

The former Crown Lynn Potteries site is getting up to 1,800 new homes, a park and 40,000sq m of commercial space.

Born and raised “out west”, Ray White New Lynn branch manager Michael Gee, says that has already made area more desirable. He says the 1800-home project is phenomenal and will make New Lynn a “metropolis of out west”.

“It wasn't that long ago that people didn’t want to live in New Lynn but it’s now very sought after. To a degree it’s a bit premium compared to other western suburbs.”

Waterview and Onehunga

Closer to the city, Waterview is benefiting from the regeneration of walk and cycleways on the back of the tunnel construction, but Evans says that as one of the last pockets of affordability on the western side of the waterfront it is attracts people moving out from expensive Point Chevalier or Westmere. Developers Ockham have a 95-unit KiwiBuild project on the former tunnel construction site.

The last of the older fringe suburb’s on Evans’ list is Onehunga, also about to benefit from a Panuku Development $140 million investment to add thousands of new homes, and improved transport.

Residential development by partners Marutuahu Iwi and Ockham in Waterview are part of the change in the suburb on land used for construction of the Waterview Tunnel. Photo / supplied

A rejuvenated Onehunga Mall and 160 new apartments at Fabric of Onehunga are already evident, while Panuku Development’s upgrade Onehunga Wharf means Evans sees Onehunga on its way back to the prominence it had over a century ago.

In real estate business for 34 years, Bayleys agent Glenn Baker says the area is becoming young, with apartments on Alfred Street and Beachgrove bringing a fresh look to the neighbourhood.

“Young professionals really enjoy that they can hop on the train with a cup of coffee with an iPad and get to the city,” Baker says.

He says it’s helping existing homeowners too, who are “pleasantly surprised” homes mainly sell for above the CV.

Tauranga Central

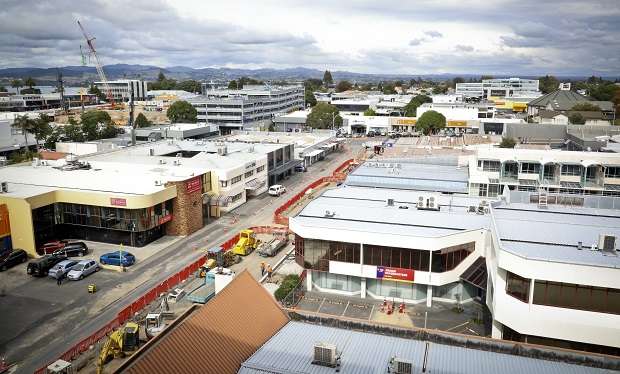

Tauranga, the eastern boundary of the so-called golden triangle of Auckland and Hamilton, has had exponential growth that the City Council expects to will continue beyond 2020. People will come back to live in the city centre, not just for work or shopping, with the University of Waikato’s new campus, 120 high end apartments going into the Farmers’ site and cool new laneways to connect walking and cycling.

“Tauranga’s CBD is on the cusp of transformation,” says Evans.

The new University of Waikato campus, along with parking building and developments on the Farmers site are transforming downtown Tauranga into a mixed use precinct. Photo / Andrew Warner

“The Bay of Plenty has always been a popular move due its favourable climate and coastal living,” says Evans, adding that it would attract a more mature market as well as the younger crowd.

“They all want the amenity,” he says. “Tauranga remains the only regional location showing similar improvement [to Auckland’s].”

Evans says that large scale infrastructure spending by central or local government, spills into existing housing stock to pull up the whole neighbourhood.

“If there are good infrastructure improvements, people will be comfortable spending $100,000 or $150,000 in renovating. With the government changing the fabric in these areas, the population will follow.

“If you rely on private developers, they won’t be doing it at that scale in established areas.”