A couple wanting to live in a major city and have a comfortable retirement would need to save a lump sum of $785,000 at retirement - and have a mortgage free home, research has revealed.

Analysis by the Westpac Massey University Fin-Ed Centre of spending by over 65 year olds in the year to June 30, 2018, shows virtually all spent more than what they get from the government in New Zealand Superannuation.

A couple living a no frills lifestyle in the provinces were able to get by mainly living on NZ Super but would still require a lump sum of around $13,000 at retirement to fund their spending.

Claire Matthews, who carried out the research, said the figures confirmed that NZ Super was not enough to fund the retirement most people want.

Start your property search

"While living on New Zealand Super is possible, for the vast majority of New Zealanders it doesn't support the lifestyle they wish to have.

"This reinforces the need to save for retirement if you want to set yourself up to have the retirement you want."

Matthews said the fact that the spending of today's retirees exceeded NZ Super showed they had prepared well by either having savings or continuing to work to support themselves.

But she said future generations may not be as prepared.

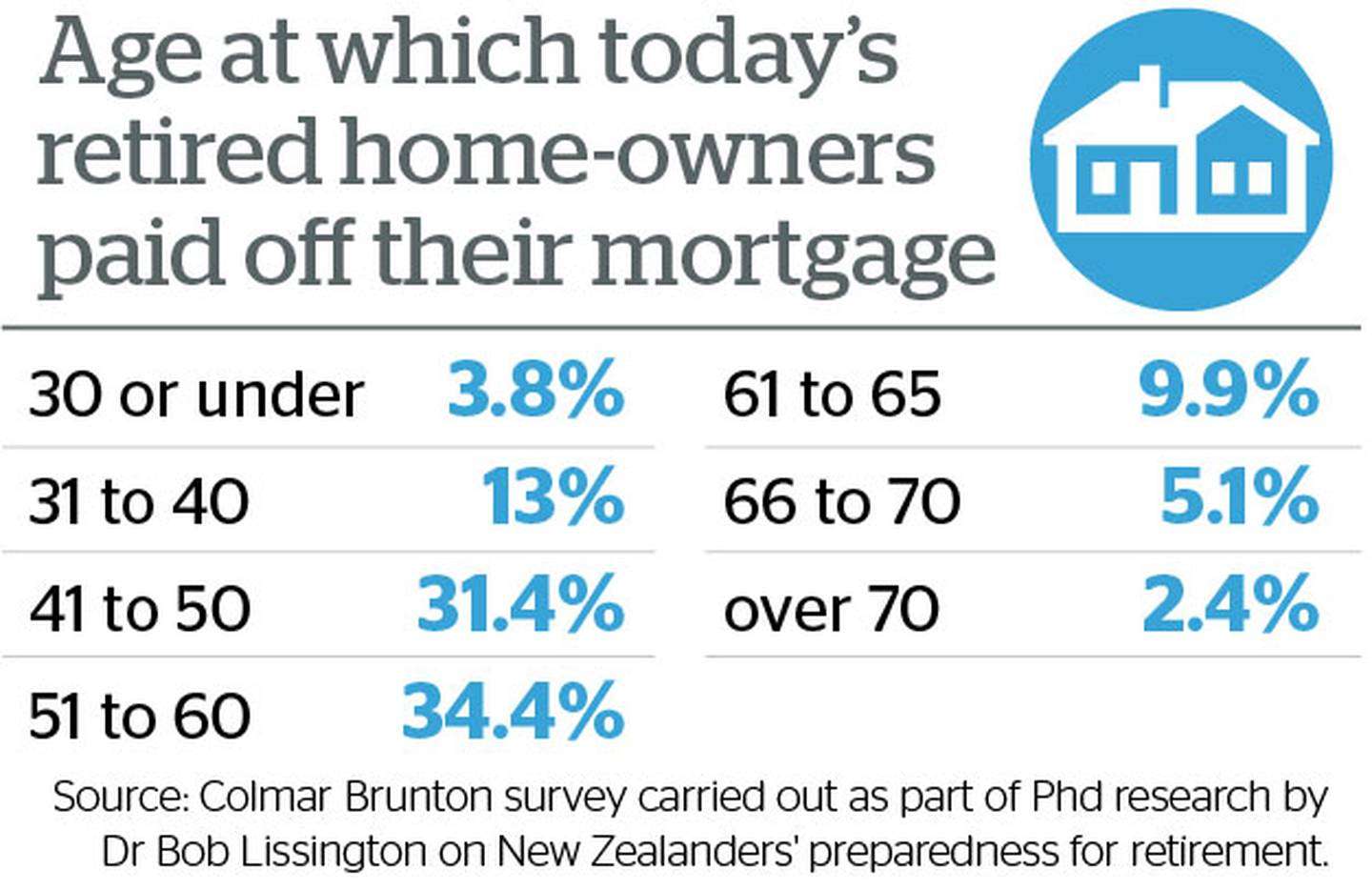

Doctorate research carried out by Massey graduate Bob Lissington as part of his PhD found today's pre-retirees - those aged 50 to 64 - were less financially prepared for retirement than the current generation of retirees.

In a survey of 1000 people aged between 50 and 80 nearly 90 per cent (88 per cent) of over 65s owned their own home and 12 per cent still had a mortgage.

In comparison 84 per cent of 50 to 64 year olds owned their own home and 52 per cent still had a mortgage.

Matthews said this suggested the level of home ownership in retirement would reduce as most people bought their first home before the age of 50.

Of the current retirees 92.5 per cent had repaid their loan by the age of 65.

Owning a mortgage-free home is seen the ideal position for those heading into retirement.

Matthews said falling home ownership rates and people having a mortgage later in life was something that needed to be monitored.

The big concern was what size a person's mortgage was and whether they would be able to pay it by retirement, she said.

"The earlier you pay it off the better because you can then save more for retirement."

Lissington said people under 50 had the advantage of being part of KiwiSaver for more than 10 years where as those 50 to 65 may have less time in the savings scheme.

"They haven't had the advantage of that."

Before KiwiSaver was launched in 2007 people did not have an easy mechanism to save, he said.

Lissington said older generations who were now retired had the advantage of working through a high inflation period where their earnings jumped up and made mortgage debt more easily payable.

But monetary policy meant inflation was no longer allowed to grow at high rates.

"Those aged 50 to 64 are the sandwich generation - their parents are living longer and they are having to support them longer and their kids are staying at home longer. They are getting squeezed both ways."

Lissington said people in the 50 to 64 age group who were not well-prepared were going to have to work longer because they did not have the financial resources to support themselves.

The challenge came if they needed to work but couldn't because of ill health or redundancy, he said.

Lissington predicted greater reliance on the state to provide for that group as they headed into retirement.

- New Zealand Herald