New Zealand has a record number of new homes in the pipeline but who is building them and where is the money coming from? Those in the business have scotched often repeated claims that the country’s new-build boom is being paid for by Chinese money.

While New Zealand has seen a number of major projects carried out by Chinese-owned development companies, much of the money for new residential construction comes from New Zealand, with New Zealand banks among the biggest backers of the new-build sector.

However, the banks can be shy when it comes to stumping up money for smaller projects.

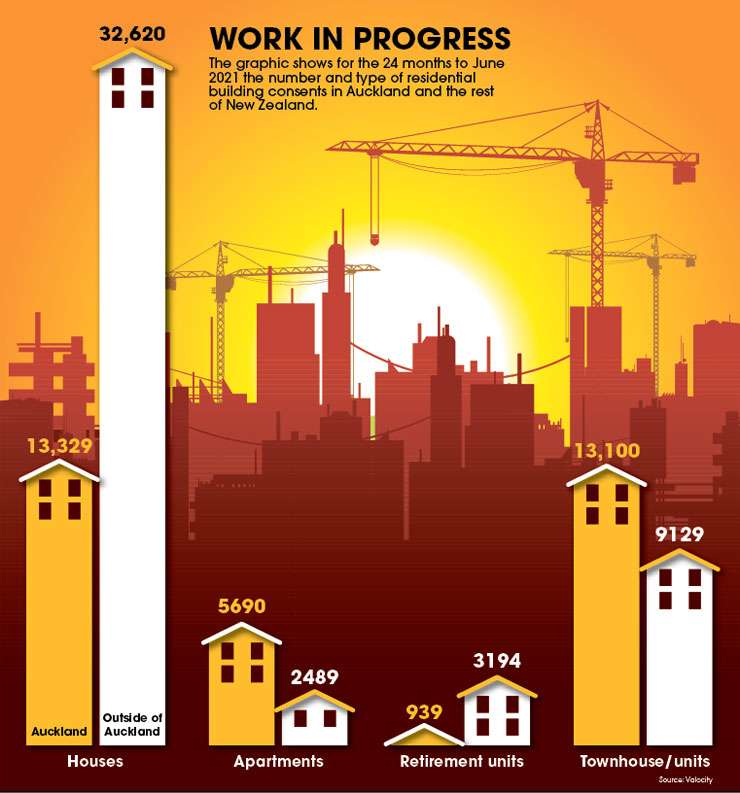

James Kellow, director at New Zealand Mortgages & Securities (NZMS), says the banks were burned by the leaky home crisis of the late 1990s and early 2000s and typically avoid townhouse developments, consents for which are set to eclipse standalone houses in Auckland.

Start your property search

“[Banks] haven’t really financed townhouses because apartments are (more) profitable for them. Banks like doing apartment developments because they might be $100m. So, it’s a big chunky loan for a bank.”

Kellow says there is no lack of local companies and wealthy individuals looking to finance townhouse developments. They’re typically very simple to build compared to multi-story apartments.

“They’re quite cheap to build. 10 units wouldn’t even cost $500,000 each. So, 10 units might be $5m, or 20 units $8m or $9m,” he says.

Chelsea Herbert, director debt advisory at Colliers, estimates there must be in excess of 100 private funders in New Zealand.

A large number of small overseas funds also do business here, she says. “They are from numerous different countries. (The money) could come from Singapore. It could come from Hong Kong. It could come from America.”

The Pacifica tower in central Auckland is one the country’s biggest apartment developments in recent years. Construction was done by Australian development firm Hengyi. Photo / Michael Craig

Kellow also sees those foreign lenders in the market. “There's been a huge number of foreign lenders annoying me,” he says. “Insurance-based funds and hedge funds. Not just Chinese but a lot of American hedge funds (and) funds out of Australia.”

Kellow, Herbert and Du Val Group chief executive Kenyon Clarke are seeing a growth in funding from New Zealand for small to medium size developments. That includes NZMS, and competitors including ASAP Finance, First Mortgage Trust, Cressida, Koru, Spinnaker, and Direct Capital.

Funders such as NZMS, Cressida Capital, and Spinnaker are largely funded by wealthy families. NZMS, for example is financed is backed by the Manson family, well-known property developers. Spinnaker Capital is similar.

ASAP Finance, is owned by a family that hails from Fiji, says Kellow. “It’s owned by guys whose parents owned all the supermarkets in Fiji. They’ve got hundreds of millions of dollars. I don’t know if they’re a rich-list family, but they should be.”

First Mortgage Trust, is one of the few funders that use the traditional finance company model enabling New Zealanders to invest, says Kellow.

As well as the funding companies, wealthy individuals sometimes fund one-off projects. “Every week I come across a deal where some rich guy’s sold a widget manufacturing business and he's investing $20m in a property development. There are heaps of those people.”

Several of the better known local funding companies l source their finance from mum and dad investors in Hong Kong, says Kellow. The well-publicised issues with Chinese development company Evergrande Group are creating a temporary issue by making the small investors nervous, he says. “It's caused a liquidity squeeze. But that will be temporary.”

Although their money comes from offshore, Herbert points out that the overseas funders are registered as financial service providers in New Zealand, adhere to relevant regulations, and pay tax. Most have people on the ground here to handle this end.

The three Chinese banks operating in New Zealand - Bank of China, China Construction Bank and ICBC - are also registered here. These banks have well-known New Zealand directors, says Kellow, and tend to lend to New Zealand Chinese because they have the connections back home to do background checks.

While small to medium size developers have choices, the size and scale of many projects in New Zealand are beyond the ability of local banks, Du Val Group’s Kenyon Clarke told OneRoof. New Zealand is woefully underbanked at this level and it’s a failing in our capital markets, he says. Larger developers such as Du Val need to go offshore for money.

In a recent blog post, Clarke wrote that no bank in New Zealand could support Du Val. “While the lack of capital is concerning for our housing market, the problem goes far further than that,” he wrote. “Many of the local banks misunderstand risk and haven’t adopted best practice international standards as it relates to development lending.”

Clarke told OneRoof it is hugely important for New Zealand that it has an efficient capital market so the country could deliver a lot more housing. “You see a gap in our capital markets for property. NZMS, Spinnaker, ASAP, First Mortgage Trust and those groups provide an incredible service for your smaller scale, medium size, developers. And it's wonderful to see.

“I would love to see greater activity from either the New Zealand Super Fund or some recognition from government. The interest component of any development is a major cost, and ultimately, when you're paying interest for an offshore institution that's money that's actually leaving New Zealand.”

The banks have sweet spots that range from around $30m for the likes of Kiwibank and other smaller players, says Clarke. The bigger banks are probably drawing the line around $75m, he adds.

That’s not enough for larger developers. “The New Zealand banks have been not quite so active in this last cycle,” he says. Instead, they’ve concentrated on profitable residential mortgage books.

The large American and Australian funding providers have provided a lifeline for Du Val and other large developers. “It has been a closed shop for a lot of years and property development in New Zealand has been essentially funded by ultra-high net worth individuals.

“We welcome the American and Australian capital for the larger scale projects,” Clarke says. “So, for instance, we signed a loan last quarter for $98m with Fiera Capital of Canada.”

It’s a point that Herbert notes as well. “There is a gap to be filled by alternative capital, and it is coming in is really building momentum here in New Zealand.”