Compared with March 2020, when we headed into the first nationwide lockdown, Auckland average house prices have risen 36%, with gains of 11% registered since March this year when tax rules for investors changed. In fact, so far for the year to June 2022, when both the Treasury and the Reserve Bank predicted price gains of 1%, average prices have risen almost 9.5%.

This just reinforces the fact that no-one, including myself, has the ability to predict house prices with any reasonable degree of accuracy. No sane soul expected factors surrounding the global pandemic to cause house prices to rise by more than a third. And no-one in the Government expected that the March 23 tax announcement would lead to prices rising 11% in the ensuing seven months.

Start your property search

Why have house prices continued to soar, despite the growing list of factors which suggest gains would be fading? First, we have to note that some slowing down has in fact occurred. For Auckland, on average in the six months to March this year, prices rose by 17%. In the most recent six months ending in October, gains were “only” 11%. Nationwide, the change has dropped from 20% to 11%.

This easing can be put down to many investors resisting making additional purchases since the end of March. According to the monthly survey I run with REINZ, on average in the six months to March a net 37% of real estate agents around the country were seeing more investors. Since then, a net 47% on average have reported seeing fewer investors.

But why the ongoing strength, with investors less present? First, there is a long queue of first home buyers seeking to make a purchase, and we learnt just recently that they have accounted for a record proportion of sales. They have jumped into the space left by the newly absent investors.

We have also seen some strong rises in concerns about prices for building materials, the ability of builders to complete jobs on time, final prices being revised upwards, and shortages of labour. At the same time FOMO – fear of missing out – has again reared its head.

Tony Alexander: "We are in the end game for this surge in prices." Photo / Fiona Goodall

From my monthly real estate agent survey with REINZ we can see that back in April 2020 only 35% of agents said they were seeing buyers display FOMO. That proportion sat at levels above 80% for August through February, then fell to 49% come April.

But since then FOMO has lifted to almost exactly 70% for each of the past three months, with one factor accounting for that likely to be the strong awareness of what happened when the first nationwide lockdown last year ended. House prices soared.

This time, since August 18 there has been a widely expressed expectation that the latest lockdown would cause the same thing. Potential buyers have not been waiting for that to happen and instead have remained actively engaged with the market, trying to make a purchase.

In Auckland, the reading for FOMO in July was 59% of agents seeing it, up from 35% in April. But that reading lifted to 67% in late-August then 79% in both September and October. The extended Auckland lockdown has boosted FOMO more than elsewhere. More people have scrambled to buy something – anything.

Another factor accounting for the recent surge in prices has been a fall in listings. Over the same period when FOMO has soared, vendors have pulled back. Nationwide property listings in seasonally adjusted terms fell 14% in August then 15% in July. They have recovered 43% in October to be barely above July levels. The stock of listings is currently 18% down from last year, nationwide and in Auckland.

The re-emergence of FOMO may help explain why prices in Auckland jumped by 4.4% in October and 2.5% elsewhere. Can this continue? No – at least not through 2022. The next few months are still likely to produce strong price gains as freedom brings a general lift in optimism and the scramble which agents are still reporting runs its course.

But as noted before, we are in the end game for this surge in prices, regardless of whether one is talking about the low inflation and low interest rates period from 1992, the post-Global Financial Crisis period of unusually easy monetary conditions, or the past 19 months of the global pandemic when our central bank and others have fully opened the stimulus spigots.

Investors face falling after-tax returns on rents as interest expense deductibility has been removed for new purchases of existing properties and will be gone for pre-March holdings within four years. Changes to the Credit Contracts and Consumer Finance Act require banks to be able to prove they have looked closely at a loan applicant’s income and expenses before granting a loan, to make sure they can truly service the debt.

As a result, lenders are capturing more expenses than before, discounting some income sources, and making less credit available than previously. Also, the Reserve Bank has instructed banks to effectively halve their low-deposit lending – something which is mainly hitting first home buyers, who account for 75% of low-deposit lending overall.

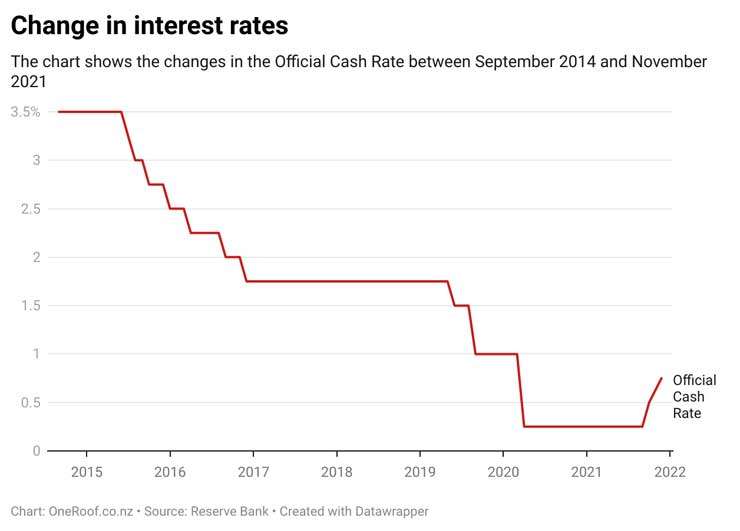

Fixed mortgage interest rates have risen 1.3% to 1.7% from the levels seen five months ago with similar gains and perhaps more likely over the coming 12-18 months.

Reopening the borders is likely to lead to a large flow of Kiwis to Australia for higher wages, lower house prices and a lower cost of living. Restoration of the ability to travel will see household budgets redirected back towards overseas trips and away from buying things locally – including each other’s houses.

New house supply is also rising at the fastest pace since the early-1970s, even allowing for shortages of materials, sections and staff.

And the outcome of these factors will be FOMO falling away in the first half of next year as we come out of summer. When that happens, we will be set for an extended period of house prices rising probably below 5% per annum rather than the boom we have seen recently. In some less urban locations falls are likely, but for Auckland there still looks to be some catch-up of prices needed relative to long-term trends.

- Tony Alexander is an economics commentator and former chief economist for BNZ. Additional commentary from him can be found at www.tonyalexander.nz