The majority of New Zealand's property valuers believe house prices will rise in the next three months, according to a new survey conducted by OneRoof's data partner Valocity.

Valocity, in partnership with economist and OneRoof columnist Tony Alexander, polled the country's valuers on the future of the housing market and the causes of the post-Covid price boom.

READ MORE: Find out if your suburb is rising or falling

The survey results comprise more than 120 responses that represent the views of active residential valuers in New Zealand.

Start your property search

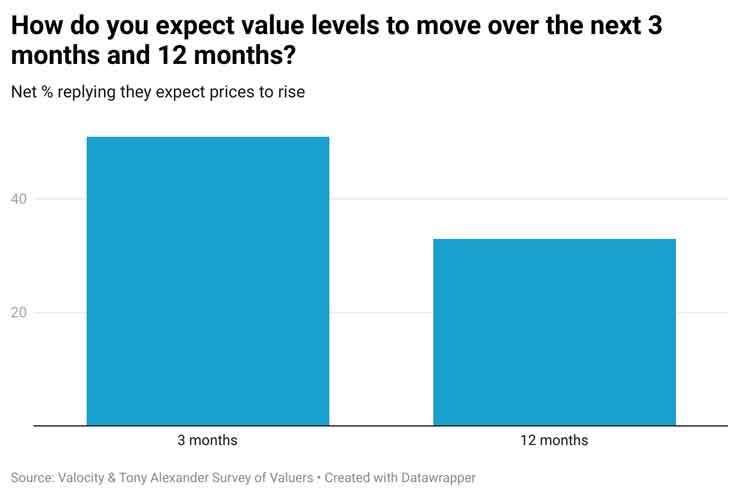

A net 51% of respondents reported that they expect prices, across all property types, to increase over the coming three months. But just a net 33% of respondents felt that prices would rise over the next 12 months.

The responses, said Valocity, suggest that while there continues to be evidence of upward pressure on prices at the moment from a wide variety of statistical and anecdotal sources, valuers expect the pace of price growth to ease off by 2022.

However, there are differences of opinion with regard to expected changes in prices for new builds as compared with existing dwellings.

A net 51% of valuers expect existing house prices to rise over the next three months, which is about the same as the net 54% expecting new build prices to rise. But only a net 31% of valuers expect existing property prices to rise over the next 12 months, compared to a net 46% of respondents who expect new build prices to go up.

Valocity said that this divergence likely reflected two developments: a rapid rise in construction costs; and investors being incentivised by the Government to purchase new builds in preference to existing houses (perhaps selling some) through planned changes in interest expense deductibility.

Valocity said that the survey results were in contrast to the Treasury’s recent forecast in the May 20 Budget that prices on average would rise only 0.9% in the year to June 2020.

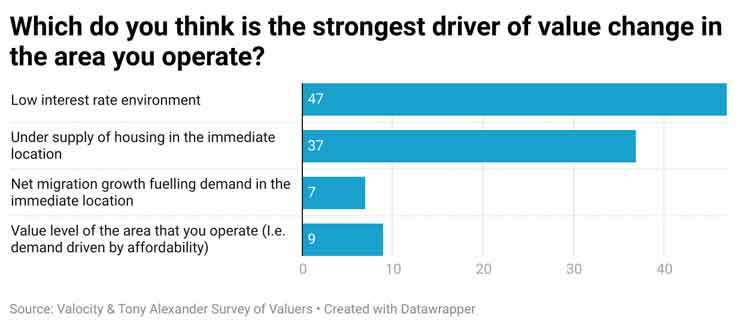

The majority of valuers cited low interest rates as the prime driver of price changes. This was important, Valocity said, because it suggested the pace of house price inflation could be impacted by a rise in interest rates.