At the start of the latest Avengers movie, half all living things on Earth had been turned into ash.

Homeowners in Auckland must be feeling the same way about their biggest asset after reading recent headlines about house prices in the city.

But despite reports warning of price collapses we aren't in the Endgame. Far from it.

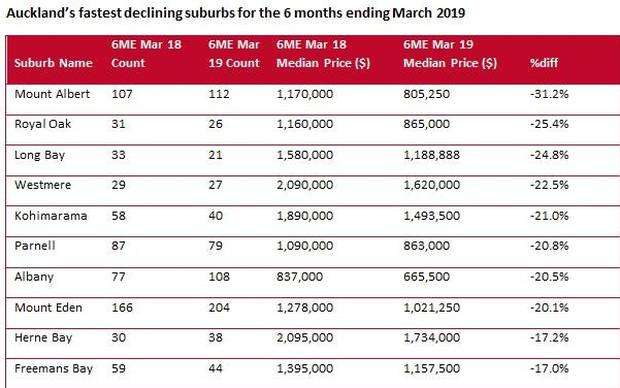

The latest data from Real Estate Institute of New Zealand shows wild fluctuations in the median price in the city in the six months ending March 2019.

Start your property search

Of particular note were the 30 per cent rise in Takapuna's median house price to $1.3 million and the 31.2 per cent drop in Mount Albert's median house price to below $1 million.

So, why are property prices surging in some suburbs but dropping like a brick in others?

Thirty per cent, up or down, is a big number, and one that's bound to have Kiwis scratching their heads. Is the city's property market about to skyrocket or is it on the verge of ruin?

Well, the numbers are telling us something, but neither of those two things, because Auckland property values have been flat for the last two years.

In fact, the median price in the city only dropped a marginal 2.7 per cent in March to $856,000, according to REINZ.

Homeowners waking up in Takapuna shouldn't suddenly expect to sell their homes for a 30 per cent mark-up, nor should buyers expect to pay "fire sale" prices in Mount Albert.

So, are the figures just meaningless gobbledegook? No. Read right, they can tell us a lot about what's going on in the market in individual suburbs. The median house price figures are good illustration of what's selling at a certain point of time. They also show what's not selling.

Houses in the higher price bands in Auckland have not been selling in the numbers they used to, and that hole has dragged down the median price in many central Auckland suburbs.

The number of buyers able to afford home in the top end of the market is much smaller. A year ago, 7 per cent of all sales in Auckland came in at $2 million and above. That's dropped to 4 per cent now.

Tighter controls on lending, uncertainty around tax changes and the foreign ban have all contributed to that drop-off.

The suburbs that have tended to do better have more affordable stock have, and the increase in first-home buyer activity would suggest that's where the action is.

What's interesting about Takapuna is that it has a good mix of large expensive houses and more affordable units and apartments.

Looking ahead, we can expect to see more monthly price fluctuations, but for the most part Auckland's property market will remain flat for the next 12 to 24 months, before picking up again. And then we'll have a whole new bunch of headlines to contend with.

- Owen Vaughan is editor of OneRoof.co.nz.