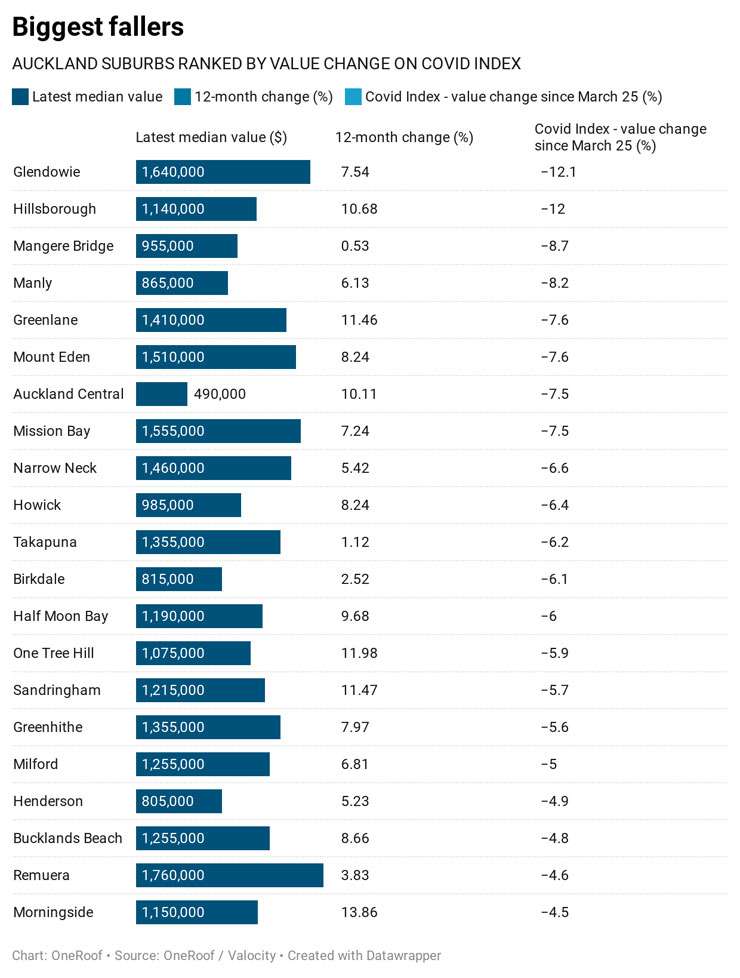

The central Auckland suburbs of Glendowie and Hillsborough have seen the city’s biggest drops in value since the start of the Covid-19 crisis, new figures show.

OneRoof’s new index, created by its data partner Valocity, showed that property values in more than a third of Auckland's suburbs were above or the same as values on March 25 - the day before the country went into an eight-week lockdown that put the brakes on the housing market.

House values in 178 Auckland suburbs were down on March 25 levels. Manukau, Waitakere Rodney and North Shore had the biggest share of falling suburbs while Papakura and Franklin had the biggest share of growth locations.

Start your property search

Glendowie and Hillsborough were the only two Auckland suburbs to see double digit drops on the index - 12.1 percent and 12 percent respectively.

Both suburbs had seen big growth in the lead up to the Covid crisis, with Glendowie's median property value for July ($1.64 million) up 7.54 percent year on year on year and Hillsborough's median property value ($1.14 million) up 10.68 percent over the same period.

Mangere Bridge dropped -8.7 percent on the OneRoof Covid index. Photo / Ted Baghurst

The next biggest Auckland fallers on the index were: Mangere Bridge (-8.7 percent); Manly (-8.2 percent); Mount Eden (-7.6 percent); Greenlane (-7.6 percent); Auckland Central (-7.5 percent); and Mission Bay (-7.5 percent).

Also down were Narrow Neck (-6.6 percent); Takapuna (-6.2 percent) and Howick (-6.4 percent).

Changing Mix

James Wilson, director of valuation innovation at Valocity, says the drops in Glendowie and Hillsborough were driven by changes in the market.

“Pre-Covid-19, most of the buyers in Glendowie and Hillsborough were 'movers' - i.e. existing homeowners who were selling up elsewhere to buy into the suburbs. However, this group has pulled back since March 25, as have potential vendors, meaning there is less high-quality stock on the market. Investors and first-home buyers have not filled the void to the same extent they have in other suburbs, resulting in a softening of values," he says.

Harcourts business owner David Findlay, whose 45 agents cover Glendowie and Hillsborough, as well as St Heliers, Greenlane and Mt Albert, says that while lower value homes are fetching really good prices, stock numbers are significantly down on the same period last year.

"The $2 million stock is not in the market," he says.

Developers are on the hunt for big, flat sections, like at 43 Wairau Road, in Avondale, which sold for $300,000 above CV. Photo / Supplied

"The problem is the $1.1 million buyers are selling to buy whereas the sub-$1 million buyer has nothing to sell. And then we are getting ridiculous results from the lower-end stock.”

Listings in Greenlane this month are about one third their usual level, and half are for apartments asking between $430,000 and $700,000 compared to houses which would sell around the $1.5 million mark.

READ MORE: Find out if your suburb is rising or falling

Findlay says developers are back in the market, but they are looking for big, flat sections - perhaps another reason why hilly Hillsborough hasn’t grown. He cites the recent sale of a tear-down home at 43 Wairau Road, in Avondale. The property had 150 groups at the open homes, and fierce bidding drove the price to $1.083 million, more than $300,000 above the 2017 CV.

Hangover effect

Lingering uncertainty among buyers and sellers could be the reason for the declines. Ray White Manukau business owner Tom Rawson believes June and July sales figures will tell a different story.

“We’ve had our personal best June in eight years, and just beaten that in July, and we’ve already got 30-plus auctions booked for August. I think in our area a property that sold for $635,000 in April, we could put back on the market now for $700,000 and get it.”

A crowded auction room at Ray White's Manukau offices in July. Photo / Supplied

Howick Harcourts agent Karl Vermeulen is surprised values in his suburb have dropped since March 25, as his office has had its best month in the 20 years, registering at least six deals in excess of $2 million.

“But July was the first indication of that $2 million market, it wasn’t there until this month,” he says. “There was heightened interest in the $1.2 to $1.3 million, and only a little investor interest.”

Vermeulen says that buoyancy in the lower end of the market, townhouse developments selling for around $900,000, would have brought values down.

Like other agents, he’s projecting a very good August, comparable to the heated market in 2014.

“Supply and demand is squarely in favour of the vendor,” he says.