House prices won’t be on the floor for long. A market forecast from one of the country’s major banks has prices rising 7.5% next year and jumping 16% in 2025.

ASB’s chief economist Nick Tuffley says that while housing affordability is still an issue in New Zealand, several factors are in play that will put upwards pressure on house prices.

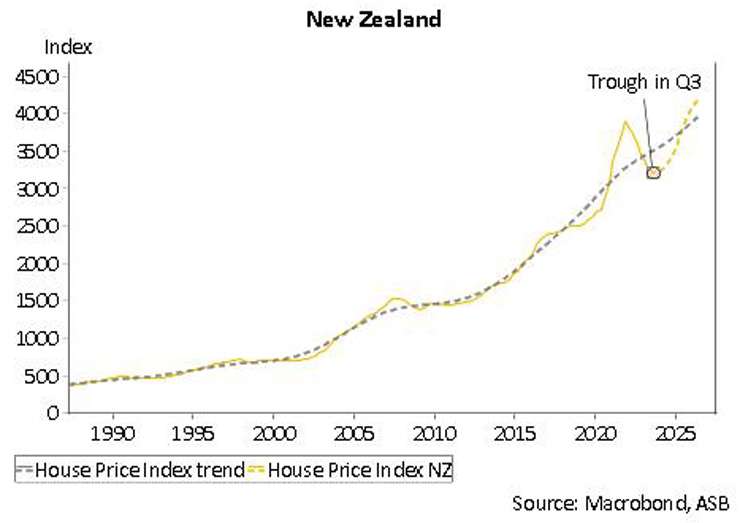

Like other bank economists, Tuffley believes the market slump is over. Since hitting a peak in December 2021, house prices have fallen around 17%, the result of unprecedented hikes in interest rates, a tightening of credit and soaring inflation. But Tuffley notes that even after such a sharp correction, house prices are still 19% higher than at the start of 2020, when Covid hit.

He says it’s important to look at historical house price trends to put his 2024 and 2025 predictions into context. “When you draw a [trend] line through the last 10 years or so, [prices have gone] from being extremely above that trend to now being below that trend.” The 7.5% and 16% rises in 2024 and 2025 would be in line with the trend, or just over, he tells OneRoof.

Start your property search

Read more:

- On the 41st floor of NZ’s tallest apartment tower and too terrified to look down

- Revealed: New Zealand’s most popular suburbs of 2023

- Are New Zealand house prices in for another ‘crazy ride’?

More of a concern for Kiwis is what the trend line means for housing affordability in general. “We’ve still got this more fundamental issue that house prices in New Zealand do look very high compared to our incomes and rent. This picture is not really changing. If you go back even well before Covid, we had quite an increase in prices relative to income,” Tuffley says.

Tuffley says the factors that will drive the next uplift in house prices will be rising net migration, a drop-off in residential construction and the eventual fall in mortgage interest rates.

“There is a substantial number of extra people pouring into the country. The surge in immigration is the thing that has been driving people's view changes. It’s pretty rare to have a surge in migration without it having much impact on house prices,” he says, adding that there is a risk that construction doesn’t keep pace with demand.

ASB chief economist Nick Tuffley: “House prices in New Zealand do look very high compared to our incomes and rent.” Photo / New Zealand Herald

ASB’s chart shows the house price trend and the forecast lifts in 2024 and 2025. Photo / Supplied

If net migration holds up at a fairly high level for a prolonged period of time, it would “put a lot more pressure on infrastructure and on housing”. With 110,000 net new migrants in a year, New Zealand would need nearly 40,000 extra homes to accommodate them, but over the year to April, New Zealand has consented just 21,700 homes.

“Construction is quite interest rate-sensitive [and] it has been a pretty challenging time for developers over the last six to 12 months to obtain the pre-sales and the financing that [they] need.” Building costs have also risen dramatically as well, Tuffley says, noting that to turn affordability around, the underlying cost structure for building new homes would need to drop.

- Click here to find properties for sale