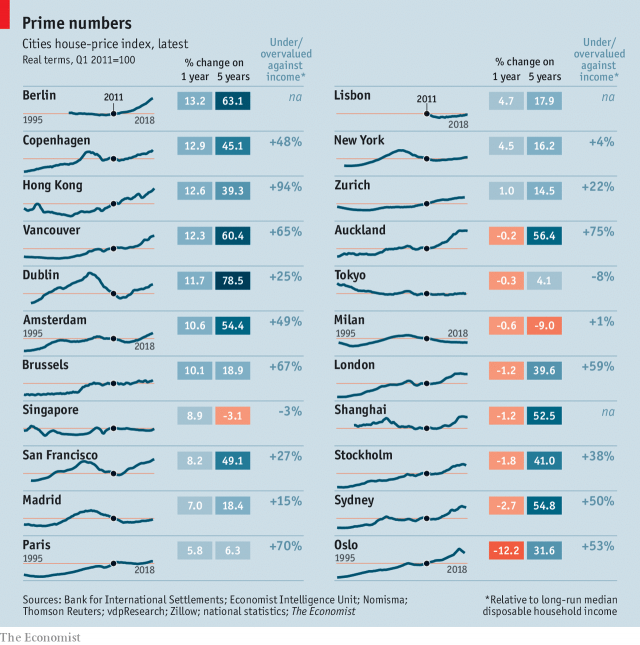

New data has found that Auckland is one of the world’s most overvalued cities for real estate.

According to The Economist’s latest annual global house-price index, Auckland is one of the world’s top 10 metropolises where property price booms are “unsustainable” compared to household incomes.

While Auckland house prices have largely been flat over the past year, the city ranked number two on the Economist'a global cities index, with home prices “overvalued” by 75 per cent when compared to average earnings.

Auckland was ahead of Sydney, Amsterdam, London and Vancouver as some of the world’s leading cities for houses that are more or less unaffordable in proportion to earnings. Only Hong Kong, where housing was overvalued by 94 per cent, was ahead of Auckland.

Start your property search

The Econmist reported that the average price of a home in the ranked cities "rose by 34 percent in real terms over the past five years. In seven cities it rose by more than half."

"Some of this is a rebound from the global financial crisis, which started with a housing bust," it said.

READ MORE: NZ needs to be ready for falling house prices

The Economist said it compared house prices with rents and median household incomes to see whether the figures froth or reflected fundamentals of the markets. "If prices rise faster in the long run than the revenue a property could generate or the earnings that service mortgages, they may be unsustainable. Or, at least, incomes or rents will eventually have to rise," it said.

"National house prices in Australia, Canada and New Zealand have been more than 20 per cent above fair value compared with income and 30 per cent above fair value compared with rents for the past three years. They have now hit 40 per cent above fair value for both metrics. Data for rents at the level of cities are lacking. But compared with long-run median incomes, prices appear even bubblier at city level than nationally."

"The three reasons why cities have experienced a property boom—and why it may now be ending—are demand, supply and the cost of money. In recent years people and jobs have flocked to the biggest cities from other parts of their own countries and elsewhere.

"A further boost to demand has come from foreign investors. Auckland, London, Sydney and Vancouver have attracted large inflows, particularly from China," it concluded.

The Economist report said that London may be a bellwether of will happen globally. "Agents say developers have started to offer discounts of as much as 10 per cent to close sales. As demand weakens, supply strengthens and mortgage rates rise, the bull run in global cities’ housing may be drawing to an end."

New Zealand economists recently reported that Auckland's housing market could follow similar trends to major Australian cities and experience price drops.

Sydney house prices are down 5 per cent, according to CoreLogic figures and Melbourne prices are down half a per cent for the first time in six years.

ANZ chief economist Sharon Zollner said she was watching the New Zealand market with interest because of what was happening across the ditch.

"Another risk has emerged on the horizon and that would be contagion from a more marked slowdown in the Australian housing market than is currently expected," she said.

However, Craigs Investment Partners' Mark Lister told the Herald it could happen but he believed a price decrease was unlikely in the current economic climate.

"It's not my expectation that it will happen here, not while our economy is as strong as it is - but you'd be very naive to rule out the prospect of house prices falling.

"I think it's entirely likely that you see house prices over the next four or five years much more subdued than they have [been]," he said.

Reserve Bank Governor Adrian Orr told Q+A a price drop was possible but was not within the Reserve Bank's projections.

"You could see a similar fall, that's not in our projections though. It's certainly within a realm of possibility, likewise you could see a rise," he said.