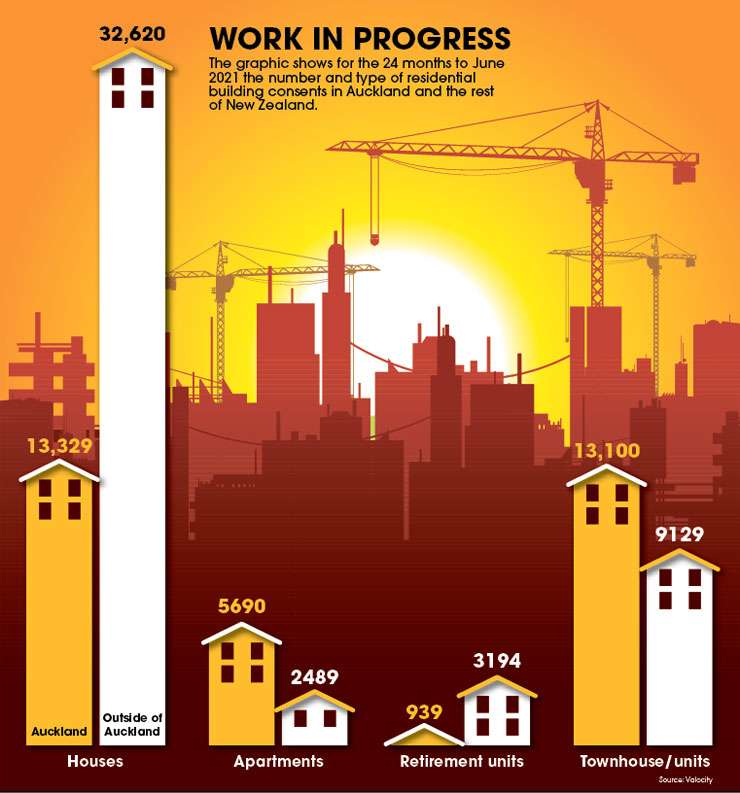

A new study by OneRoof has found that the building boom is making a huge difference to the number of homes available to buy in New Zealand and to price points.

First-home buyers in three of the country’s biggest and most expensive cities could save hundreds of thousands of dollars by choosing to buy new, according to the new research.

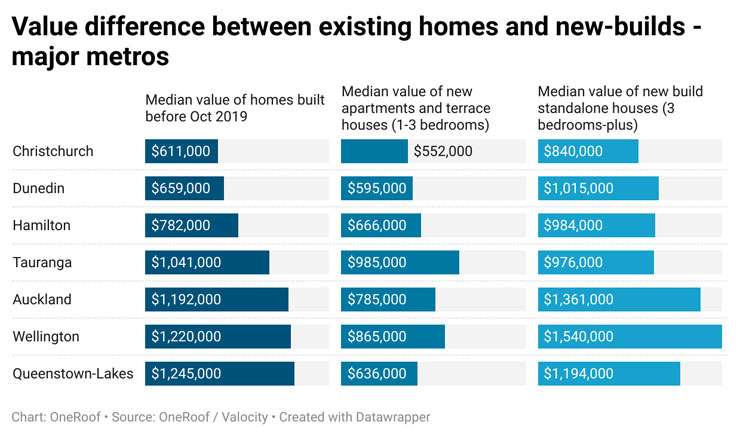

OneRoof and its data partner Valocity found that new homes were cheaper than existing properties in Auckland, Wellington, Tauranga and Queenstown Lakes – sometimes by as much as $600,000.

And in some suburbs, the difference between a new-build and an existing home was as much as $1.5 million.

Start your property search

The figures show that while new-build homes are still a costly option for the much of the country, the surge in house-building is offering buyers more affordable options where it matters most.

New vs old

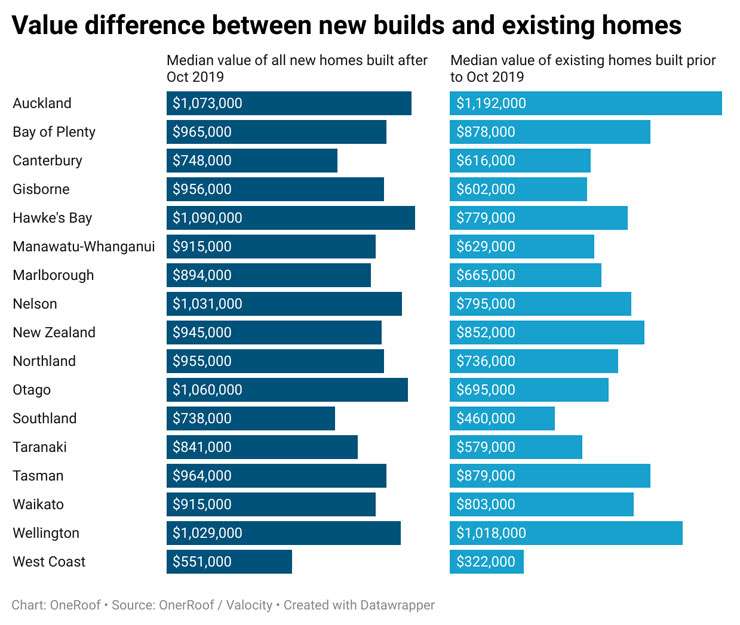

The OneRoof-Valocity research compared the median value of all homes built since October 2019 to the median value of existing homes built prior to that date.

Wellington offered first-home buyers the biggest savings, with the typical price of a new home in the city sitting at $972,000 – $248,000 lower than the cost of an existing home.

In Auckland, new homes are $119,000 cheaper than existing homes, although the median value for all new builds in the city is still a high $1.073m.

Other areas where big savings were identified were Tauranga, where the new-build median value is $966,000, $75,000 less than the median value of existing homes; and Queenstown-Lakes, where the new-build median of $1.175m is $70,000 lower than the $1.245m median for all existing homes.

New builds were also found to be cheaper in Western Bay of Plenty (by $67,000); Selwyn (by $59,000) and Lower Hutt (by $14,000).

A billboard advertising new-build homes in Auckland. Photo / Fiona Goodall

However, the OneRoof-Valocity research shows that outside these areas new builds can be more expensive than existing homes. Nationwide, the median value of all homes built in the last two years is $93,000 higher than the median value of homes built before Oct 2019.

At a regional level, the median value for all new builds was only lower than existing properties in Auckland, with the extra cost of new builds ranging from $11,000 in Greater Wellington to $895,000 in Otago.

Biggest savings for first-home buyers

However, savings can be found where developers and builders have been able to provide homes with smaller footprints.

The research found that the West Coast is the cheapest region to buy a new-build home, although few new homes have been built in the last two years (just 88) and the median value of those homes, $551,000, is almost double the median of existing homes.

In demand: A row of new-build terrace houses in Auckland. Photo / New Zealand Herald

The region with the most expensive new homes is Hawke’s Bay, although the area’s median of $1.09m for new builds is largely due to the fact that most new homes in the area are large free-standing homes aimed at the upper end of the market.

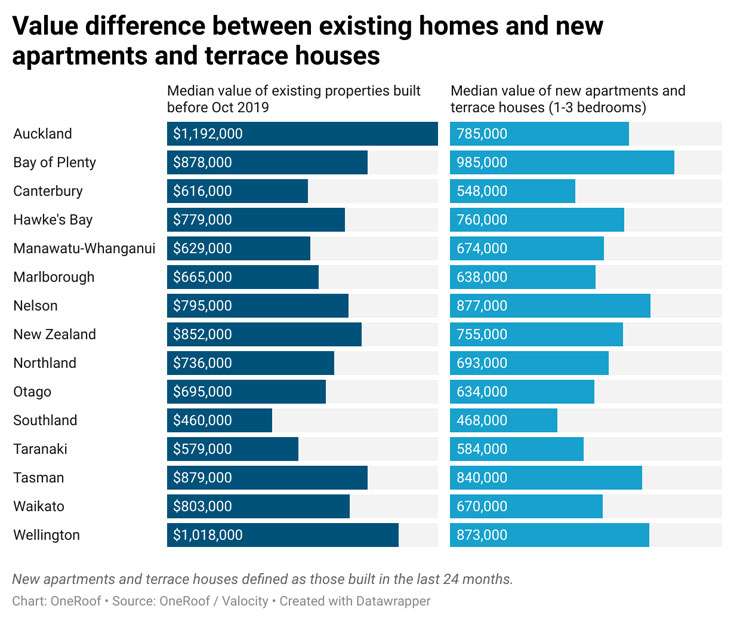

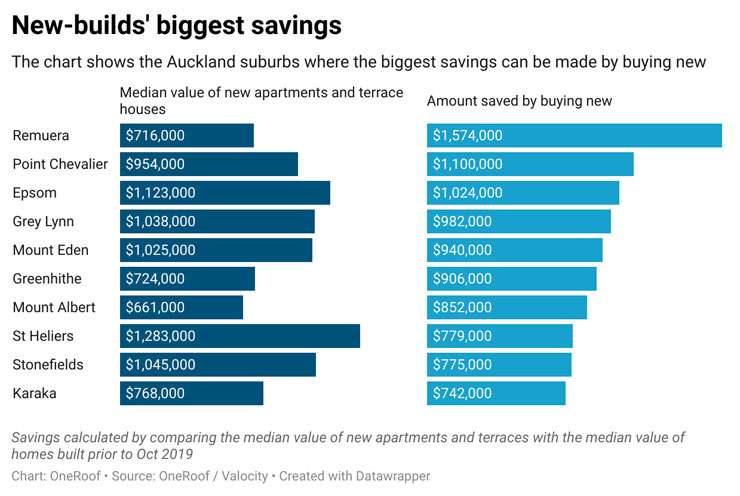

The research shows that cheapest entry points to the housing market are new-build apartments and terrace houses. In Auckland, the median value of new apartments and terraces is $785,000 – $407,000 lower than the median of existing homes (standalone new-build houses in the city, however, are $169,000 more expensive than existing properties).

However, the biggest savings are in Queenstown-Lakes, where new-build apartment and terraces have a median value of $636,000 – $609,000 lower than the median value for existing homes.

Other TAs offering first-home buyers an easier path to home-ownership are Wellington, where the median for apartments and terraces is $865,000 – $355,000 lower than the median for existing homes; and Selwyn, where the price difference is $313,000.

In fact, in the 44 TAs where they can be found, new-build apartments and terraces are cheaper than existing homes in all but 10.

New builds growing in value

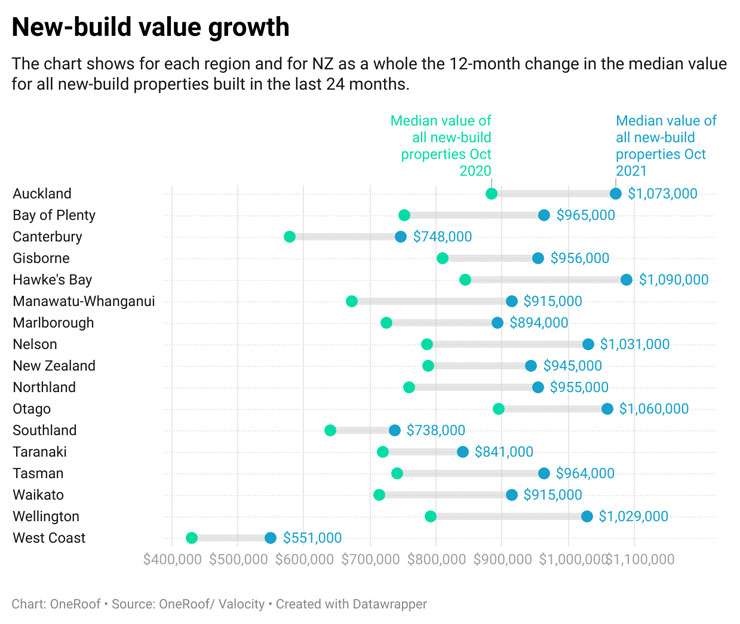

The figures also strongly suggest that new-build homes are good investments.

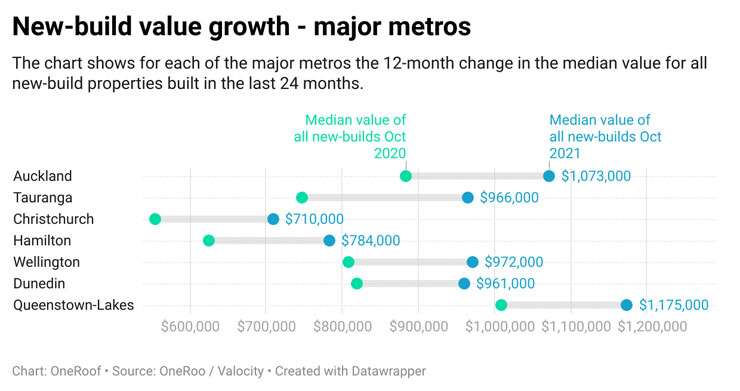

Nationwide, the median value of new-build homes rose 19.77% in the 12 months to October 2021 to $945,000. Value growth for new-build homes was strongest in Manawatu-Whanganui (up 35.96% to $915,000) and weakest in Southland (up 15.31% to $738,000).

Just one TA, Tararua in Manawatu-Whanganui, saw a drop in new-build values since October 2020. The TA that saw the biggest annual growth in new-build values was South Waikato. Its median new-build value rose 70.91% to $887,000, although this was off the back of just 25 new homes.

In Auckland, where 19,660 new properties were added to the housing stock since October 2019, the median value of new-build homes grew 21.4% in the last 12 months (a gain of $188,000).

Of the major metros, value growth for new-build homes was highest in Tauranga (up 29.14% to $966,000). Next highest was Christchurch, where the median value of new-build homes grew 27.93% to $710,000. The median value of new builds rose 25.24% to $784,000 in Hamilton, and 20.15% to $972,000 in Wellington.

Slower value growth was evident in Dunedin (up 17.2% to $961,000) and Queenstown-Lakes (up 16.4% to $1.175m).

What the figures tell us about Auckland

As Auckland is the centre of the building boom and the centre of the housing affordability crisis, OneRoof decided to look at new-build prices in the city’s suburbs.

Of the 277 suburbs in the city, 226 (81%) had new-build activity in the last two years. New apartments and terrace houses could be found in 112 (40%) of the city’s suburbs, while standalone new-build homes with three bedrooms or more were in 213 (76%) suburbs.

Auckland is the centre of the new-build boom, with new homes representing 4.15% of Auckland’s total housing stock, the biggest share out of all the regions. Papakura on the southern fringes had the highest concentration of new-builds in the city – 11.65% of total housing stock – and the second highest overall, behind Selwyn, in Canterbury, where new builds make up 12.61% of total housing stock.

New builds represented more than 10% of total housing stock in 24 suburbs across the city, with Wainui, in Rodney, sporting the highest concentration (94.67%), followed by Okura Bush (92%) and Ramarama (59.7%). Other new-build hotspots include Paerata (49%), Westgate (24.7%) and Glen Innes (14.43%).

Apartment living: Fabric in Auckland's Onehunga has added to the suburb's housing stock. Photo / Fiona Goodall

Of the 222 Auckland suburbs that had 10 or more new homes built in the last 24 months, 48 (21%) had a new-build median value of less than $1m (71 if you only count new-build apartments and terrace houses).

Cheapest pathway to owning a home

The Auckland suburb with the lowest entry point into the new-build market – and housing market overall – is Otara, in South Auckland, where typical cost of a new terrace or apartment is $538,000. New builds in neighbouring Mangere East are almost as cheap, with the median value of terraces and apartments just $542,000. Entry level for Hillpark is $555,000 and $579,000 for Mangere.

The Auckland suburb with the most expensive entry point to the new-build market is Orakei, where apartments and terraces will typically set back buyers just over $2m.

Ramarama, south of Papakura, has the cheapest standalone new homes, at $892,000, while Herne Bay has the most expensive, at $7.135m.

Overall, new builds were cheaper than existing homes in 75 Auckland suburbs, with the biggest price gaps in Ramarama ($922,000), Epsom ($915,000) and Stonefields ($741,000).

However, the number rose to 89 suburbs when comparing the median value of new-build apartments and terrace houses to the median value of existing homes, with the price gaps between the two biggest in Remuera ($1.574m), Point Chevalier ($1.1m) and Epsom ($1.024m).

Overall, new homes were more expensive than existing homes in 51 Auckland suburbs, but just 11 suburbs when looking at apartments and terrace houses. The figures suggest that buyers concerned about price would be better off buying an older home in Royal Oak, Milford, Orakei, Mairangi Bay, Manukau, Grafton, Eden Terrace, Snells Beach, Auckland Central, Murrays Bay and Three Kings, where entry level new builds were between $5000 and $528,000 more expensive than homes built before 2019.

The figures suggest that benefits of new builds extend beyond a new home, with the median value of Auckland homes built since October 2019 growing 21.4% in value in the last 12 months (a gain of $188,000). Fifteen suburbs saw value growth of more than 30% for new builds since October last year, with new-build owners in Panmure enjoying the biggest lift (58.83% to $953,000). The biggest value gain, however, was seen by new-build owners in Hauraki (up $685,000 to $2.2m).