ANALYSIS: Forecasts made earlier this year that the Reserve Bank would raise the cash rate beyond 5.5% are incorrect, but the shock impact of those predictions has likely contributed to the current slowdown in the housing market. I can see this from the results of my latest survey of real estate agents run with NZHL.

The full results will be out in a few days, but what I can reveal for the moment is that FOMO has gone back almost to where it was between the start of 2022 and May last year, before prices started rising again. According to the latest reading, just 10% of agents believe buyers are exhibiting a fear of missing out, compared to 23% a month ago and 40% in October.

Buyers are in no in a hurry to make a purchase and for the first time since June 2023, more agents have said prices are easing in their location than are rising. What is going on? Specifically, why has the market’s recovery from June last year seemingly stalled?

Read more:

Start your property search

- Tony Alexander: Ignore the screams - there won't be any more rate rises this year

- Digger noise killed off sale of multi-million-dollar 'Fire Pit House'

- MP's iconic waterfront homestead for sale, comes with its own 'boatel'

I can discern from my survey results several reasons.

First, the impact of weak growth in our economy appears to be affecting people’s feelings of job security.

A year ago 10% of agents said buyers were worried about their jobs and incomes; that's 23% now - the highest reading since September 2020.

That means continued weakness in household spending and hesitancy about taking on a mortgage. But it also means the Reserve Bank will begin to feel more confident about the pace of wages growth slowing down. That in turn reinforces the chances of monetary policy easing in the second half of this year and not, as the Reserve Bank predicts, the middle of 2025.

Another factor is renewed worries about interest rates. A year ago 84% of agents said buyers were worried about interest rates. That level of concern tracked lower to reach just 43% a month ago, which was the lowest such reading since September 2021. But now 61% of agents say those interest rate worries are back.

Independent economist Tony Alexander: "The outlook for construction is now worse than it was a couple of months ago." Photo / Fiona Goodall

Considering that this rise has occurred during a period in which banks have been making small cuts to their fixed mortgage rates, it seems reasonable to blame the lift in interest rate worries on the strange debate about further cash rate rises being needed.

The third factor in play is this: well over a year ago I wrote that the housing market’s recovery would be assisted by the activation of a queue of buyers, which has been building since late 2021. I think we saw that queue get activated in the first half of last year. But what’s happened is that a queue of frustrated sellers has also been activated, and this queue appears more motivated to make a sale than the queue of buyers.

We are back into a buyer’s market again.

Data recently released by OneRoof shows new residential listings in February were up nearly 30% year-on-year nationwide and up nearly 47% in Auckland. Total residential listings at the end of the month exceeded 38,000, up 9.8% year-on-year and over 5000 more than at the end of last year.

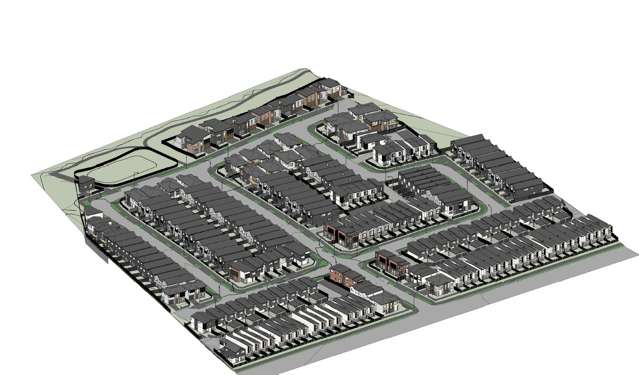

There are again plenty of properties for buyers to choose from and that unfortunately is bad news for builders. The incentive to get something built or to sign up for an off the plan unit is naturally diminished when there are plenty of existing properties to from. The outlook for construction is now worse than it was a couple of months ago and that means in the context of rapid migration-driven population growth, when the shortage strikes it will hit harder than would be the case if construction were to remain strong. That will generate a price impact through 2025 and 2026.

- Tony Alexander is an independent economics commentator. Additional commentary from him can be found at www.tonyalexander.nz