A smart five-bedroom house on Auckland’s North Shore sold over Matariki weekend for $1.78 million – $105,000 above its CV.

It was a strong win in a sluggish market, and one that was the direct result of quick thinking in the auction room by the vendors.

Helene Brownlee, the Ray White agent who marketed the four-year-old house on Hillcrest Avenue, in Hillcrest, said many properties were selling at or below CV, so this was a “good news story”.

The vendors dropped their reserve mid-way through the auction after the energy in the room evaporated. The strategy worked. Bidding reignited and the house sold under the hammer for more than the original reserve (which Brownlee could not reveal).

Start your property search

The agent told OneRoof that 10 bidders had registered for the auction – rare in this market – and that the auction kicked off with a bold bid of $1.6m.

“The bidder came in with almost her best offer. That’s a tactic which I would choose because it takes out all the underlings,” Brownlee said.

Discover more:

- South Auckland home with underground reservoir police mistook for secret drug lab

- James Hardie manor sells after attracting buyer interest from as far as Monaco

- Banks pick date of first interest rate cut - will mortgage pain ease this year?

Bidding stopped at $1.735m and the auction paused for negotiation. The vendors decided to risk it, lowering the reserve and declaring the property on the market. That did the trick, with two final bidders going at it until auctioneer Mark Sumich brought the hammer down at $1.78m.

Brownlee said: “I call it a risk-and-reward scenario. It’s a risk because if we take it back [to the room] and there’s no further bidding, it will sell for that. So, you have to remind people why they are selling.

“The reward scenario is that the bidding will continue.

“At this point, buyers are actually bidding for the keys. They are not buying a house for $1.7m or $1.8m, they are buying it for another $1000.”

She added: “I’ve always said the most important person in an auction is the under-bidder, because the top bid would never get there without them.”

Ten bidders registered for the auction of the Hillcrest Avenue house, but it wasn't until the reserve was dropped that bidding took off. Photo / Supplied

Brownlee said interest in the property was huge, but even she was surprised there were 10 bidders registered for the auction. It helped, she said, that the advertising for the house bluntly stated the vendors needed to sell and had already bought.

“That is telling us this is going to be selling. Everybody wants to deal with somebody that wants to deal,” she said.

Getting real about market prices meant vendors had to make fast decisions, Sumich told OneRoof, as buyers were fewer in number.

“New Zealanders do not like making decisions, but when you do the deal, that is one less thing to worry about. If there is no bidding, the seller is not getting the chance to see what the market is saying.”

Last month, at the high-profile auction of the North Shore home of Barfoot & Thompson’s Garth Barfoot, a similar scenario played out.

Bidding on the family’s original house on Island Bay Road, Beach Haven, did not reach the declared reserve of $1.45m, which was $1m below CV. However, after a third pause for negotiation, it was announced on the market at $1.26m and after some fast and furious bidding sold for $1.32m.

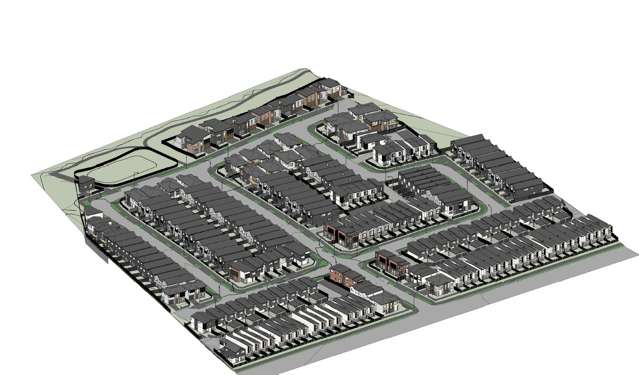

In another auction for a house in Murrays Bay, on Auckland's North Shore, after the house was declared on the market for $1.2m it sold for more than its CV at $1.387m. Photo / Supplied

Barfoot told OneRoof after the auction that he had not decided which way he was going to jump as the bidding rose in fits and starts. “I always say let’s put it on the market, but others were saying, ‘If you do that, you might not get higher bids’. I’ve been to lots of auctions where you don’t reach reserve, but once people know it’s on the market, the bidding starts again – and that is what it did.”

Other experienced auctioneers told OneRoof that reserves do sometimes change in the heat of an auction. “The stark reality of any market is that every bit of price feedback is relatively hypothetical until someone puts their hand up on the day,” Harcourts national auction manager Shane Cortese told OneRoof.

“If you want the owner to accept where the market is at the moment, then you have to let them know where the market is.

“It ignites a bidding war because buyers now know it’s on the market. The fear of missing out comes into play. If you’ve got two or three people bidding, they now know that if they don’t win this auction, they’re back looking at houses.

“You want to show the owners where the market is in the current climate and do all that you can to get the property sold.”

A mid-auction change of the declared reserve of $1.45m to an on-market price of $1.26m saw Barfoot & Thompson patriarch Garth Barfoot's house sell for $1.32m. Photo / Supplied

Barfoot & Thompson auctioneer Murray Smith said reserves “protect the owner’s position and let them retain a bit of control over their own auction. They might trust us, but, you know, it’s their money, not ours”.

He added: “If you’ve got a few bidders, it is better to pull that reserve back because the bidding is going, and you’ll get FOMO kicking in.

“Once it’s declared on the market, it means someone is going to buy it, people think ‘I’m going to miss out here’. People start to show their cards.”

A recent example, he said, was an auction he called last month for a place in Murrays Bay, which had a pre-auction offer and was declared on the market at just over $1.2m. After some 130 bids, the hammer came down at $1.387m, $37,000 over its CV.

“When I called with the pre-auction offer, the owners said, ‘Not quite where we wanted to be, but I understand the market, let’s go’.

“It’s the same with declared reserves – the owner is showing the public that they want to sell.”

Ray White’s head auctioneer Sam Steele agreed that the properties selling under the hammer in this market were the ones that have a realistic reserve.

“They get on the market and bidding takes off from there. Getting something on the market forces all the buyers to compete with each other. And clearly if someone else is bidding, it reaffirms that there’s value in the property,” he said.

But Steele said that while pausing to negotiate a reserve down means sometimes the auction can lose momentum, vendors can see in real-time what the market is saying about price.

“If the bidding stops below that reserve number, at least I’ve got social proof and social evidence, that that is where the market is. They can make a calculated and educated decision whether they want to drop the reserve or not, but it allows an owner to physically see exactly what’s happening.”

- Click here to find more properties for sale