A young English couple were shocked to find that they could not sell their Auckland home because of an error in the property title.

The couple, Samantha and Dan, had put their townhouse on the market after a sudden illness forced them to return to the UK at the end of last year.

Dan had been diagnosed with stage three colorectal cancer and could only access the treatment he needed overseas. But what should have been a quick sale turned into a financial and bureaucratic nightmare.

The couple, who asked OneRoof not to use their full names, have spent the past three months and nearly $15,000 trying to rectify an error in their property title, which they were unaware of until three months ago.

Start your property search

OneRoof recounts their story as a warning to other homeowners, who may be in a comparable situation.

At the end of 2020, Samantha and Dan thought themselves lucky. They were expecting their first child and had managed to get a foot on the property ladder in Auckland at an affordable price.

Discover more:

- Auckland CVs: Which suburbs are at risk, which ones are in the money

- Mystery mortgagee house sells for $815,000 - even after agent's warning

- 'S***, we can't afford this': Homeowners fear they'll lose everything

They bought a two-bedroom townhouse in a new development The Neil Group was building in Swanson under the auspices of the Housing Accords and Special Housing Areas Act.

The title of their house at Patrick Rice Drive stipulated that the developer must sell it to first-home buyers for no more than $637,000. The couple snapped up the property for $633,000 and moved in with their growing family in March 2021, just after construction was finished.

“It was a nice neighbourhood. You’d see kids playing on the street and we had lovely neighbours. There was a community Facebook page, groups that organised Halloween prizes for the kids,” Samantha told OneRoof from the UK.

Dan added: “You were right on the edge of the Waitakere Ranges – you felt as if you were not in the city, but it was only a short drive to the train station and the motorway.”

Two-and-a-half years later, tragedy struck the family. Dan’s cancer diagnosis saw him, Samantha, and their two children on a plane back to the UK, where Dan could access treatment he couldn’t get in New Zealand.

The townhouse on Patrick Rice Drive, in Auckland’s Swanson, which Samantha and Dan bought at the end of 2020. Photo / Supplied

The following six months were difficult for Dan and the family, as their hopes of making a swift return to New Zealand rapidly faded. Their incomes had shrunk, and Samantha was juggling working part-time with raising the couple’s two children, now aged four and two.

In July, they made the painful decision to sell their Auckland home. “We kept the house in New Zealand because we were hoping treatment would be successful and we could return to our lives,” Samantha said. “But unfortunately, things did not work out that way and Dan is now undergoing a different kind of treatment.”

Within a day of listing their home, they had a buyer. “We thought we were so lucky at that point. We did the negotiations and signed the sale and purchase agreement,” Samantha said.

But that’s when they discovered they had been sitting on a legal nightmare. Even though the Affordable Homes Act was no longer in force, their title still carried the consent variation, which prevented them from selling at what they thought was a fair price.

The buyer’s lawyer argued that the price of the home shouldn’t exceed $637,000, even though the property had a 2021 CV of $805,000.

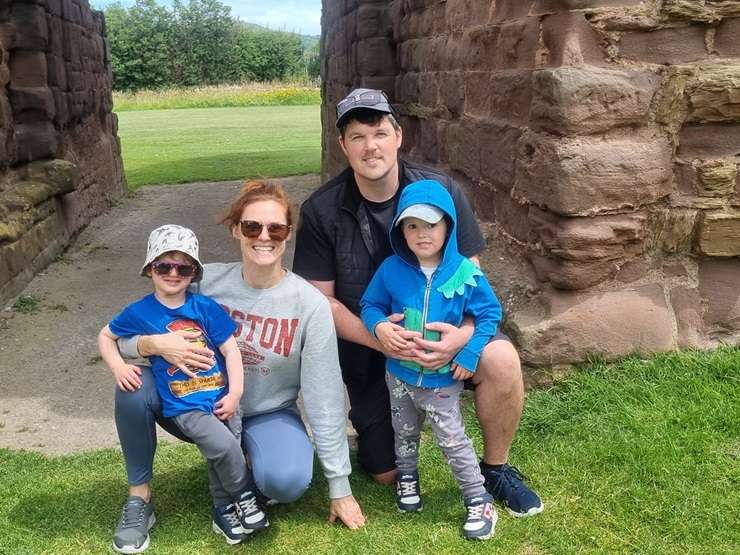

Samantha and Dan with their boys. The family are now in the UK. Photo / Supplied

“We were confused. Our lawyers hadn’t brought anything up, and they hadn’t dealt with something like this before,” Samantha said.

Stuck in the UK, Dan and Samantha were in a panic. They couldn’t afford to sell at that price and were scared no one would want to buy a home that had restrictions on the title.

The consent variations stipulated:

• The home could only be sold to a first-home buyer;

• The buyer’s household income could not exceed 120% of Auckland’s median household income at the time of purchase;

• The owner could not sell within three years of purchase, and

• The purchase price could not exceed 75% of $850,000, Auckland’s median house price for September 2017.

The couple’s bank had given them a three-month mortgage holiday, but as that deadline approached, they became increasingly stressed.

“We’re under immense financial pressure on top of all the medical stuff,” Samantha said.

“We’re living with family – four of us in a small three-bedroom house. We needed to sell because we couldn’t afford to keep our home. We didn’t know what we were going to do, we were just stuck,” Samantha said. “It made no sense.”

To remove the consent variation, Dan and Samantha had to petition Auckland Council. Their application was denied, with council officials notifying the couple’s lawyer they hadn’t submitted the right paperwork. So far, the couple spent more than $3000 trying to fix the issue. That wouldn’t be the end of their financial headache, though.

They spent thousands more drawing up a new application with the help of a planning consultant. The submission was lodged at the start of October and the variation was removed on October 21.

The removal couldn’t come soon enough, with a deal to sell their home hanging on a successful outcome. Dan and Samantha told OneRoof they signed the paperwork at the end of last month.

They said they were shocked to find their title lacked a key termination clause that could have saved them months of financial stress.

The clause would have voided the stipulations in the consent variation three years after they took possession of the house.

The inside of the Patrick Rice Drive home. It sold last month for $735,000. Photo / Supplied

The Neil Group, which sold 17 other homes in the development with the same consent variations on the title, admitted that an administrative oversight may have occurred in the paperwork.

Trevor Canty, senior development manager for the developer, told OneRoof by email: “We sold all 18 homes to qualifying first-home buyers and when titles were issued would have expected the affordability consent notices that were drafted by Auckland Council’s solicitor to accurately reflect the above condition.”

The above condition to which he referred was the following clause in the consent notices: “These new consent notices or covenants will then cease to have effect three years after the date of the transfer of title to the first purchasers.”

Three other properties in the affordable development have been resold without problems and Canty said the company has now instructed their solicitors to investigate with Auckland Council why the expiration clause was missing from some of the titles, including Samantha and Dan’s.

He added that the company would work with Auckland Council to remove or correct the consent notices for all the houses in the subdivision, at their cost. They have also picked up the tab for the costs incurred by Samantha and Dan.

“We have adopted this position because we do not consider it the responsibility of a first-home buyer to detect a missing line of text in a legal document,” Canty said in an email to OneRoof.

“The omission went unnoticed by the authors, Auckland Council, a review by us as developer and subsequently our solicitors. It seems this was also missed or not interpreted negatively by solicitors acting on three other resales that occurred earlier this year.”

The news has been warmly welcomed by Samantha and Dan. “I couldn’t believe it,” Samantha told OneRoof. “This will be a great help. [And they are] removing the notice for the other ‘affordable houses’ like ours so others won’t have to go through this process.”

Property lawyer Joanna Pidgeon: “I would strongly encourage councils to ensure there is a low-cost system for the removal of these redundant conditions." Photo / Supplied

The subdivision the Neil Group was building in had been designated a Special Housing Area and covered by the Housing Accords and Special Housing Areas Act.

SHAs had been created to make housing more affordable by increasing housing supply. Developers would allocate a proportion of their new homes as affordable homes, which were priced significantly cheaper than similar houses in the area, and buyers had to confirm that their income was below a certain threshold, and that they would live in the homes and not rent them out or on-sell them for three years.

These special conditions appeared as a consent notice on the property title, but normally were meant to have a time limit so they would expire after the first three years of the homeowners’ ownership.

Numerous other homeowners may, unknowingly, be facing the same issue as Samantha and Dan – and may have to spend money they can ill afford to rectify it.

James Hassall, head of resource consents at Auckland Council, told OneRoof that the authority was not required to automatically change titles affected by the revocation of the Housing Accords and Special Housing Areas Act. He explained that it had to be done on a case-by-case basis and that the Resource Management Act set out the process for affected homeowners.

“The consent notices are covered by the Resource Management Act [which] sets out the rules for consent notices. The Act doesn’t provide a mechanism for the blanket removal of consent notices, so it needs to be done on a case-by-case basis,” he said in an email.

An Auckland Council spokesperson separately told OneRoof it was “reviewing the wording on the consent notices in question, the precinct rules and Housing Accords and Special Housing Area legislation that applied at the time to check for an inaccuracy. We are happy to provide an update once this review is complete”.

Harcourts agents Nicky and Georgia Malloy, right and centre, have been battling for their clients. Photo / Fiona Goodall

Between 2013 and 2017, 1353 consents for Auckland homes were approved under the Act, but Auckland Council is unable to say how many homeowners have SHA consent notices, nor how many may be faulty.

Affected homeowners would still have to pay to have them removed. “The process to amend or remove a covenant is not set by the council, it’s set out by law, and it can be a long and costly process,” Hassall said, adding that homeowners should check their property title “and consider the impact and process if you wish to remove it”.

Hassall said it was not up to council to notify individual homeowners of the changes to the Act, noting that the information was publicly available on the council website and government gazette notices.

Property lawyer Joanna Pidgeon was unimpressed with the local authority’s approach to the issue. “I would strongly encourage councils to engage and ensure there is a low-cost system for the removal of these redundant conditions,” she told OneRoof.

“Given these were used to make housing affordable for low-income earners, it is incumbent on local government to ensure that these buyers are not burnt by unnecessary costs when they try to remove these redundant conditions.”

At the end of last month, Samantha and Dan sold their home for $735,000, ending months of stress. Their listing agents, Harcourts’ Nicky and Georgia Malloy, have been battling for them since August, contacting OneRoof about their plight and even going as far as to call the Ministry of Housing and Urban Development.

Nicky told OneRoof she had been approached by other homeowners in the close-knit community who were aware of Samantha and Dan’s problems. They too are afraid they’ll face the same nightmare when they come to sell.

“They’ve been waiting with bated breath because they were looking to sell in the new year,” she said.

“We were just stonewalled at the council; it was going around in circles. Our lovely sellers had to forge the way, but it’s going to make it easy for everybody else. We were all a bit teary when [the news] came through. I’ve been so invested in this.”

- Click here to find properties for sale in Auckland