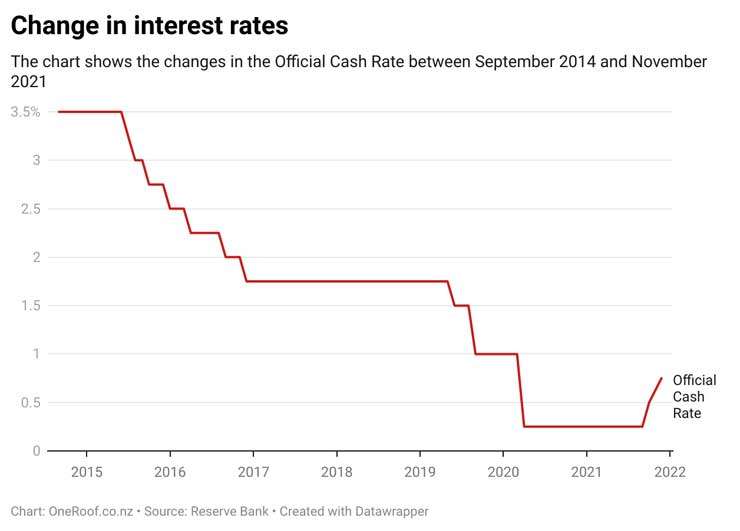

COMMENT: Mortgage interest rates have sky-rocketed lately. This week the Reserve Bank increased the Official Cash Rate to 0.75%, and has signalled more hikes to come, but the one-year fixed rate that had been hovering around 2.1% in June is now sitting at 3.65% for almost all the main banks. Mortgage professionals are getting almost daily notifications of interest rate increases as the banks as adjust to the increased cost of their funds.

A question that is common in the market is; should homeowners break their current low rate to lock in these higher rates on the off-chance that mortgage rates continue up even further? In other words, pay a little penalty now, to save even more pain in the future.

Here’s what you need to think about if you’re looking at this strategy:

1: How long do you have to go on your current fixed rate? It may be one month, it may be a couple of years. You need to know this because in the next section you’re going to try and guess (and it will absolutely be a guess) what the interest rate will be when your fixed rate is due to mature.

Start your property search

(Note that, if your fixed mortgage rate is within one to two months of maturing, you may be able to fix your new rate today so ask your bank how far out you can fix - banks range from 30-60 days from maturity date. If the maturity date is further away than that, you’ll need to move to the next section.)

2: What do you, or what does the market, think interest rates will be when your current fixed rate is due to expire? For example, if your maturity date is six months away from expiring, what will mortgage rates be like in six months' time? Could they be 1% higher? Let’s say, for this example, you thought the interest rates were going to be 0.5% higher in six months' time. Now you’ve guessed what the cost in the future is, it’s time to figure out what the cost will be in taking today’s rates.

3: How much premium will you pay in the meantime to lock in today’s mortgage rates? In other words, if you are currently fixed at 3.15% and you can break that rate and fix it at 3.65% you will be paying a 0.5% premium (3.65% minus 3.15%). But in the example above, the fixed rate was half a year away, so the premium is actually half that. For this example, then, the premium is 0.25%.

(Note: It’s unlikely that you will pay any serious break fees at the moment as rates have increased so much but it is always worth asking just to make sure. Factor this in as an extra cost as well, if necessary.)

So for this example, you’ll pay an additional 0.25% of your mortgage to save yourself from a further increase of - what you believe to be - a 0.5% p.a. increase in the future. On the face of it, that looks like a good reason to break, and if you’re still with me, thanks for sticking around. Here’s why I think this strategy is not great and almost all homeowners should avoid it:

• We’re currently in quite turbulent economic times and forecasting interest rates is pure guesswork. It’s almost as likely that the interest rates will be near to where we are now as it is that they will have increased 1% or 2%. The only thing you can be 100% sure of is that, by breaking the current lower rates, you are definitely paying a premium. All potential savings are just a roll of the dice.

• In this example, you’re shifting the refix date forward by six months but what happens when that refix date matures in, say a year or two years. You’re just as likely to have gotten yourself on the wrong side of an interest rate upswing then. Leaving the refix as is might have protected you from this upswing for a little longer. There’s simply no way to time significant increases in interest rates, particularly more than a year out.

My suggestion is that, rather than worrying about interest rates now versus interest rates later, homeowners concentrate on decreasing unnecessary spending and getting themselves in a position that they can pay their mortgage off at much higher rates - for example 5% or 6%. To be honest, 7% or 8% is ideal but will take longer for some people to achieve.

Calculate what your mortgage repayments will be at those levels and aim to be able to pay your mortgage at 6% in the next 12 months and 8% in the next 24 months. If you know you can afford that, then it won’t matter what interest rates do in the meantime - it’s likely they’ll be less than 8% for quite a few years - and you can deal with whatever the rates are when they’re ready to be refixed on their normal cycle.

- Rupert Gough is the founder and CEO of Mortgage Lab and author of The Successful First Home Buyer.