The housing market in the regions has slowed from a boom to a trickle since the lockdown but agents are preparing to be rushed off their feet once restrictions are lifted.

There is the odd upside to the crisis – as many first home buyers reportedly fear the negative impact of the coronavirus on their KiwSaver deposits an agent in Rotorua spoke of some already with deposits who hope they may have a chance to get into a house after missing out on numerous properties during the hot pre-lockdown buying market.

More properties could be listed from people needing to look at debt, and more properties could also come into the scarce rental market as bookabach owners might look to exit the once-thriving international tourism market – though the agent expected domestic tourism to increase when the alert level is reduced.

Following the Global Financial Crisis of 2008 people tightened their belts by not travelling overseas but holidaying instead in the myriad beautiful spots to be found in New Zealand.

Start your property search

And a mortgage broker in the Hawke's Bay praised clients for not rushing into mortgage “holidays” – which he pointed out are not holidays because repayments are added to the loan and must be paid back.

Rotorua - "Life will carry on"

Tim O’Sullivan, from Ray White Rotorua, said there were still inquiries about properties and some had gone under contract in the last couple of days.

While those buyers had seen the homes pre-lockdown there were also buyers asking to view properties as soon as possible. “I’m anticipating we’re going to be quite busy once the lockdown is over," he says.

“I think there are a lot of people still looking to buy. I’ve had a couple of conversations with first home buyers.

“They’ve rung up asking what my thoughts were in terms of purchasing now or waiting but obviously it’s a bit difficult when you put an offer in on a property when you haven’t seen it. You’re only going to end up putting a clause in subject to viewing whenever that may be.”

Rotorua may see a rush of buyer inquiry after the lockdown lifts. Photo / Getty Images

O’Sullivan spoke to a young builder who had missed out on several properties who was hoping he’d be able to secure one once the lockdown finished, and O’Sullivan thinks the listings will be there.

“I think life will carry on. There will still be people that are listing their home. There may be people that are reducing debt type of thing," he says.

“Who knows? It’s going to be quite interesting whatever happens. I think people are going to take a really good look at their personal situation in life in general.

“From what I’ve heard from several people, some of the bookabach properties will possibly come to the market.”

If that happened it might ease pressure on people looking for places to rent.

Job security would be a major issue but O’Sullivan says we are a food producing nation with a relatively robust economy.

Conversations about the property market showed the crisis had people thinking bricks and mortar was the way to go – “there’s probably nothing better to have your money in than a home for one thing".

“Hopefully for Rotorua and other parts of the regions local tourism may kick in. I’d say after people being locked down for a month, I mean even getting away for a couple of days, there’s a lot to do in Rotorua," O’Sullivan says.

“It’s a beautiful location with all the lakes and walks, it may help everybody I guess. When the GFC kicked in in 2008 Rotorua did benefit from local tourism. People didn’t do the trips overseas, they had to tighten things up so they went away for weekends. And we are quite central here, so that will be interesting to see.”

Invercargill - "We’ll come out of this flat out"

At the bottom of the South Island, John Murphy, from Ray White, says the brakes have well and truly gone on: “There’s nothing happening.”

That made it a great time to list, because there wasn’t much in the way of competition with only two new listings for the city last week compared to about 70 a week from before the lock down.

Having said that, agents were being kept busy with virtual appraisals so people were still thinking about property.

“I think we’ll come out of this flat out. People are doing their properties up and using this time.”

Invercargill's famous watertower. The city's housing market has quietened but agents report activity is still taking place - albeit digitally.

Sales meetings were taking place on Zoom or Google Hangout and owners were walking agents through properties via technology. “Something like that isn’t the same as viewing physically but often we know the property so we can give them an idea of where their property sits according to the market," Murphy says.

“People are basically carrying their phone through the property on camera and at the end of it you get an idea, sit back down and compare it to recent sales and collate a price band their property may be sitting in.”

A property can still be appraised, listed, marketed and sold in this market with a conditional period taking the home to the stage it can go unconditional.

Mortgage brokers were also working from home: “When this is over I think the market is just going to go gang busters,” Murphy says.

Hawke's Bay - Mortgage holiday inquiries up

Inquiries are still trickling in, says mortgage broker Darrin McCormack, from DM Consult Mortgages.

“I think people are just going to hold off to wait until things open up again to see what happens from that point on before they leap in," he says. “I’ve got some pending settlements waiting for the system to get cranking again.”

There had been a lot of inquiry about the mortgage “holidays” banks had rolled out.

“We spent a lot of time last week talking to clients around that. Interestingly, out of maybe 40-odd people we spoke to the top preference at this point in time was ‘let’s do nothing and see how things go.’”

The next most popular option was paying the interest-only on a mortgage and the last was the repayment holiday but only three clients had taken that up.

Napier in Hawke's Bay. The region's housing market may come out of the coronavirus stronger. Photo / Getty Images

People were researching and seeking financial advice then realising taking a mortgage holiday was detrimental to their financial position. “I suppose the only winner out of that ironically, apart from a person in financial stress, is the banks, because essentially a mortgage repayment holiday is a loan," McCormack says.

“It’s just adding more repayments to the back end of the loan, and once people do a lot of research and they realise ‘well, actually, I don’t want to do that, what are the other options’ they shy away from it.”

An issue McCormack had run into was clients with pre-approved finance being asked questions by their bank about how the coronavirus was impacting them.

“It’s putting into question those pre-approvals. I had one instance last week where we had an unconditional approval and because settlement is not until June, and all we’re asking for is that unconditional approval to be rolled over, the bank asks how have they been impacted by the coronavirus.

“I did write to the bank and say are you sure you should be doing this, because these people did go unconditional on that approval. “

The only reason the client needed the pre-approval rolled over was because the settlement had been drawn out due to the coronavirus.

Mortgage inquiries had quietened down this week, however, what happens after the lockdown remained to be seen.

But 20 years ago when McCormack returned to the Hawke's Bay from Tauranga he predicted the area would boom – but his prediction was 20 years early.

Hawke's Bay in the last 12 to 24 months had finally showed signs of coming of age with both baby boomers redistributing themselves throughout New Zealand, and young, entrepreneurial people using technology to grow successful businesses who realised they don’t need to be in big cities to do that.

“If their businesses keep ticking along and there’s still that redistribution of the population out of the larger centres, that could be a good thing for provinces like Hawke's Bay,” McCormack says.

Whangarei - Watching and waiting

Up north, Martin Dear, from Barfoot & Thompson Whangarei, says his team are still working on agreements but they are from pre-lockdown showings. “From now on it’s going to get really difficult because there’s nothing coming forward,” he says.

People are sitting back watching and waiting to see what is going to happen rather than continue with listing.

“You can’t do anything so really it’s a time to sit and watch what happens to the market at the end of it," Dear says.

Whangarei's housing market may be down just now but agents believe a lift will follow once the lockdown is over. Photo / Getty Images

“People can probably get through this, it’s when the assistance is over and things get back to normal again, it depends what happens then.”

Dear is prepping his sales people to get ready as Whangarei had been so busy he had added another tier of management to the business “and then bang, lights out”.

The lights would come back on: “I think this time next year we’ll be thinking ‘God, I wish I’d got a bit more done around the house.’ I think what we’ll do is we’ll just fire straight back into business. I think we’re going to be quite busy either way. Often with a bust comes a boom.”

Nelson - "Business as usual, it’s just a different usual"

Chris Harvey, from Harcourts Nelson, says the market hasn’t ground to a halt. Agents are working through settlements for when restrictions are eased.

“We’ve had several contracts that are looking at going unconditional that have been put back to a time where the clauses and the conditions can be satisfied," Harvey says.

“There’s still a bit of inquiry on properties and still people making plans to list once the conditions get lifted.”

It’s hard not being able to get people through properties, though, he says.

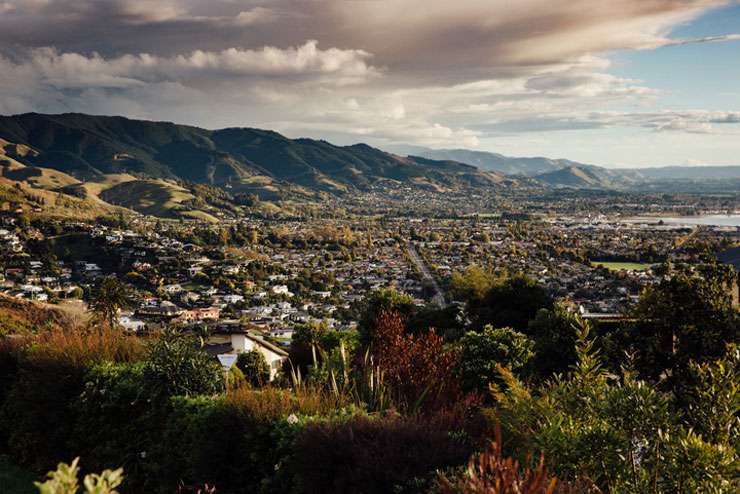

Nelson agents are reporting a good level of buyer inquiry on properties. Photo / Getty Images

“With virtual you can look through but I think you’d find if you talk to principals around the place the legal advisors that purchasers and vendors have are saying just to wait. That’s what we’ve found with our ones anyway," Harvey says.

He adds: “It’s business as usual, it’s just a different usual. If we can get people through with virtual reality we are.

“There’s a lot of talk between vendors and our salespeople, and obviously purchasers are talking to us as well. It’s a big dialogue period really.”

The market in Nelson had been strong and there’s still a shortage of property so will be strong again. Harvey says buyers and sellers should still talk to agents and make enquiries.