The stellar performance of the Christchurch industrial property market shows no sign of abating, with investors throughout New Zealand seeking a slice of the action.

Sam Staite, Director of the industrial division at Colliers International in Christchurch, says there is an insatiable demand for quality stock.

“The long-term outlook of low deposit rates has thrown out the retirement plans for a lot of people and, as such, they are being forced to look outside of the bank for reasonable returns.

“Understandably, retirees find it difficult to come to terms with spending their capital to fund their lives after they have finished up at work. They are far more comfortable with spending investment returns and people are crawling over themselves to secure industrial properties that have decent lease terms remaining.

Start your property search

“We’re getting multiple offers for anything that fits that description.”

Staite has recently completed a number of large-scale asset sales which highlight the strength of the sector and has several others currently under contract.

A purpose-built facility for household name Akaroa Salmon, at 89 Treffers Road in Wigram, drew four offers – a week ahead of deadline.

The majority of interest came from outside of Christchurch and the successful buyer was a local investor; the other interest varied from unlisted funds to private investors and trusts.

Investors were attracted by the 2019 architecturally designed facility that had a 20-year lease in place.

Another keenly sought asset, which is currently under-offer, is a breeder rearing unit in Rakaia, Canterbury, leased to Tegel for 15 years from 2018. Situated on a 20ha parcel of freehold land situated on State Highway 1, the Tegel operation occupies approximately 3ha.

“With a lease to Tegel running through until 2033, this state-of-the-art unit provides the new owner with strong returns and fixed annual increases,” says Staite.

“Again, we received multiple offers from across New Zealand with investors attracted by the tenant brand, long lease term with good fixed growth.”

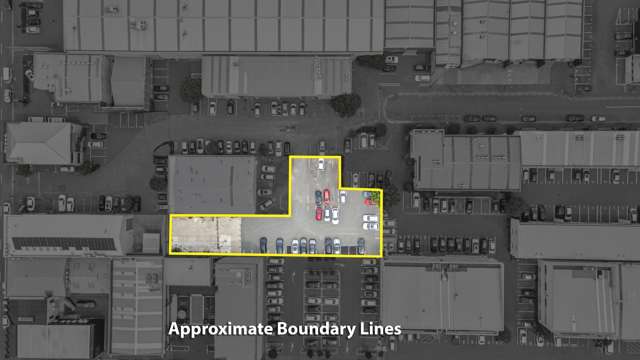

Interest has also been strong in a property located at 26 Logistics Drive, Christchurch, which is being offered for sale with a new 15-year lease back to the well-established tenant.

“The 2013 constructed premises fits the business perfectly so they’re very comfortable with committing to a long lease.”

Fronting State Highway 1, and in one of the most sought-after industrial areas of Christchurch, the building features more than 4,500sq m of lettable blended between warehouse, office and canopy areas. It sits on 10,855sq m of land and has an annual rent of $651,216 plus GST.

“With solid fixed annual growth, this is the perfect bottom drawer investment. Barring a major event we expect no- hange to investor sentiment leading into 2021 and if anything we are predicting yields to tighten further as demand continues to grow.”