Incoming Prime Minister Christopher Luxon has given his strongest hint yet that he may not be able to deliver a reversal of the foreign buyer ban.

On TVNZ's Breakfast show this morning he said he was committed to tax relief for low- and middle-income New Zealanders but repeatedly refused to answer if National would still be funding the cuts through a foreign buyer tax.

National is still in negotiations with Act and New Zealand First in order to form a coalition government, and Luxon said it was a big job going through each of the party's manifesto pledges.

While there seems to broad agreement among the three parties on issues such as the reform of the criminal justice system and the need to rein in government spending, there are key differences on several economic policies, including those affecting housing.

Start your property search

National’s big promise of the campaign was tax cuts for hard-pressed Kiwis, which would be partly funded by the taxing of $2m-plus property purchases by foreign buyers.

Read more:

- ZURU Toys billionaire pays $24m-plus for Herne Bay bowler

- Revealed: Where council rates are hurting property investors

- Tony Alexander: Expect house prices to rise 10% in 2024, and 15% in 2025

New Zealand First has shown antipathy towards a reversal of the foreign buyer ban, which was introduced when it was in government with Labour in 2018.

Other National housing policies that are seen to favour property investors may get the thumbs up but their survival during the parties’ negotiations is far from guaranteed.

The week before Luxon's comments on TVNZ, OneRoof polled leading economists for their thoughts about the final election results, what policies they think are unlikely to be binned and what the future holds for the housing market.

All expected a new National-led coalition government to reinstate interest rate deductibility for investment properties and reduce the bright-line test from 10 years to two.

They were less sure about foreign buyers and the reversal of the previous Labour Government’s abolition of no-fault evictions.

Westpac senior economist Satish Ranchhod

According to Ranchhod, reinstatement of the mortgage interest deductibility is one of the most significant housing policies that the National-led coalition is likely to enact, and will likely boost investor activity in the market.

“We are also expecting to see other changes that will be relevant for the property market, including changes to zoning laws and potentially changes to policies that affect tenancy such as the ability to evict tenants in different circumstances,” he said.

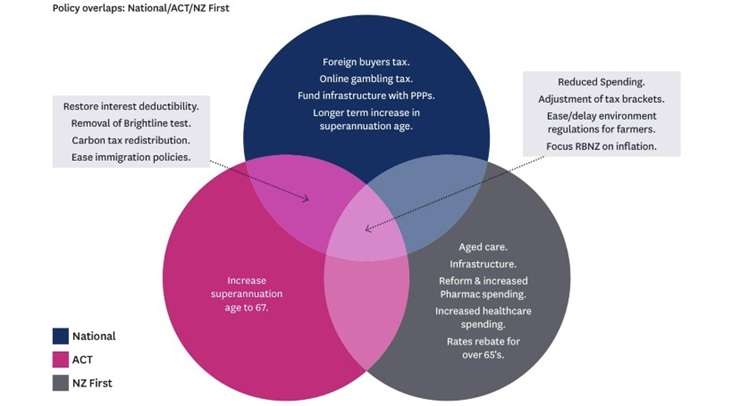

The areas of agreement and disagreement. Photo / Supplied

The Labour Government removed no-fault evictions, which had allowed landlords to give tenants 90 days notice to vacate, and replaced it with a three-strikes rule that made it difficult for landlords to take back their properties. Another key change was to automatically roll fixed term tenancies over to periodic tenancies. This made it impossible for bach owners to let properties to tenants in the off-season, because they couldn’t get the properties back for their own use or for short-term rentals over the summer.

CoreLogic chief economist Kelvin Davidson

Davidson said changes to interest rate deductibility could encourage investors to start buying again while a two-year bright-line test could bring forward some house sales. “People that perhaps are topping up the rental properties each week, but didn’t want to sell, because paying capital gains tax [as a result of the bright-line test] could be worse financially,” he said.

The policy that might be hardest to secure the support of New Zealand First is the proposed 15% foreign buyer tax, with the party making clear during the election campaign that it opposed allowing foreign buyers back into the residential property market.

However, Davidson said the housing market started to regain strength before the election and was likely to continue to do so. “Sales were starting to rise, and prices were bottoming out before the election. Maybe house prices will grow a bit faster under National than Labour.

CoreLogic chief economist Kelvin Davidson: “Sales were starting to rise, and prices were bottoming out before the election." Photo / Peter Meecham

“When you look at shorter bright-line test, reinstatement of interest deductibility, maybe some foreign buyers in the market, and maybe not, maybe a slightly tighter supply situation, you’d have to say house prices would probably rise more quickly under the new government than the old one.

“But I’m not convinced it’s going to be that much [of a rise] because nothing will change in terms of housing affordability. Mortgage rates are still going to be high and debt-to-income ratio caps are still on the table.

“From an investor point of view it’s great that you’ve got the tax deductibility, but you’d be pretty hard pushed to find too many properties that will give you a positive cash flow.”

Infometrics chief forecaster Gareth Kiernan

Kiernan said house price forecasts for next year weren’t particularly strong at 4%, but that could push up towards 10%. “The caveat is when you think about where interest rates are likely to go, which is probably more or less sideways for the next year, and you look at affordability for first-home buyers, pushing house prices back up 10% is really making that issue even more critical than it is at the moment.”

New Zealand First leader Winston Peters, whose party has made known its opposition to rolling back the foreign buyer ban. Photo / Getty Images

Kiernan says the consequences of rolling back the tax deductibility of mortgage interest and the bright-line test could affect the building of new homes.

“The other thing that you might see is with the change in tax deductibility and bright-line is that it might just have a bit of a dampening effect in terms of new-builds occurring, particularly in that townhouse terraced housing base.”

New Zealand Council of Trade Unions economist Craig Renney

Renney said New Zealand First’s opposition to foreign buyers could hamper National’s ability to deliver its $3 billion tax cut. “That’s going to be very challenging to deliver without the foreign buyer tax.”

He added that National, Act and New Zealand First were all committed to reviewing the role of Kāinga Ora. “National and Act will be very keen to move towards more community housing provider type models. The challenge will be, how do we do that in ways that don’t disrupt the flow of new state housing when we’ve got nearly 25,000 households on the wait-list?”

It’s not entirely clear what the coalition would do about the Medium Density Residential Standards, which National no longer backs. “They’re tied up with potential zoning changes and reform of the Resource Management Act,” Renney said.

“Act wants to see hugely liberalised land-use laws and National and New Zealand First want to be a bit more be a bit more selective in that space.”

Renney said rolling back of tenancy protections such as no-fault evictions “would create enormous amounts of [rental] market uncertainty for people”.

- Click here to find properties for sale