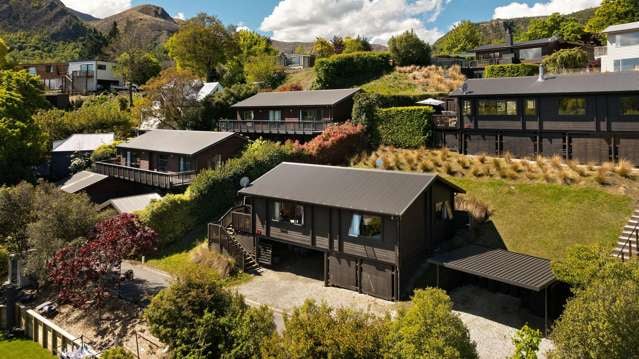

1. A city to province drift …

The latest sub-national population estimates from Stats NZ made for interesting reading last week, with many of our major centres actually seeing their population fall in the year to June 2022, including -1.1% in Wellington City (2,300 people), -0.5% Auckland (8,900), Dunedin -0.3% (400), and Christchurch -0.2% (700). On the other hand, there were gains of 2% or more in areas such as Waimakariri, Western Bay of Plenty, Masterton, Waikato District, Central Otago, and Selwyn. Even so, I’d be cautious of concluding that this pattern will last or that property values are suddenly about to surge in the provinces due to a population spike. After all, our major cities still have huge pull-factors such as diverse employment opportunities and other social amenities – and when net migration turns positive again, this also tends to benefit the cities more than the provinces (at least for a start, as new migrants get accustomed to NZ life in a main city first).

2. Confidence low, inflation fears high

ANZ’s latest business confidence measure showed that firms remained cautious in October, with the index dropping back again after what had looked like a better trend over the previous few months. Meanwhile, there doesn’t seem to have been much let-up in terms of the cost pressures being faced by businesses and hence the need to pass on price rises to consumers. The consumer confidence measure, also released last week, contained similar themes. On the whole, nothing here to suggest that the OCR increases by the Reserve Bank are about to be halted suddenly.

Start your property search

3. New mortgage lending activity still quiet

The Reserve Bank’s mortgage lending figures for September didn’t show too much change, with overall volumes still low, and low deposit finance still restricted. The share of owner occupiers getting a low deposit (high LVR) loan in September was flat at 4.1% (versus the speed limit of 10%) and only 0.6% of investors (vs speed limit of 5%). With mortgage rates now rising again, it seems pretty likely that new lending flows could stay fairly low, albeit the banks will continue to be busy with fixed loan maturities and potentially a greater risk of dealing with repayment stresses.

CoreLogic chief economist Kelvin Davidson: “With mortgage rates now rising again, it seems pretty likely that new lending flows could stay fairly low.” Photo / Peter Meecham

4. Unemployment still sub-3.5%?

All eyes this week will be on the latest benchmark labour market figures from Stats NZ, to be published on Wednesday at 10:45am. The key measure is the unemployment rate, and there seems little reason to think that it would have changed too much in the three months to September, i.e. staying pretty flat at around record lows of 3.3%. If so, the odds would probably increase of a 0.75% official cash rate rise on 23rd November, underlining the recent upwards pressure on mortgage rates.

5. Unlikely to be any surprises in the next Financial Stability Report

Just prior to the labour market figures, the Reserve Bank will publish its latest six-monthly FSR (at 9am), which in the past has often been used to announce changes to the rules around high loan to value ratio mortgages. I suppose you could never categorically rule out some LVR changes this week either, but it seems a very low probability – the housing downturn doesn’t yet appear to be driving heightened financial stability risks, and of course it’s a ‘hard sell’ to allow more low deposit loans when house prices are already falling (which would increase the exposure to negative equity). Instead, my focus will be on any updates around the process to formulate and eventually implement caps on debt to income ratios for new mortgages – keep in mind these would tend to hamper investors more than owner-occupiers, as the former group uses high DTI loans much more often.

- Kelvin Davidson is chief economist at property insights firm CoreLogic

Listen to The NZ Property Market Podcast below