Mortgage rates were up within an hour of the Reserve Bank of New Zealand raising the OCR 25 basis points yesterday.

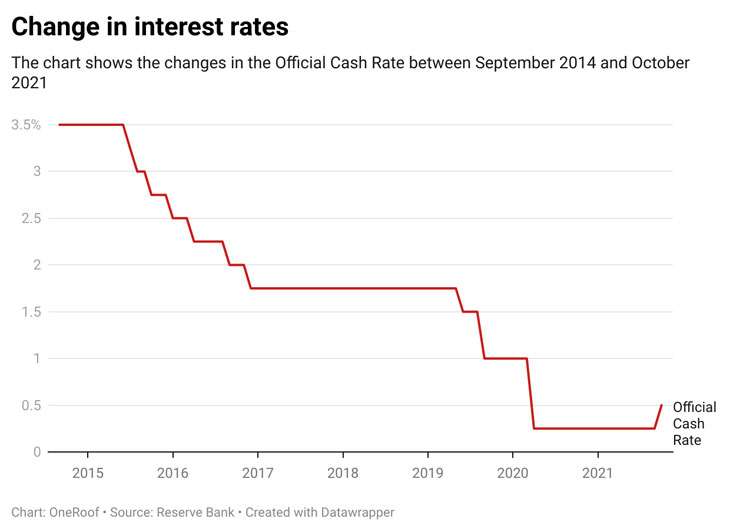

The rate hike - expected back in August, but delayed due to the Covid lockdown – marks the first time the Reserve Bank has raised the official cash rate in seven years.

The rolling back of emergency borrowing measures – after the reintroduction of the loan to value restrictions – is another sign of tighter lending conditions in the months ahead as the Reserve tries to curb inflation and house price growth.

Banks had been prepping for the rate hike, with some quietly upping their mortgage rates ahead of time. But the Reserve’s announcement spurred a new round of increases.

Start your property search

ANZ, New Zealand’s largest bank announced it would raise mortgage rates on its floating and flexi home loans by 0.15% from October 12 for new loans and October 26 for existing loans. ANZ’s move adds about $20 a fortnight on a $350,000 mortgage.

Kiwibank has said it will pass on that full 0.25% to mortgage customers, although pointed out its rates were still below its competitors. The ASB says it will hold rates. Lenders base their mortgage rates on the OCR, but don’t always change what they charge customers at the same time as OCR announcements.

The rate rise has come as little surprise to economists. Most including ANZ, Kiwibank and Westpac’s chief economists surveyed in the Finder RBNZ Official Cash Rate Survey earlier this week predicted exactly what the Reserve Bank did, raising rates by 0.25% to 0.5%.

The Reserve Bank had intended to raise rates in August on the same day the latest Covid-19 outbreak became public. Inflation had leapt to 3.3%, which took it outside the limits of 1% to 3% in the Reserve Bank’s mandate.

The August OCR rise had been tipped to be 0.50% and the first of several increases. Economists are now expecting a series of small rises over time to catch up.

“They're going to go cautiously,” says independent economist Tony Alexander. “But the inflation indicators are going through the roof.”

While interest rate rises affect homeowners who hold mortgages, the Reserve’s driving force is its mandate, which is designed to keep inflation under control, and to encourage employment.

Opes partners economist Ed McKnight says the move was not in response to house price increases as some homeowners and investors will assume. “This is not in response to house prices. The Reserve Bank wants to keep inflation under wraps. It’s about inflation settings,” says McKnight.

The mortgage rate increases will surprise some, and while mortgage-holders might see some discounting of one-year rates in the short-term future, rates overall are going to trend up, not down, Alexander says.

Homeowners are usually stress tested by the banks to ensure they can afford to pay their mortgage if rates rose to 6% or more. McKnight says his company’s clients buy investment properties and their 15 year cash flow forecasts factor in a 5% mortgage rate, which means they can afford rate increases.

More rate increases area expected this year. Prior to the latest lockdown the banks were predicting OCR rises adding up to between 1% and 2.25% by early 2023.

Kiwibank chief economist Jarrod Kerr said yesterday’s rise was just the start: “The RBNZ won’t stop here. October marks the beginning of a new chapter for the cash rate - onwards and upwards.

“Looking ahead we expect [the] rate hike will be the first in a series of hikes towards 1.5% and possibly higher. As signalled by RBNZ Assistant Governor Christian Hawkesby, a least regrets approach will be one with ‘considered steps’.

“We expect 25bp (0.25%) hikes will be delivered in October, November, February and May, with the OCR reaching 1.50% by the middle of next year. We expect a considered pause around 1.5%. Although the RBNZ is signalling a continuation to 2% in 2023.”